No one likes repossession of any kind.

It’s a nightmare for everyone involved.

Why? Because there are laws involved (which means everything has to be done by the book.)

So, how does the vehicle repossession procedure work in South Africa? What are the laws? And how long does it take?

Let’s find out.

What is vehicle repossession?

Vehicle repossession in South Africa occurs when a lender (creditor) takes back a vehicle from the borrower because they defaulted on the loan payments (did not pay as agreed) to recover the debt on the loan.

In essence, when someone can’t keep up with their car payments, the institution that financed the car has the right to take it back to recover their debts (debt collection).

It’s a legal process, so there are several moving parts.

Here’s how it works.

📖 Bonus reading: Debt collection and consumer rights in South Africa

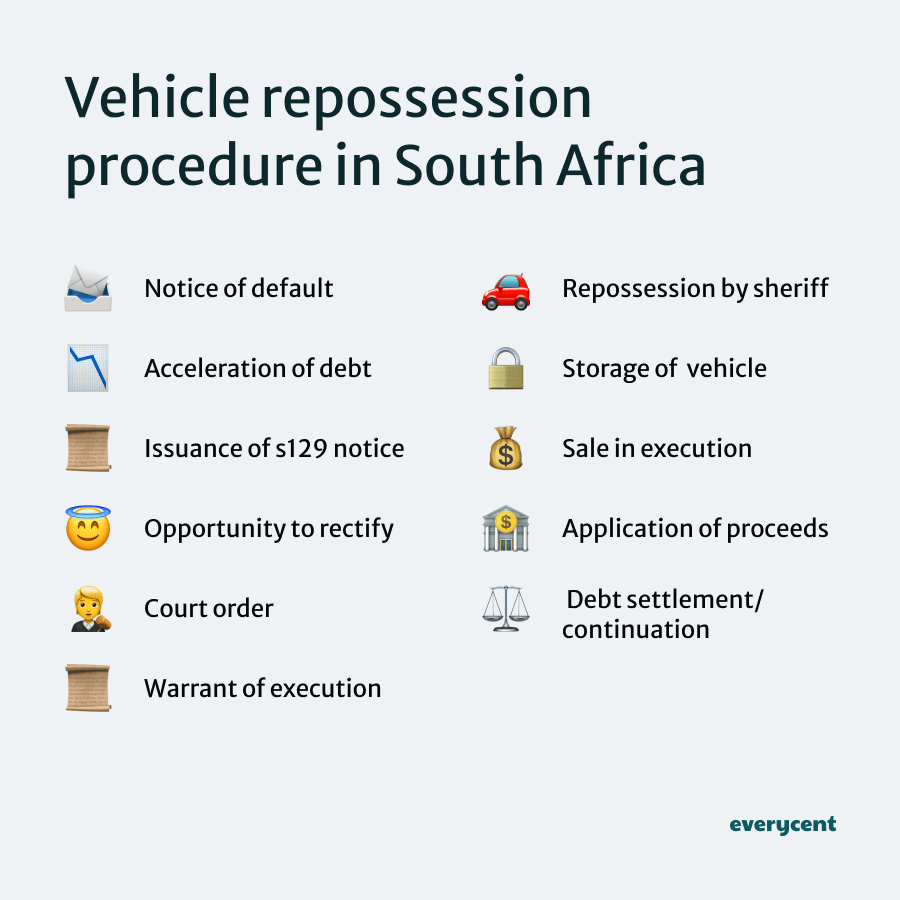

Vehicle repossession procedure in South Africa

The path to vehicle repossession isn’t a simple “miss a payment, lose your car” equation.

Several steps and legal requirements must be met before a creditor can lawfully repossess a vehicle.

This is the vehicle repossession procedure in South Africa:

- Notice of default

- Acceleration of debt (not always applicable)

- Issuance of section 129 notice

- Consumer’s opportunity to rectify default or consult a debt counsellor

- Court order or consent order (if debt not rectified)

- Warrant of execution against property

- Repossession by sheriff

- Storage of repossessed vehicle

- Sale in execution

- Application of proceeds from the sale

- Balance of debt settlement or continuation of payments

1. Notice of default

When the borrower misses a car payment, the lender must send a notice of default.

It’s a formal notification that proclaims that the loan agreement has been breached.

(Think of it like a nudge. The first reminder to pay the overdue amount.)

2. Acceleration of debt (not always applicable)

Certain contracts allow lenders to accelerate the debt when the borrower breaches the contract.

In plain English, acceleration of debt means the total outstanding amount becomes due immediately. Not just the missed payments.

3. Issuance of section 129 notice

Under the National Credit Act, before any legal action can be taken, the lender must issue a Section 129 Notice.

This notice confirms the default and urges the borrower (person with debt) to resolve the outstanding amount or talk to a debt counsellor.

It’s a legal requirement and a crucial step in the process.

Are you struggling to afford your car payments?

Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.

4. Consumer’s opportunity to rectify default or consult a debt counsellor

This is the window of opportunity to set things right.

The borrower can either settle the overdue amount or, if they’re struggling financially, consult a debt counsellor.

Debt counselling can help to restructure the borrower’s debt and help them avoid repossession.

5. Court order or consent order (if debt not rectified)

If the debt isn’t settled or an agreement is reached through debt counselling, the lender can approach the court for an order.

This is either:

- A court order following a hearing; or

- a consent order (where the borrower agrees to the vehicle’s repossession.)

6. Warrant of execution against property

Once the court grants the order, the next step is issuing a warrant of execution against property (the borrower’s assets, like the car.)

With it, the sheriff can seize assets, including the vehicle, to settle the outstanding debt.

7. Repossession by sheriff

The actual repossession is done by a sheriff (an officer of the court.)

They have the legal authority to take the vehicle as long as they do so within the bounds of the law.

Take note of this next step.

8. Storage of repossessed vehicle

After repossession, the vehicle isn’t immediately sold off.

It’s usually stored in a secure location while the necessary legal and administrative processes get wrapped up.

Storage costs add up.

And you guessed it: the borrower is usually liable to pay the storage costs, which are added to the total amount owed.

9. Sale in execution

The next step is the sale in execution—where your vehicle is sold to recover the outstanding debt. In most cases, this happens at an auction.

The process should be fair, with the vehicle sold for a reasonable market-related price.

10. Application of proceeds from the sale

The proceeds from the sale are used to cover the outstanding debt, including additional costs incurred (like storage and legal fees.)

Remember, It’s not just about selling the car; it’s about settling the debt.

11. Balance of debt settlement or continuation of payments

If the vehicle’s sale doesn’t cover the full debt amount, then the borrower is still responsible for the balance.

This can be tough. The car is gone, but the debt remains.

On the other hand, if there’s a surplus, it gets paid back to the borrower.

Keep reading to see how it plays out in a ‘real-life’ example.

Are you struggling to afford your car payments?

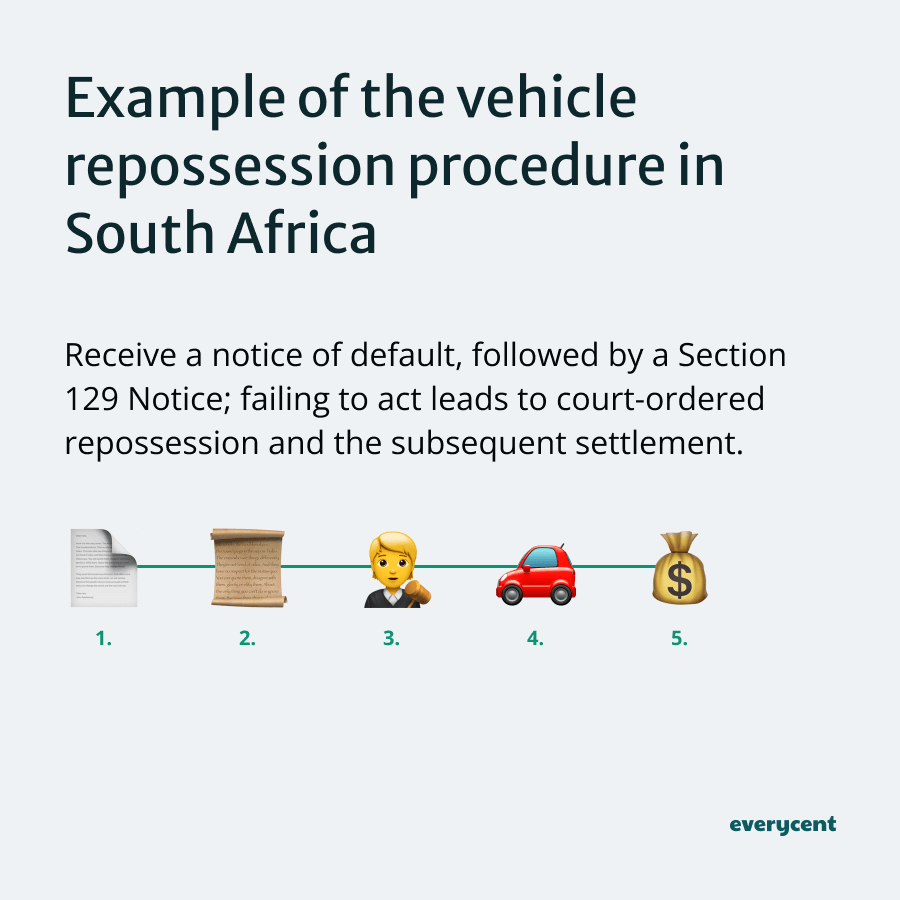

Example of the vehicle repossession procedure in South Africa

Ashley financed her dream car two years ago and recently started to miss car payments.

Here’s how the process unfolds for her:

Notice of default: Three months into missing her payments, Ashley received a notice of default from her lender.

Section 129 notice: A month later, she is issued a Section 129 Notice, which advises her to pay the outstanding amount or consult with a debt counsellor.

Court proceedings: Unable to settle the amount and unsure about consulting a debt counsellor, Ashley fails to respond to the notice (big mistake). Now, the bank proceeds with court action to repossess the car.

Repossession: Within six weeks of the court order, the sheriff arrives at Ashley’s place to repossess the car.

Sale and settlement: Her car gets auctioned off, and the sale doesn’t cover her entire debt. Now, she remains liable for the balance.

The takeaway? Understand the process (check) and take the necessary action to respond.

Car repossession laws in South Africa

In South Africa, the legal document that outlines car repossession laws is the National Credit Act (NCA) of 2005.

NCA sections that deal with car repossession laws in South Africa:

- Section 127—deals with the surrender of goods by the consumer.

- Section 128—addresses the surrender and repossession of goods.

- Section 129—outlines the notice that initiates the vehicle repossession procedure.

Here are the answers to some of the most frequently asked questions surrounding the process.

How long does it take to get a court order to repossess a car?

The time that it takes to obtain a court order for car repossession in South Africa varies between several weeks to a couple of months after the borrower is served a Section 129 notice and given a chance to remedy the default. How fast it happens depends on the court’s schedule and the specifics of the case.

Can your car be repossessed while under debt review?

In South Africa, according to the National Credit Act, your car cannot be repossessed after you are officially declared under debt review.

Remember:

- The debt review process must be finalised and underway; otherwise, creditors may still have the right to repossess the vehicle.

- Failing to adhere to the debt review requirements could also lead to a breach of contract, which may reinstate the creditor’s power to repossess the car.

📖 Related content:

- Can your car be repossessed while under debt review? (explained in detail)

- Advantages & disadvantages of debt counselling

Other relevant points include:

Voluntary surrender:

Voluntary surrender allows the borrower to return the financed vehicle to the lender if they can’t afford payments.

Why? Because voluntary surrender could reduce the costs compared to forced repossession, which generally incurs more legal fees.

To do so, the borrower must notify the lender in writing. After surrender, the lender sells the car, applying the proceeds to the debt. If the sale doesn’t cover the full debt, the borrower still owes the remainder.

(it may also do less damage to the borrower’s credit score than a repossession.)

Reinstatement of credit agreement:

The borrower may reinstate the credit agreement after repossession by paying all past-due amounts and associated costs before the car is sold.

This restores the original agreement and lets the borrower keep the vehicle and continue with the payments as agreed, thus keeping the car and avoiding long-term credit damage.

(Likely the best option if you can afford it.)

In Summary

It is important to remember that there is a legal process that must be followed. Use it to your advantage.

For borrowers: Don’t just stand by if you’re facing vehicle repossession (or fear that you might soon). Take action.

Vehicle repossession doesn’t just end with losing your car; it can impact your credit score and future financial opportunities.

For lenders: Follow the vehicle repossession procedure we outlined, and everything will go off without a hitch.

Want to learn more? Keep reading on Everycent.