Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Is debt review a magic solution to vehicle repossession problems?

Yes and no.

What a frustrating answer—I know. You see, while debt review offers legal protection that can protect your car from being repossessed… it’s not a guarantee.

There are a few conditions that need to be true.

Let me explain.

Can your car be repossessed while under debt review?

Legally, the National Credit Act protects people who are under debt review from asset repossession. This means someone’s car cannot be repossessed while under debt review. Unless the individual misses payments under debt review or applies too late. If the person misses payments or doesn’t successfully apply for debt review before the Section 129 notice grace period ends, then creditors may still be able to repossess the car.

📖 Related content: Advantages and disadvantages of debt review

Are you struggling to afford your car payments? Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.

When can your car be repossessed?

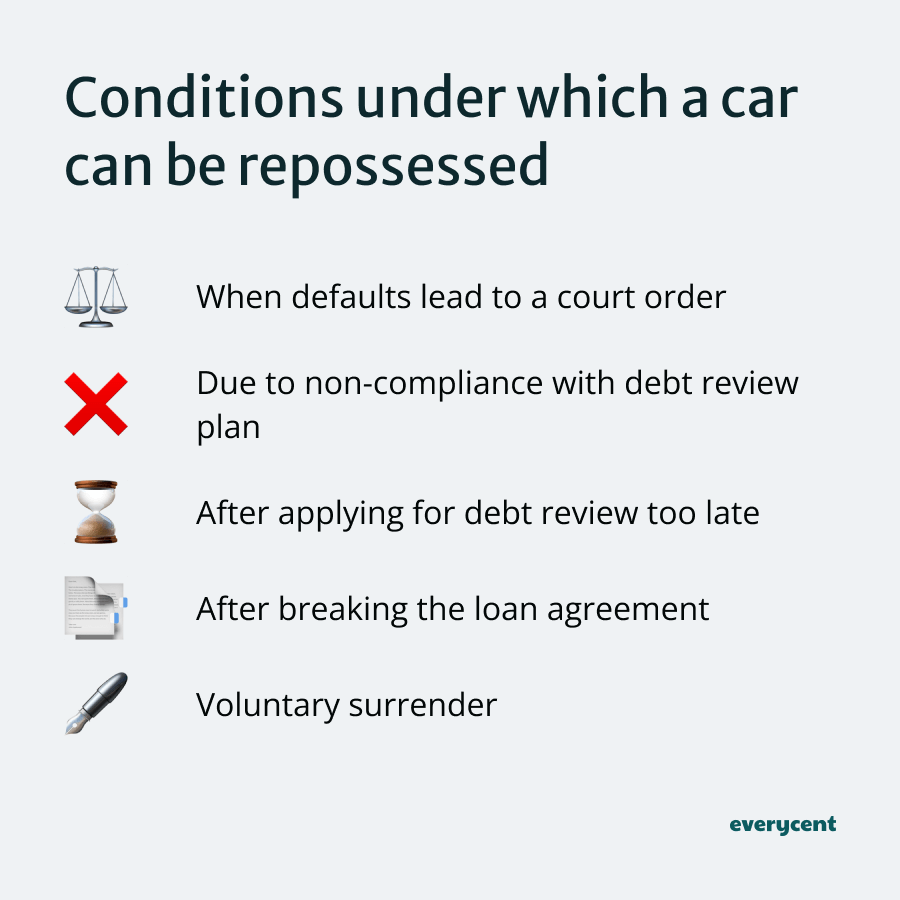

A vehicle can be repossessed under several scenarios, each involving specific legal and financial conditions.

Conditions under which a car can be repossessed:

- Missing car loan payments and receiving a court order

- Not following the debt review plan

- Applying for debt review too late

- Breaking the loan agreement

- Choosing voluntary surrender

Missing car loan payments and receiving a court order: The biggest reason for repossession is missed car loan payments. After missing several payments, the credit provider may send a Section 129 notice. A formal letter detailing the missed payments, legal action, and what to do to prevent it. After that, the credit provider can get a court order to repossess the car.

Not following the debt review plan: If someone doesn’t follow their new repayment plan while under debt review, then the credit provider can still repossess your car. Not sticking to the plan puts repossession back on the table.

Applying for debt review too late: It may be too late for debt review to protect the car after legal action for repossession has already started. It’s important to apply early on.

Breaking the loan agreement: Things like not insuring the vehicle or violating the loan agreement in other ways can also lead to repossession. More examples include unauthorised use or not maintaining the car.

Choosing voluntary surrender: Sometimes, people choose to voluntarily give up their vehicle when they can’t keep up with payments. Usually, this happens as part of a deal with the credit provider to settle the debt in a more manageable way.

📖 Related content: Car repossession process

That’s how it could go down.

Let’s turn our attention to the solution rather than the problem…

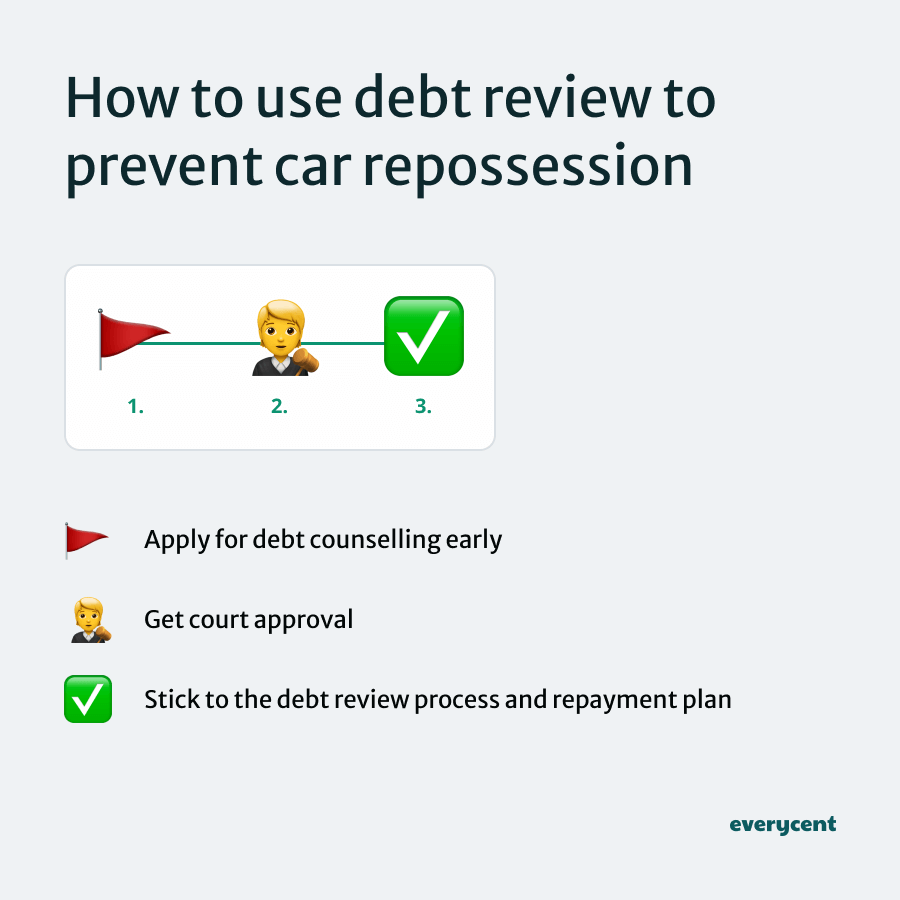

How to use debt review to prevent car repossession

Debt review offers legal protection. Which prevents creditors from repossessing anything. To use debt review to prevent car repossession, apply for debt counselling (debt review) before creditors take legal action. Then, follow the new payment plan to make sure the legal protection under debt review remains in effect.

Here are the steps to use debt review effectively to avoid repossession:

- Apply for debt counselling early

- Get court approval

- Stick to the debt review process and repayment plan

Apply for debt counselling early: Apply for debt counselling as soon as you start struggling with debt. This way, the legal protection can take effect before it’s too late. Plus, it’ll lower the total cost of the debt and help stop missed payments from piling up.

Get court approval: A magistrate’s court needs to approve the debt repayment plan for it to become legally binding. The debt counsellor takes care of this process. Be patient, it may take a while for creditors to approve proposals and agree to the new terms. There’s still a risk of repossession until the court approves the repayment plan. After that sticking with it is what matters.

Stick to the debt review process and repayment plan: Follow the new repayment plan carefully. Make payments in full and on time. Like you agreed. This makes sure the car stays protected. It’ll prevent legal action like repossession and help you get out of debt over time.

Frequently asked questions

How many car payments can you miss before repossession in South Africa?

In South Africa, if a borrower misses one or two car payments, the lender may take steps to get a court order to repossess the car. First, the lender must send a Section 129 notice. Then the process escalates through the court. The lender can only repossess the car when the court grants a warrant of execution or the borrower grants a consent order. But legal fees may start to pile up during this process.

📖 Related content: What to do if you can’t afford your car payments

Can the bank repossess my car without notice?

No, in South Africa, a bank cannot repossess a car without notice. The law requires the lender to first issue a Section 129 notice. This gives the person a chance to fix the problem. After that, if you don’t make payments or apply for debt counselling, the lender must get a court order before they can repossess your car.

Can I sell my car while under debt review?

Yes, you can sell your car while under debt review. If the car is financed, then you’ll need to follow certain steps and get approval. First, find out what your car is worth. Then, talk to your debt counsellor. They can help you to get a settlement amount to assess whether there will be a shortfall. If the lender agrees to the sale, then you can sell the car.

📖 Related content: How to sell a financed car

In summary

Okay so the bottom line is: If you’re under debt review (or apply in time) and stick to the plan. Then your car will remain safe from repossession.

However… if you don’t, and go back to missing payments or apply too late, then the car will be at risk.

Want to learn more? Keep reading on Everycent.

Are you struggling to afford your car payments? Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.