Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

A legal document arrives in the mail…

Two things happen: panic sets in, and so does confusion.

A section 129 Letter of Demand is one of those documents — a real heart-stopper.

What is an S129 Letter of Demand? And should you be worried?

Let’s clear up any confusion and calm your nerves.

Section 129 Letter of Demand

Sometimes, financial obligations go bad, and this leads to official notices and legal procedures— the Section 129 Letter of Demand is one of those notices.

It’s an important notice that precedes legal action related to debt recovery (or collection).

Here’s what you need to know.

What is an S129 letter of demand?

A S129 Letter of Demand is a formal notice issued in South Africa under Section 129 of the National Credit Act that informs consumers who have defaulted on a loan, account, or credit agreement of their infringement and outlines what will happen if the debt isn’t addressed (repaid on time).

Sending an S129 Letter of Demand is one of the first steps that credit providers must take before they’re allowed to take legal action during debt collection.

📖 Bonus reading: How to deal with debt collection in South Africa

Here’s a quick overview of Section 129. Don’t worry. We’ll keep it [very] short.

Section 129 of the National Credit Act (NCA) of South Africa

In South Africa, the National Credit Act (NCA) governs the credit industry (and consumer rights within it).

In the NCA, Section 129 refers specifically to a notice that credit providers (like banks or retailers) must send to consumers when they default on their loan or credit agreement.

This letter is commonly known as the “S129 Letter of Demand.”

And that’s it for the quick overview of Section 129.

Back to the letter of demand.

How does the Section 129 process work?

Remember, it’s not just a letter; it’s a formal step in a legal procedure. There’s a process and consequences.

Here’s how it works:

- The borrower misses their payment

- Creditors give a courtesy period

- Creditors send the section 129 letter of demand

- Borrower gets time to sort things out

- Risk of legal steps if no action is taken

1. The borrower misses their payment

First things first, a Section 129 letter of demand doesn’t just appear out of the blue.

It’s triggered when you, as a consumer, default on your payments. This could be missing a monthly instalment on a loan, credit card, or any credit agreement.

2. Creditors give a courtesy period

Before a creditor sends out a Section 129 letter, they usually give a grace period.

This is an internal process where they may send reminders or make calls to inform you about the missed payments.

3. Creditors send the section 129 letter of demand

If the arrears aren’t settled during the grace period, the creditor then proceeds to issue a Section 129 letter.

This step is legally required under the National Credit Act.

The notice formally recognizes that you have missed payments and strongly urges you to address the issue.

Details of the missed payment in the notice

The Section 129 letter of demand contains specific details like missed payments, how much you owe, and your choices under the National Credit Act.

These choices include getting help from a debt counsellor or making a different plan to pay back what you owe.

4. Borrower gets time to sort things out

Then, You usually have about 10 business days to respond to the notice.

This time is your chance to fix the problem – by paying what you owe, proposing an alternative solution, talking to a debt counsellor or legal professional, or by questioning the debt if you think it’s wrong.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

5. Risk of legal steps if no action is taken

If you don’t act within the given time, the creditor may start taking legal steps to get the debt back. This can lead to court and more financial and legal issues.

It’s important to know that the Section 129 letter of demand is more than a warning. It’s the first step that creditors take before they start taking legal action.

Example of how the Section 129 process works

Ashley borrows money, and for some reason, Ashley starts struggling to keep up with repayments and starts missing payments (or defaulting on payments).

(It happens.)

Now, credit providers can’t just swoop in and take legal action against Ashley.

They must first send a letter that gives Ashley a heads-up, saying, “Hey, you’re behind on payments, and this is what’s going to happen next if you don’t address it.”

That notice/letter is an S129 letter of Demand.

It’s a formal indication that:

- Ashley is behind on agreed payments by a specific amount.

- Ashley has a set period (usually ten business days) to get things sorted. Pay the balance and catch up or seek additional help.

- And, if Ashley doesn’t, legal action might follow.

Thankfully, the National Credit Act is set up to take care of consumers. This means there are a couple of things you can do in response.

Let’s check them out.

What to do with a Section 129 letter

Got that Section 129 Letter in your hand?

Here’s the deal: the credit provider sends you this notice after you’ve been behind on payments for over 20 business days. The good news? You get a 10-business-day window to take action and set things straight.

Here’s what you can do:

- Read and understand the letter

- Act within the given time frame

- Pay the outstanding debt

- Seek additional assistance:

- Propose a plan to the credit provider

- Explore debt counselling

- Seek legal advice if necessary

1. Read and understand the letter

Carefully read the Section 129 Letter of Demand to fully understand the details of your outstanding debt, including the amount due and the reason for the notice.

2. Act within the given time frame

You have 10 business days to respond. It’s critical to act within this period to avoid further legal action.

Can you pay the outstanding debt?

- Yes: Make the necessary payment.

- No: Seek additional assistance. See options A, B, and C below.

If you can’t afford to pay, then you could try the following:

A = Propose a plan to the credit provider, B = Explore debt counselling (debt review), or C = Seek legal advice if necessary (and applicable).

A. Propose a plan to the credit provider

Reach out to your credit provider to discuss the debt. Remember, you have the right to make a proposal. Be honest about your situation and see if there’s room for negotiation or a payment plan.

B. Explore debt counselling

If you’re struggling to afford your debts, consider contacting a debt counsellor. Debt counsellors can help reduce the monthly cost of your debt.

This would make the debt repayment affordable and allow you to make payments to prevent further legal action. Plus, debt counselling typically offers additional protection against legal action.

Optional bonus reading: Debt counselling vs debt review vs debt consolidation loans.

C.Seek legal advice if necessary

If you’re unsure about the contents of the letter, your rights, or how to proceed, consult with a legal professional who specialises in consumer debt.

This could be your lawyer, an alternative dispute resolution agent, consumer court, or ombud with jurisdiction.

Additional tips for dealing with a Section 129 letter

These tips may also be useful.

Keep all communication records: Document all interactions with your credit provider for future reference. This includes emails, letters, and notes from phone calls.

Plan for future payments: If you arrange a payment plan, budget accordingly to meet these new commitments and avoid future defaults.

Monitor your credit report: After resolving the issue, regularly check your credit report to ensure it accurately reflects your current financial status.

What happens after getting a Section 129 letter of demand?

When you receive a Section 129 Letter of Demand in South Africa, you have a window of time (typically ten business days) to address the outstanding debt and resolve the issue.

As we mentioned, you can do so by settling the amount, negotiating a payment plan, or opting for debt counselling.

If unaddressed (or ignored), then the credit provider can initiate legal action, which could lead to a court judgement, asset repossession, or garnishee orders on your salary.

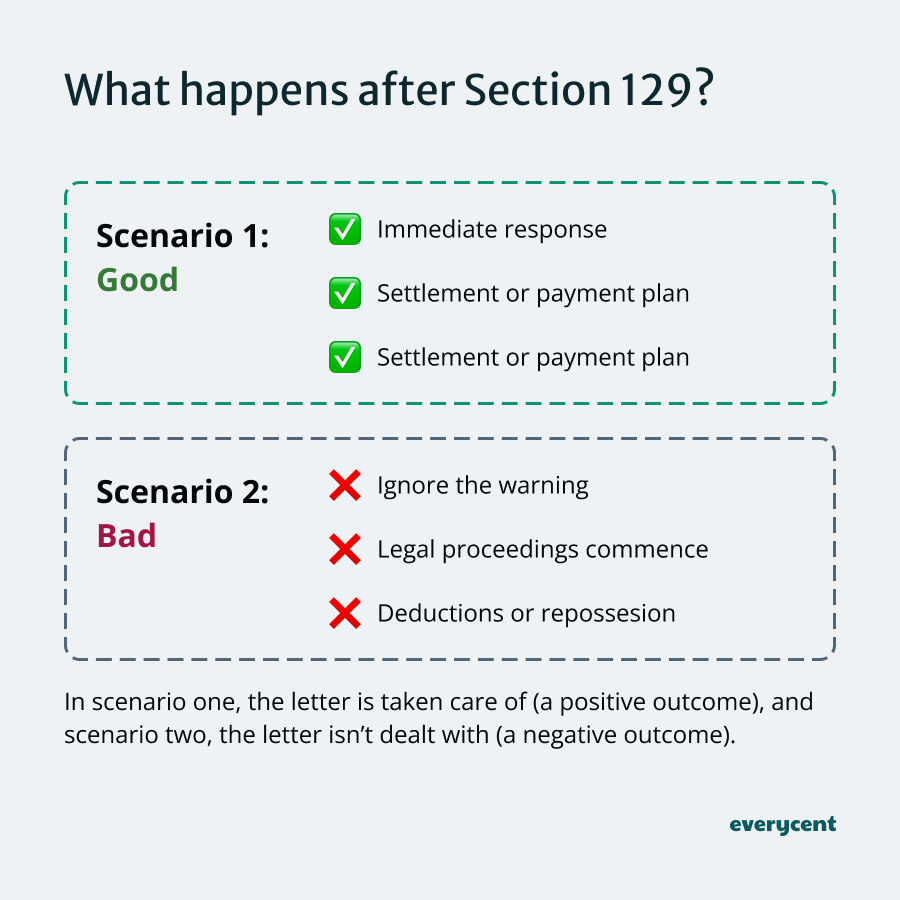

Let’s look at two scenarios to make this clear.

Scenario one, where the letter is taken care of, and the issue gets resolved (a positive outcome), and scenario two, where the letter isn’t dealt with (a negative outcome).

Scenario 1: addressing the problem after receiving a Section 129 Letter of Demand

- Immediate response — upon receiving the letter, review the contents to understand the amount in arrears, the situation, and the stipulated time frame for action.

- Contact the credit provider —reach out to the credit provider to discuss the debt, express concerns, or dispute any inaccuracies in the letter.

- Settlement or payment plan — if possible, pay the outstanding amount in full or negotiate a new payment plan or settlement figure with the credit provider.

- (Optional) Apply for debt counselling — if the debt is unmanageable or unaffordable, then debt counselling can help simplify debt repayment with a consolidated repayment plan and reduced monthly debt repayment.

- Stick with the agreement — once a plan is in place (or the outstanding balance is caught up), commit to the agreement without missing another payment.

- Monitor credit report — it helps to monitor personal credit reports after these incidents to make sure that the default is updated and that there aren’t any lingering issues.

Scenario one is what is supposed to happen.

Try and avoid this next one (it doesn’t end well).

Scenario 2: not addressing the problem after receiving a Section 129 Letter of Demand

- Ignore the warning — either by overlooking or intentionally ignoring the Section 129 letter and not taking any corrective action within the stipulated period.

- Legal proceedings commence — the credit provider initiates legal action due to non-response, which might lead to a court summons. (Check out: What to do when you get summons for debt in South Africa)

- Judgment issued — if the court summons isn’t successfully defended, or if the court rules in the credit provider’s favour, a judgment is registered against the consumer.

- Severe consequences — with a judgment, the credit provider can enforce various measures to recover the owed amount. This includes:

- Garnishee orders: Where legally, a portion of the consumer’s salary gets deducted to repay the debt.

- Asset repossession: Valuable assets, like cars or property, get repossessed and auctioned to recover the debt amount.

- Credit profile suffers — the judgement remains on the consumer’s credit report for several years, making it challenging to obtain new credit, loans, or even certain jobs.

- Debt still remains — after all that, if the credit provider cannot recover the full amount owed through legal means, the debt still remains, and the consumer is obligated to continue to pay it off.

That’s a pretty scary outcome, right?

We’ve covered a couple of legal aspects here and there. Now, we’ll make it more concrete.

Rights and legal requirements under Section 129

First, we’ll go over your rights as a consumer. Then, we’ll look at the legal requirements that creditors must meet. If they fail to do so, then their actions may be void.

Your rights under Section 129 as a consumer

Notification of default — the consumers must be notified in writing by the credit provider if they are in default under a credit agreement.

Options for resolution — the notice must include proposals for the consumer to resolve the default.

Opportunity to rectify default — the consumer must have the opportunity to rectify the default status.

Legal requirements for creditors

Mandatory notice — creditors are required to issue a written notice.

Delivery methods — the notice (or letter) must be delivered either by registered mail or personally to an adult at a location designated by the consumer.

Proof of delivery — creditors must provide proof of delivery (written confirmation from the postal service or the signature of the recipient.)

Waiting period before legal action — creditors have to wait and meet other legal requirements under the NCA before taking legal action.

Consequences of non-compliance — if a creditor fails to comply with these requirements, any legal action taken may be void.

Remember, creditors can’t instantly drag someone to court the moment a payment is late.

They need to follow the law, too.

Here’s what the letter should include and what a sample Letter of Demand might look like.

Section 129 Letter or Letter of Demand must include the following information

- The recipient’s personal details and account information.

- The exact amount in arrears.

- Notice that the recipient has the right to refer the credit agreement to other parties, including a debt counsellor.

- A clear indication that if no action is taken by the recipient, legal proceedings may commence.

- The name and contact details of the credit provider.

Check your letter. Does it meet these requirements?

And if you were wondering, here’s what it might look like.

Sample Letter of Demand South Africa

Sample letter of demand South Africa (PDF)

Here’s a simplified version of what a section 129 letter of demand might look like in South Africa:

| [Sender Name/Company]

[Sender Address] [City, Postal Code] [Date] Dear [Recipient Name], RE: NOTICE OF DEFAULT IN TERMS OF SECTION 129 OF THE NATIONAL CREDIT ACT, 34 OF 2005 Account Number: [Relative Account Number] We hereby notify you of your default under the above-mentioned agreement. As of [Date], you are in arrears in the amount of [Amount in Rand]. In terms of Section 129 of the National Credit Act, you have the right to: Refer the credit agreement to a debt counsellor, alternative dispute resolution agent, consumer court, or ombud with jurisdiction. Resolve any dispute you may have concerning the agreement or make arrangements with us to pay off the debt. Please take note that if you do not take any of the above steps, legal action may commence. Yours faithfully, [Sender Name/Company] |

*This sample letter is a general representation and may not capture all nuances of an official Section 129 Letter of Demand. Real letters from credit providers may differ in content and structure.

Remember, this is all part of a legal process that creditors must follow before they may take legal action to recover outstanding debts.

Basically, everything needs to be legit.

In summary

A Section 129 Letter of Demand is a big deal.

For creditors, it’s a step in the debt collection process, and for consumers, it’s a chance to fix things before the courts get involved.

The smart move is to address the notice either by paying the outstanding amount or by putting a new agreement (or repayment plan) in place. Debt counsellors can help with this process.

Failure to do so could have several financial consequences.

Now, you’re ready. Proceed calmly and take care of that letter.

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.