Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Debt collectors have to play by the rules.

Get to know these rules, and you can protect yourself from debt collection.

Here are your rights and how to deal with debt collection.

Consumer rights and debt collection in South Africa

The good news is that the debt collection process falls under the National Credit Act. This means it’s a legal process, and creditors and debt collectors must play by the rules. South African consumers have the right to a fair process.

And that’s the secret to dealing with debt collectors.

Quick recap: Debt collection is the process creditors follow to collect outstanding or overdue debt from borrowers. Debt collection usually starts after the debtor (person who borrowed money or has an account) fails to make scheduled payments and gets a Section 129 Letter of Demand.

Most of the time, it involves a debt collector, either an individual or an agency, who has to ‘collect’ the money that’s owed.

📖 Related content: What happens if you can’t pay your debt in South Africa?

Okay, now let’s look at some of the laws that come into play and the consumer rights that go with them.

First up is The Debt Collectors Act.

Debt Collectors Act South Africa

In South Africa, debt collectors are governed by the laws and regulations set under the legislation of The Debt Collectors Act of 1998.

It ensures that debt collectors recover debts legally and ethically. It also governs consumer rights during the debt collection process.

Here are a few important laws.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Key debt collection laws in South Africa (essential for consumers)

Consumers have rights, and the only way to protect yourself is to get to know them.

Here are a few debt collection laws that stand out:

- Debt collectors must not harass or abuse: They are prohibited from using threats, obscene language, or making repeated calls to annoy debtors.

- Debt collectors may not lie to consumers: They must not make false statements about the debt, their identity, or authority, and must represent the creditor and debt truthfully.

- All debt collectors’ fees must be regulated: This prevents debtors from facing unreasonable costs and excessive charges.

- Debt collectors must respect confidentiality: They must keep personal and debt-related information of debtors confidential (private) and not share it with unauthorised parties.

- Property seizure must follow the proper legal procedure: Debt collectors need a court order to seize or sell a debtor’s property. This refers to ‘property’ as belongings and includes things like cars or personal items.

📖 Bonus reading:

It’s worth mentioning that debt collectors must be registered.

To verify whether a debt collector is legit, try searching the Council for Debt Collectors (CFDC)’s active register. The CFDC regulates the conduct of registered debt collectors in SA.

Now, what if a debt collector isn’t sticking to the laws mentioned earlier?

Well, then they should be reported.

Where to report debt collectors in South Africa

Debt collector misconduct or harassment should be reported to the National Credit Regulator (NCR). The NCR encourages consumers to report companies or lodge complaints by sending the complaint to complaints@ncr.org.za or calling 0860 627 627, after first lodging a complaint with their credit provider or debt counsellor.

The National Credit Regulator (NCR): Oversees the compliance of debt collectors with the National Credit Act and related regulations.

This is the best place to report most issues with debt collectors. If you believe a debt collector has broken any rules or engaged in harassment, you can file a with the NCR.

Other channels for filing complaints include the Credit Ombudsman and the National Consumer Commission (NCC).

The Credit Ombudsman: Handles disputes involving credit agreements.

The National Consumer Commission (NCC): Deals with broader consumer rights issues, including debt collection practices.

When filing a complaint, it’s vital to provide detailed information and any available evidence for an effective investigation and resolution.

Lastly, the Council for Debt Collectors (CFDC) regulates the conduct of registered debt collectors in South Africa. While the CFDC isn’t typically the primary or direct avenue for consumers to report issues related to debt collection, it may be worth submitting a complaint to the CFDC.

You can do so via their website www.cfdc.org.za, emailing info@cfdc.org.za or calling 012 804 9808.

Harassment, misconduct, and illegal practices are big deals.

Report it. It could help someone else, too.

Now, let’s cover how to defend yourself.

How to deal with debt collectors and attorneys

Dealing with debt collectors and attorneys can be stressful.

Usually, they only get involved when things are already going bad and add even more pressure.

Thankfully, there are ways of dealing with both debt collectors and attorneys.

How to deal with debt collectors when you can’t pay

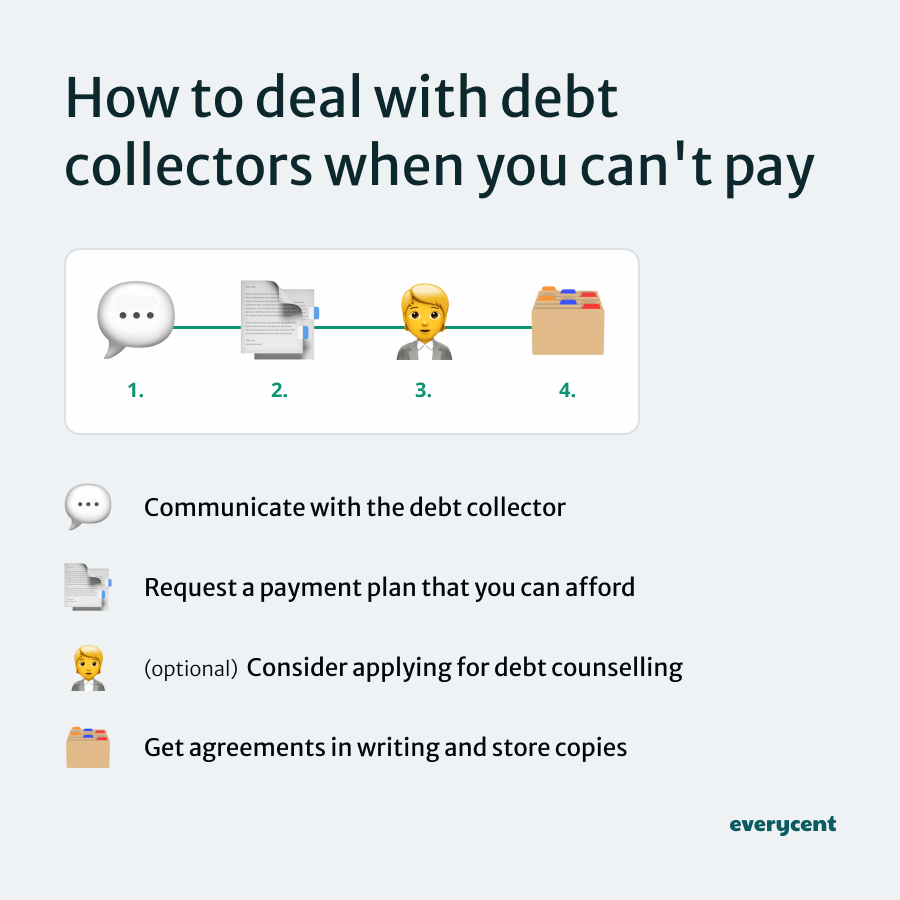

If you can’t pay a debt, consider these steps:

- Communicate with the debt collector: Be honest about your financial situation and talk to the debt collector and your creditor. Avoiding contact may result in more aggressive collection tactics and legal action.

- Request a payment plan that you can afford: Many debt collectors are open to negotiating a payment plan that fits your financial situation.

- Consider applying for debt counselling (optional): If you’re significantly over-indebted, entering into debt counselling (debt review) can help restructure your debts to make them affordable again and provide legal protection against further collection actions.

- Get agreements in writing and store copies: Ensure any payment plans agreed upon are documented in writing. You’ll need evidence to avoid future disputes.

Basically, the best way to deal with debt collectors when you can’t pay is by finding a way to restructure your debt or agreement, either by requesting a new payment plan or by applying for debt counselling so that a debt counsellor can negotiate a repayment plan on your behalf.

Other options may include refinancing over a longer period, selling your home or car to pay off the debt, negotiating a settlement, or finding ways to reduce your expenses to make the debt affordable.

📖 Bonus reading:

- What is debt review in South Africa?

- Advantages & disadvantages of debt counselling (debt review)

- 7 things you can do if you can’t afford your car payment

Remember. Once a court order is issued and a debt is handed over to an attorney, then it’s too late to enter into debt counselling (debt review) for that specific debt.

If you really need the help, then it may be best to get started before it’s too late. Consider your situation and what’s best for you.

How to deal with debt collection attorneys

If attorneys handle your account in South Africa, these steps can assist you:

- Respond promptly: Quickly address communications from attorneys to prevent legal action.

- Understand your rights: Know your rights in debt collection and legal proceedings to protect yourself from unfair practices.

- Seek legal advice if necessary: Consult a legal professional for advice and guidance.

- Negotiate a settlement: Attorneys might accept a reduced amount to settle the debt.

- Stay compliant with legal requirements: In case of court proceedings, always comply with all legal requirements, including attending hearings and submitting necessary documents. Failing to do so could make the court rule in favour of the creditors.

Frequently asked questions

Can a creditor refuse a payment plan in South Africa?

Yes, in South Africa, creditors aren’t legally required to accept payment arrangements and can refuse a payment plan.

However, many creditors are willing to consider reasonable payment plans, especially if they can recover outstanding debt.

Can debt collectors blacklist you?

No, debt collectors in South Africa cannot blacklist you.

The term ‘blacklisting’ usually refers to recording a consumer’s credit information, such as defaults, on their credit report.

There’s no official ‘blacklist’. Being ‘blacklisted’ basically means having a very low credit score. Therefore, this gets handled by credit bureaus, not debt collectors.

Debt collectors can, however, report unpaid debts to credit bureaus, which could negatively impact your credit score.

In summary

Now, you understand your rights as a consumer and know how to deal with debt collectors during debt collection.

The best solution is to stay proactive, be honest, talk to your creditors, and seek help from a debt counsellor if you’re really struggling to make debt repayments each month.

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.