Does owning a car feel like it is just, just, just out of reach?

Car prices are getting a little out of hand, which makes it feel like it is getting harder to own a car.

Luckily, there’s an alternative to the traditional way of buying a car—rent-to-own (for cars).

Here’s how it works.

How do rent-to-own cars work?

Rent-to-own cars allow individuals to rent a car with the option to own it at the end of a full rental term. A portion of the rental payments go toward buying the car, which means the renter could own the car once it is paid off. The renter also gets insurance and maintenance. Unlike traditional financing, rent-to-own agreements don’t require strong credit or large upfront deposits. But, the renter must complete the full rental term and make all of the payments to get ownership of the vehicle; otherwise, the car remains with the provider.

📖 Related content: Credit score required to buy a car

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Here’s an example.

Example of how rent-to-own cars work

Sam is a young professional living in Johannesburg. She needs a reliable car but struggles to qualify for a traditional car loan because of her credit score.

Here’s how rent-to-own works for her:

- The Agreement: Sam signed a three-year rent-to-own contract. Her monthly payment is R6,000, which includes insurance and basic maintenance.

- Payments: Each payment covers rental, insurance, maintenance, and contributes to the car’s purchase price, making progress toward ownership over time.

- Ownership Transfer: At the end of the three years, Sam makes her final payment, and the provider transfers ownership of the car to her name.

So far so good. But there are a couple of things you should know about the rent-to-own model.

What is rent-to-own?

Rent-to-own, or rent-to-buy, is a legal agreement where individuals rent an asset or property, like a car or a home, for a set period with the option to buy or own it at the end of the contract. In most cases, a portion of the monthly payment goes toward the asset’s purchase price, essentially paying it off while renting it.

That’s rent-to-own in general…now let’s look at the specifics for cars.

What is rent-to-own cars? A rent-to-own car is a car leased under a rent-to-own agreement

Alright, this next part gets interesting.

Take a look at how it all works (and why it’s not for everyone).

How does rent-to-own work in South Africa?

In South Africa, rent-to-own agreements offer an alternative to traditional financing. These agreements allow people to lease an asset like a car for a fixed period, typically 24–60 months. For rent-to-own cars, monthly payments often cover the car’s purchase price, insurance, and maintenance. Unlike traditional financing, if the renter stops paying, they forfeit the car but don’t have to worry about outstanding debt for the unpaid balance. This means the renter doesn’t build equity in the car until the agreement is fulfilled.

Read that again.

This highlights a couple of things about rent-to-own agreements—some pros and some cons.

Let’s compare them.

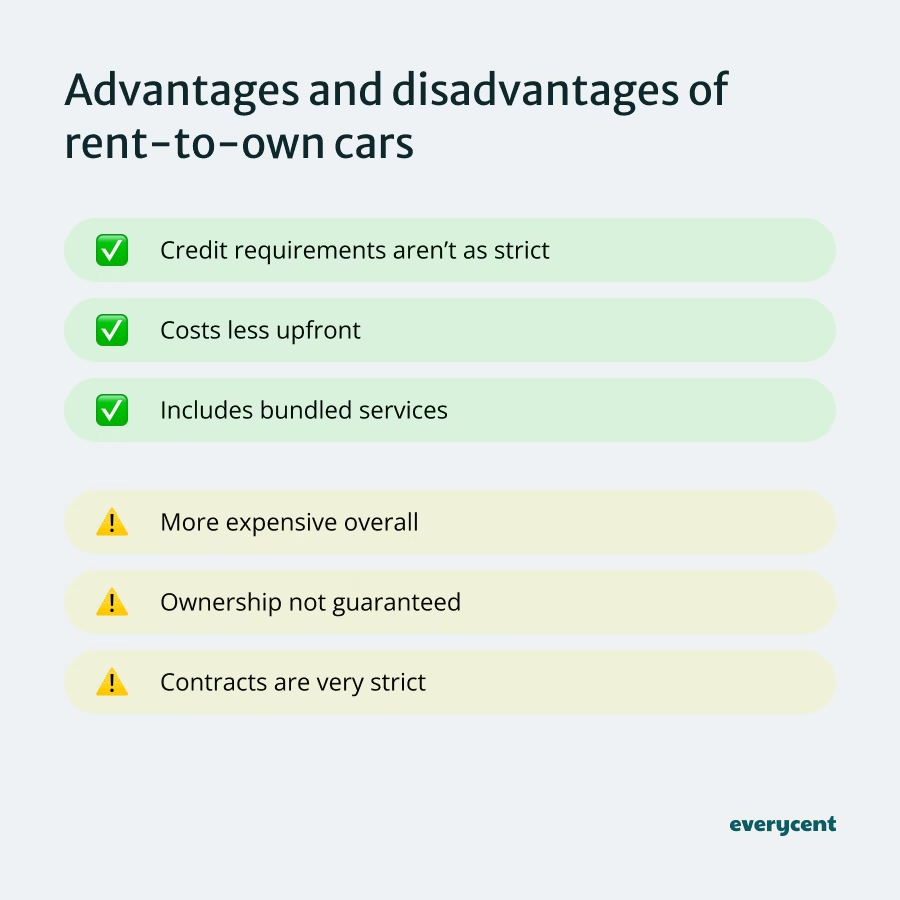

Advantages and disadvantages of rent-to-own cars

Advantages of rent-to-own cars

The biggest advantage of rent-to-own cars is the flexibility and accessibility. Credit checks aren’t as strict; they cost less upfront and include bundled services like insurance and maintenance. It also provides the option to upgrade during the contract and creates a clear path to ownership over time.

- Credit requirements aren’t as strict

- Costs less up front

- Includes bundled services

- Offers some flexibility

- Can lead to ownership

Credit requirements aren’t as strict: People with poor or no credit history qualify because credit requirements are less strict.

Costs less up front: Minimal to no deposit is required, making it more affordable upfront.

Includes bundled services: Payments often include services like insurance and maintenance for added convenience.

Offers some flexibility: Upgrades or changes are allowed under certain conditions during the contract.

Can lead to ownership: A clear and structured payment plan leads to ownership over time.

Those are the pros. Now, let’s review the cons.

Disadvantages of rent-to-own cars

Rent-to-own cars have several downsides like cost and risk. The total cost can be higher than the car’s actual value, and missing payments can lead to repossession. Plus, ownership isn’t guaranteed until the last payment is made, which puts renters at risk during the contract.

- More expensive overall

- Ownership not guaranteed

- There are fewer vehicle options

- Contracts are very strict

- Not protected by debt review

More expensive overall: The total payment often exceeds the car’s market value, resulting in higher costs.

Ownership not guaranteed: When the renter can’t afford the car payments it could lead to the repossession of the vehicle which means the renter loses all of their equity in the vehicle.

There are fewer vehicle options: Fewer vehicle options compared to traditional financing.

Contracts are very strict: Renegotiating terms is difficult, especially when financial circumstances change.

Not protected by debt review: Rent-to-own agreements can not fall under debt review, which means there is no protection against repossession if payments are missed.

Now, let’s suppose you want to get a rent-to-own car. Where can you get one?

Let’s see…

Struggling to pay your debt bills?

Affordable rent-to-own cars

In South Africa, many companies offer rent-to-own vehicles tailored for affordability. These vehicles are often pre-owned and range from budget-friendly sedans to compact hatchbacks. It’s best to do a bit of homework to find a reliable provider. But, companies like Rentadeal and Planet42, amongst others, offer rent-to-own cars.

Here are a few tips:

- Compare providers and read reviews to find a good company.

- Make sure you understand the total cost over the agreement term.

- Ensure the monthly payment fits within your budget.

- Check if the agreement includes added benefits like insurance or maintenance to avoid extra costs.

In summary

Rent-to-own cars have their place. But, most South Africans prefer traditional financing. While the costs and risks are real, the flexibility and availability could make it an appealing option.

Want to learn more? Keep reading on Everycent.