Debt counselling (debt review) is amazing. It is probably the most powerful tool in South Africa for taming out-of-control debt. Yet, some people end up regretting their application — why is that?

In all likelihood, they just weren’t aware of the disadvantages of debt counselling (debt review).

So, before anyone applies, let’s look at both sides of the coin (the pros and cons) and make sure we all know what we’re getting into.

Recap: what is debt counselling (debt review)

Debt counselling is a formal process introduced by the National Credit Act (NCA) to give over-indebted South Africans a way out of debt by reducing how much they owe each month. The process offers several benefits but does come with its own restrictions.

That’s where our neat list of advantages and disadvantages comes in (we’ll get to that in a moment).

It is worth mentioning that we discuss debt counselling and debt review together in this post. The two are closely related and often used interchangeably (that’s why).

Debt counselling = the broader process/service

Debt review = the legal programme/process (outlined in the NCA) that follows

If you want to learn more about their differences, check out debt counselling vs debt review.

Now, let’s compare the pros and the cons.

Advantages and disadvantages of debt counselling (debt review)

| 🟢 PROS | 🔴 CONS |

| Reduced monthly payments | Fees and costs |

| Protection from legal action | Restricted credit access |

| Consolidation of debt | Applicable to limited debt types |

| Mediation between you and your creditors | Qualifying criteria |

| No permanent record of your debt review status | Negative impact on credit score |

| Reduced stress (indirect benefit) | Long-term commitment (indirect) |

| Better financial management skills (indirect benefit) | Potential risk for default remains |

| Opportunity to improve credit score (indirect benefit) | Potential risk for legal action remains |

“Great. Nice list! But what does each pro and con mean?” — we’re glad you asked.

Let’s examine each of the pros and cons more closely. We’ll start with the good news.

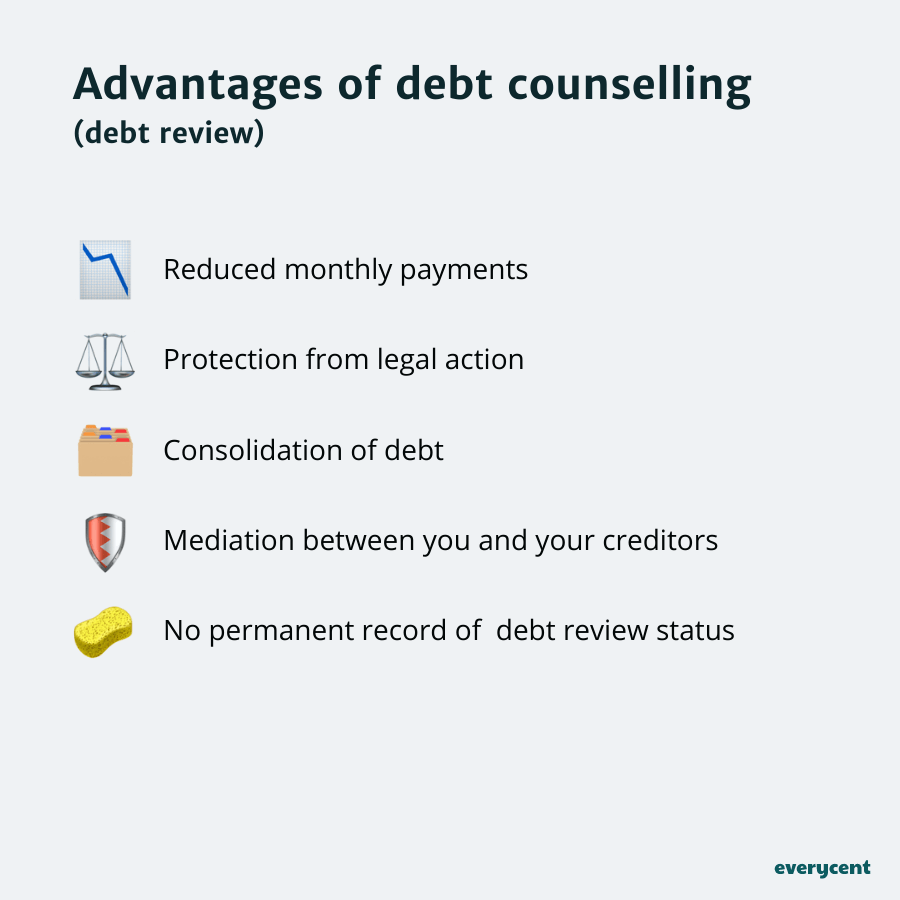

Advantages of debt counselling (debt review)

- Reduced monthly payments

- Protection from legal action

- Consolidation of debt

- Mediation between you and your creditors

- No permanent record of your debt review status

- Reduced stress (indirect benefit)

- Improved financial management skills (indirect benefit)

- Opportunity to improve credit score (indirect benefit)

Direct advantages

Reduced monthly payments

Benefit: spending less on monthly debt repayments = more money for other needs and expenses.

During the debt counselling (debt review) process, the debt counsellor negotiates with creditors to lower what each of them is owed each month and creates a new debt repayment plan. This means that the person going through debt counselling gets to pay less.

For example, an R5,000 monthly auto loan repayment gets lowered to R3,250 monthly.

Protection from legal action

Benefit: keeping all your stuff and not going to jail.

This means that creditors won’t be able to pursue any legal action. Therefore, there’s no repossession of assets (you get to keep your stuff), judgements, s129 letter of demand, or garnishee orders.

You’re safe.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Consolidation of debt

Benefit: making one payment each month instead of dozens. Plus, it’s easier to keep track of.

To consolidate means to combine (many things) together. In this case, the various debts and accounts. As a result, the consumer (person under debt counselling) goes from paying ten (or however many) bills to just one. It’s much easier to manage and less stressful (yay, consolidation!).

Mediation between you and your creditors

Benefit: The phone stops ringing, and everything is taken care of.

Here, debt counsellors get creditors off your back. Legally, creditors aren’t allowed to harass borrowers undergoing debt review. They need to take it up with their debt counsellor.

No permanent record of your debt review status

Benefit: there are no lasting consequences.

The evidence gets erased after the process is complete.

(The following advantages are indirect, but they’re advantages nonetheless)

Indirect advantages

Reduced stress (indirect benefit)

Benefit: sleeping at night, not losing all your hair in 24 months, less fighting at home, you name it. Stress sucks.

Having a structured plan that is easy to follow, affordable monthly instalments and creditors taken care of removes A LOT of stress.

Improved financial management skills (indirect benefit)

Benefit: getting better at managing money has a massive knock-on effect that’s bound to result in more money in the future.

Undergoing debt review gets you to shake your reliance on debt and develop healthier financial habits.

Struggling to pay your debt bills?

Opportunity to improve credit score (indirect benefit)

Benefit: starting from a clean slate makes it easier to build a healthy credit score afterwards, and a better credit score = lower interest rates + more opportunities.

Before, it might have been difficult to keep up with payments, which probably hurt your credit score.

Once you’re caught up and debt-free or no longer over-indebted, then that’s no longer the case. It is time to build a good credit score!

That’s the pros. There are several, and some are pretty powerful. However, there are reasons why it’s not for everyone.

So, let’s avoid the raging 1-star reviews and catch up with the cons next.

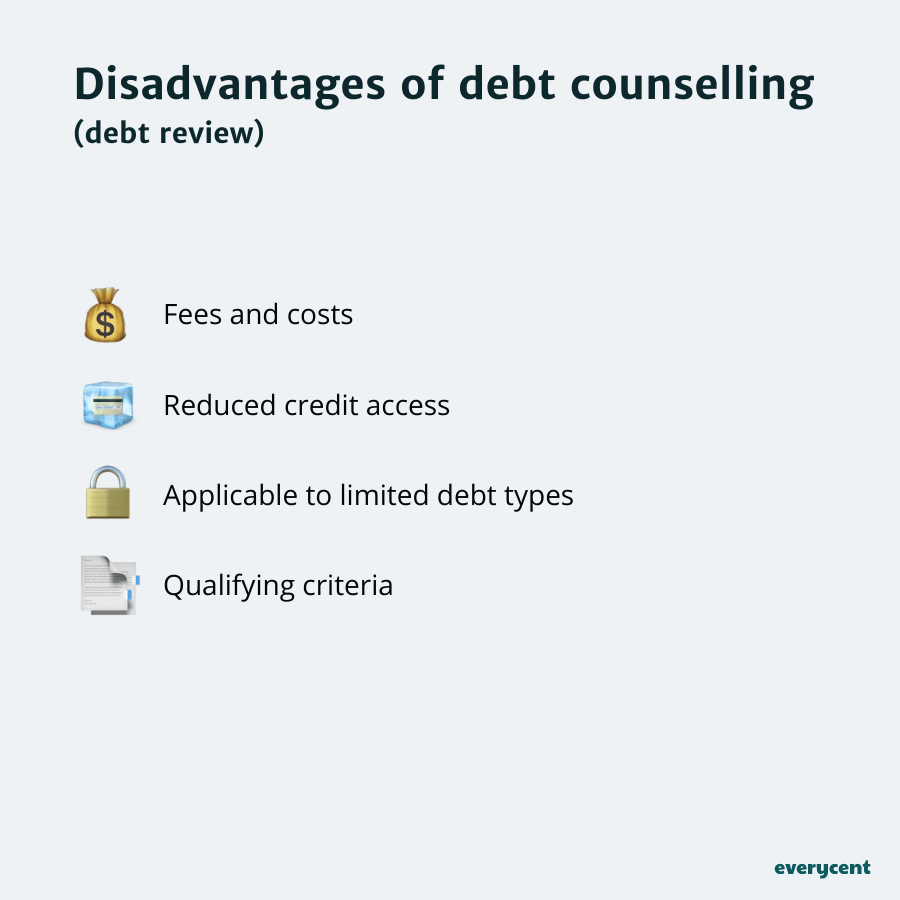

Disadvantages of debt counselling (debt review)

- Fees and costs

- Reduced credit access

- Applicable to limited debt types

- Qualifying criteria

- Negative impact on credit score (potentially)

- Long-term commitment (indirect)

- Potential risk for default remains

- Potential risk for legal action remains

Direct disadvantages

Fees and costs

Drawback: debt counselling (debt review) costs money, which adds to the overall cost of the debt.

Debt counselling isn’t free. There are debt counselling fees that you need to consider. Luckily, the National Credit Regulator (NCR) sets the maximum fees that debt counsellors are allowed to charge. This keeps the cost down.

Restricted credit access

Drawback: no new loans or credit cards while under debt review (this is actually important and can also be seen as a benefit. It depends on how you look at it.)

To protect over-indebted consumers from falling further into the debt trap, debt counselling (or, more specifically, debt review) is set up to limit additional lending.

Legally, creditors aren’t allowed to lend money to individuals rehabilitating their debt (going through debt counselling or review).

Thankfully, this doesn’t mean that it is IMPOSSIBLE to get a loan under debt review. There are exceptions to the rule.

Applicable to limited debt types

Drawback: Not every single type of debt is eligible to get reduced and consolidated during the process (don’t worry. The ones that matter apply.)

Most debt can be reduced and consolidated under debt review. But not all of them. This depends on several factors, so we recommend contacting a debt counsellor to determine what applies to you.

Qualifying criteria

Drawback: Not everyone qualifies.

This one can be hard to swallow for some. There’s a list of requirements that need to be met to apply for debt counselling. One of which is having a steady source of income. Here’s the list:

- Be a natural person (human)

- Be over-indebted

- Have a steady income

- Mustn’t already be registered for debt review

Negative impact on credit score (potentially)

Drawback: building a good credit record takes time, and any negative impact will take time to mend.

This only applies when someone with a good credit score goes under debt review. Most applicants have bad credit scores because their high debt bills have already created a history of missed or late payments. In this case, there’s not much room to go from bad to worse; sorting out the mess is more important.

After the process, getting out of debt will make it much easier to build a strong credit score.

Indirect disadvantages

Long-term commitment (indirect)

Drawback: it takes time and requires patience and perseverance.

Once you sign up, you’re in it for the long haul. Debt counselling (debt review) typically lasts 36 – 60 months.

⭐ Bonus: How long does debt review last?

Potential risk for default remains

Drawback: it’s not an automatic out. Applicants still need to make monthly payments.

If a person under debt review (debt counselling) doesn’t pay enough or at all, then they’re breaching the agreement. Defaulting payments under debt counselling is no different from defaulting on regular credit agreements.

Potential risk for legal action remains

Drawback: not doing your part could still land you in hot water (get you in trouble). Legal action is back on the table when applicants don’t honour their part of the agreement.

Any legal protection dissolves once the contract is breached. So, not paying or paying less than agreed upon can result in legal action (yikes).

Another alternative that could reduce monthly debt repayments and potentially lower interest rates is debt consolidation loans.

There’s some overlap between debt counselling and debt consolidation loans and a few key differences.

Let’s compare apples with apples.

Struggling to pay your debt bills?

Debt consolidation loans comparison

For some, a debt consolidation loan is a good option. For most, however, it could be risky.

Consider the benefits and drawbacks of each.

| DEBT REVIEW | DEBT CONSOLIDATION LOANS |

| Advantages | |

|

|

| Disadvantages | |

|

|

Final thoughts

What do you think? Some of the benefits are pretty compelling. In some cases, debt counselling becomes the only solution that’ll work, while for others who don’t NEED it, the disadvantages might be too unappealing.

At least now you know what’s what. Choose accordingly and get your debt back on track. We’re rooting for you!

Want to learn more? Keep reading on Everycent.