Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

You know what’s funny about debt review?

The fact that the #1 thing that holds people back from applying is the fear that they won’t be able to get new loans.

It’s a fair concern.

Financial troubles are REALLY difficult to overcome, and loans and credit can help us get by.

So, whether you’re under debt review or considering an application, let’s find out whether getting a loan under debt review is possible and how to do it.

Plus, we’ll share a few alternative options.

Here we go.

Can I get a loan while under debt review?

In most cases, the answer is no; you cannot get a loan while under debt review. However, there is an exception to this rule that is outlined in section 88(3) of the NCA.

Under normal circumstances, the debt review status (indicated on your credit report) discourages creditors from lending you more money, but prior written consent from a debt counsellor and credit provider may override this rule under unforeseen or emergency circumstances.

Here’s the exception to the rule. Let’s see what the National Credit Act says.

Exceptions

Check this out.

Section 88(3) of the NCA says:

“If a consumer under debt review needs credit to satisfy any unforeseen or emergency expense, or the cost of maintenance or repair of a necessary household appliance or motor vehicle, the consumer may, with the prior written consent of the debt counsellor and credit provider, obtain credit to satisfy the expense.”

But what does this mean in practice?

Let’s look at examples.

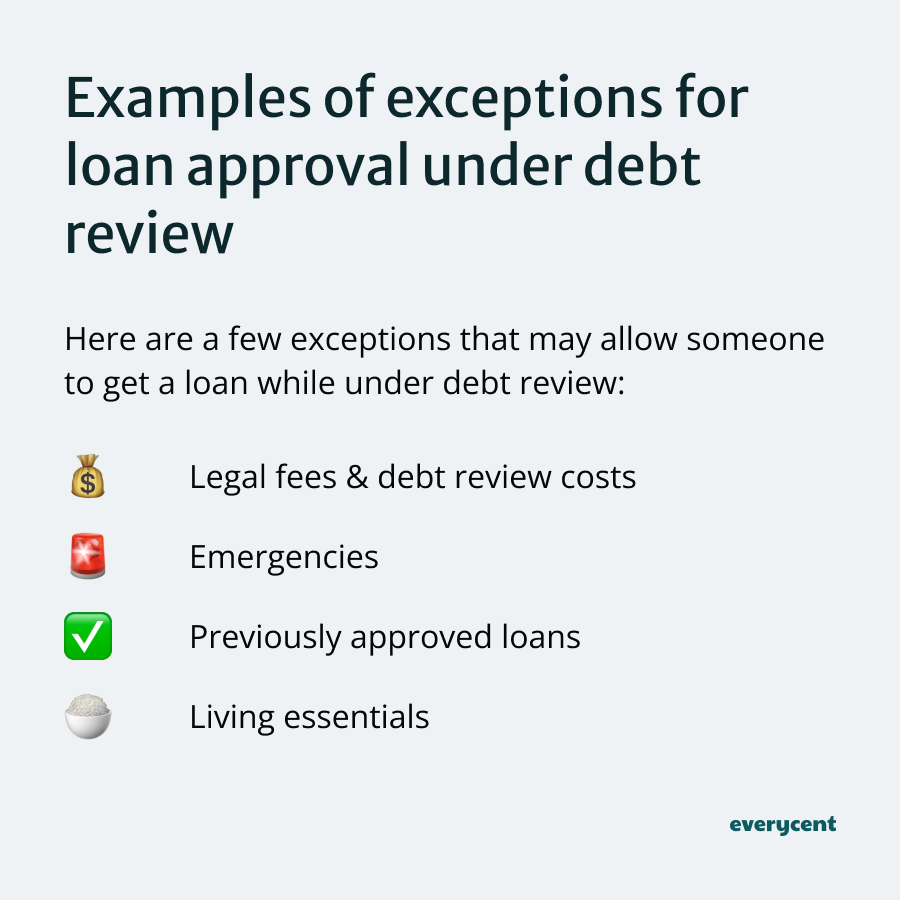

Examples of exceptions

Here are a few practical scenarios that illustrate when someone might be eligible for an exception that allows them to get a loan while under debt review:

- Legal fees & debt review costs

- Emergencies

- Previously approved loans

- Living essentials

Legal fees & debt review costs

If the reason you’re seeking credit is to handle legal fees or costs related to the debt review process, then an exception can be made.

Remember, it’s not about just wanting the credit; you need the nod from your debt counsellor.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Emergencies

A real emergency may also constitute a viable reason to get approved for a loan while under debt review.

This could be a medical emergency or an unexpected job loss—sometimes unforeseen circumstances necessitate new credit.

Again, your trusty debt counsellor needs to give the green light.

Previously approved loans

Were you already approved for a loan or credit facility before entering debt review?

Well, then, you might still be able to access the loan.

Living essentials

In extreme cases, if you’re struggling to meet ends and require credit for essential living expenses like rent, utilities, or food, your debt counsellor might (emphasis on ‘might’) give permission.

It has to be genuine. Otherwise, it won’t cut it.

Let’s be real for a second, though.

Although exceptions exist, none of these examples are a free pass.

It’s paramount to obtain explicit permission from your debt counsellor before taking on any new credit. But for someone who really needs it, there are options. So, don’t view the credit restrictions as one of the disadvantages of debt review (it’s meant to be an advantage).

What about consolidation loans?

Glad you asked.

Bonus reading: Debt counselling vs debt review vs debt consolidation loans.

Can you get a consolidation loan while under debt review?

No, you cannot get a consolidation loan while under debt review. Like other loans or forms of credit, the debt review status discourages creditors from approving debt consolidation loans. It’s considered reckless lending.

With that being said, the same rules apply. Exceptions could be made under extreme circumstances.

So, although, like debt review, a consolidation loan restructures debts, it’s still a loan.

Therefore, it falls under the same umbrella, which means you’ll need permission from your debt counsellor.

Here’s how to (and how not to) go about it.

How to get a loan under debt review

Now, if you’re thinking, “Great, so there are exceptions. But how do I navigate these waters?” we’ve got you covered.

Do’s

- Get permission

- Allow your debt counsellor to adjust your repayment plan

Get permission

First and foremost, always seek permission.

Don’t try and go behind your debt counsellor’s back (it doesn’t work). Play by the rules. It’ll help you get out of debt sooner.

Allow your debt counsellor to adjust your repayment plan

If you do get the nod to take a loan, ensure that your repayment plan is adjusted accordingly.

New debt requires tweaks to the original debt repayment plan. You could end up in more trouble if this gets overlooked.

Don’ts

- Go to underhanded lenders

- Rush to ‘Debt Review Removal’ services:

Go to underhanded lenders

Beware of lenders who claim to offer loans specifically for those under debt review without any checks and balances.

They might seem like a lifeline, but often, they’re too good to be true.

And you know what they say about things that seem too good to be true, right?

Rush to ‘Debt Review Removal’ services

There are companies that provide legitimate debt review removal services. Usually at an extra cost. This works for some. But it all depends on where you are in the debt review process and what you’re able to afford.

What if exceptions don’t apply or your DC doesn’t approve? Then what?

There are a few more options.

What else can you do if you need a loan while under debt review?

So, your debt counsellor advised against getting a loan, or you just can’t find one that’s right for you?

Don’t fret.

Here are other ways to meet your financial needs:

- Sell assets

- Freelance or side jobs

- Negotiate with creditors

- Cut non-essential expenses

There are thousands of opportunities to earn extra income in South Africa.

Sell assets

Perhaps all you need is a little extra cash.

In this case, selling some of the items that you have lying around the house could help you to get by.

Freelance or side jobs

Got a skill? Put it to use.

Create a little extra income rather than rely on more debt.

Negotiate with creditors

Sometimes, simply explaining your situation to your creditors and asking for an extension or a reduced payment can do the trick.

Cut non-essential expenses

There’s a lot you can do to reduce spending.

Cancel the Netflix subscription, eat in, switch brands, car-pool, or get a new hobby (one that’s free).

It doesn’t have to be permanent; it just has to get you by.

The problem with loaning money while over-indebted

Here’s an analogy worth remembering:

Loaning money while over-indebted is like drinking seawater while stranded in the ocean: it seems like a good idea, but it’ll only make the situation worse.

(If you’re unsure—no, you can’t/shouldn’t drink seawater!)

Here are three reasons why taking out a loan under debt review is a bad idea:

- It increases the financial burden

- Raises interest rates

- Prompts a debt spiral

It increases the financial burden

More debt means more repayments.

And if you were already struggling, this can be the straw that breaks the camel’s back.

Raises interest rates

Only over-indebted South Africans get approved for debt review—this means there’s a chance that lenders already see you as a high-risk candidate (bad credit score).

This, in the end, means that you’ll have to repay higher interest rates, so the new loan will cost even more by the time you’re done.

Prompts a debt spiral

Trying to use debt to pay off debt is a dangerous game to play.

It can quickly lead to a vicious cycle where the debt keeps piling on, and interest rates keep climbing.

In summary

Overcoming unmanageable debt is hard.

Really, really hard.

New loans remain an option. The NCA included a clause for exemptions, so over-indebted consumers can ‘break glass in case of emergency’.

But, it might not be the best solution.

There are other avenues to explore, and sometimes, the best option is to hunker down, reassess, and make some sacrifices.

There you have it.

Now you know everything about loans under debt review.

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.