Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Under debt review and want to get out?

You’re in the right place.

Here is everything you need to know about debt review removal.

Debt review removal

In this post we’ll cover the service developed to get South Africans out of debt review—debt review removal. We’ll start by clarifying what debt review removal is, and isn’t. Then go on to explain how it works, how long it takes, and how much debt review removal costs.

Let’s get started.

What is debt review removal?

Debt review removal is a service that helps clear the ‘debt review’ status from someone’s credit profile. This service typically involves collecting ‘paid-up’ letters from creditors, issuing a Clearance Certificate, and contacting credit bureaus. Otherwise, in some cases, people who need to prove they are not over-indebted to withdraw from debt review, before a court grants a Debt Re-Arrangement Order, can also use the service.

📖 Related content: How to get out of debt review

What debt review removal isn’t:

It’s not a quick way to get out of debt review… If a court grants the Debt Re-Arrangement Order, then the only way to remove the debt review status is with a Clearance Certificate. (Which requires paid up letters from Creditors. Which means the debts under debt review need to be settled.)

I’ll explain the process. It’ll make things even clearer.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

How does debt review removal work?

To remove the debt review status, companies help consumers either submit a court application to prove they are not over-indebted, or get a Clearance Certificate to remove the debt review status from their credit profile. Withdrawing from debt review before a court grants a Debt Re-Arrangement Order can work if the court approves a court application. After that, only a Clearance Certificate can legally remove the debt review status.

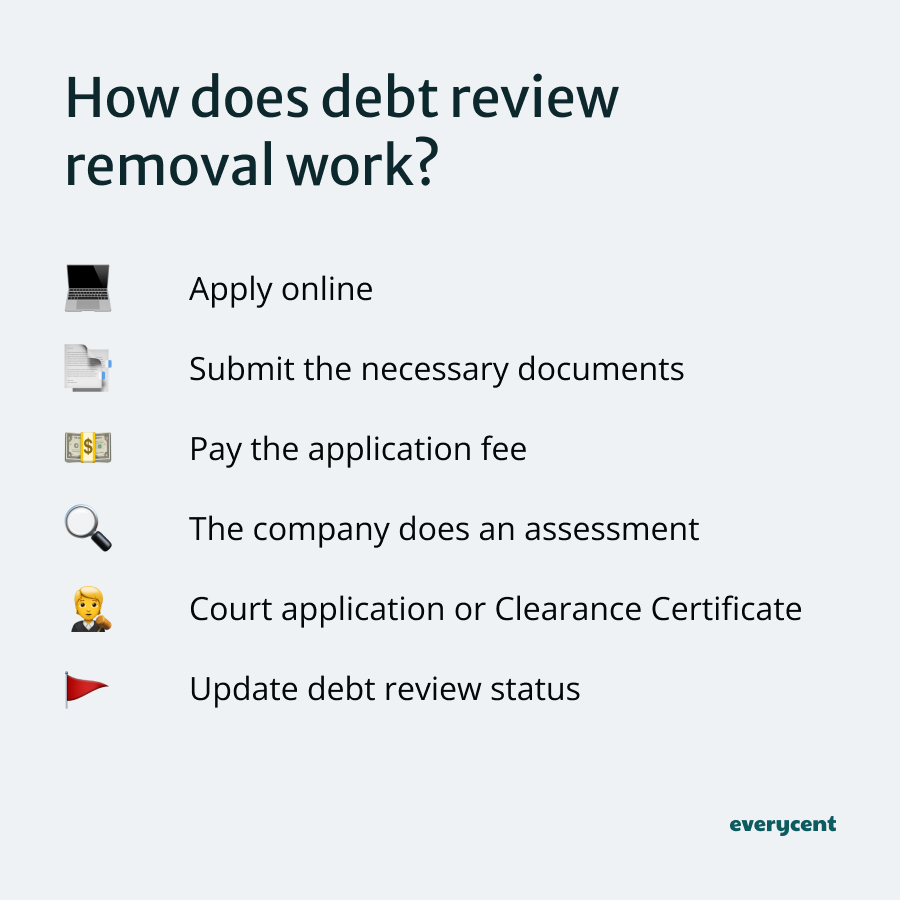

Here’s a simple breakdown of the process:

- Apply online

- Submit the necessary documents

- Pay the application fee

- The company checks the credit record and does an assessment

- The company submits a court application or issues a Clearance Certificate

- Contact creditors and credit bureaus

Step 1 – Apply online: Start by filling out an easy online application to initiate the process.

Step 2 – Submit the necessary documents: Upload documents like paid-up letters from your creditors. Either the sign up process or someone from the company will guide you. If you don’t have paid-up letters, then the service provider may be able to collect them for you.

Step 3 – Pay the application fee: The application fee covers the administrative costs involved in the process. Different companies use different fee structures. (More on the cost of debt review removal in a moment.)

Step 4 – The company checks the credit record and does an assessment: Your current credit status is reviewed to confirm the presence of a debt review flag.

Step 5 – The company submits a court application or issues a Clearance Certificate: Depending on the progress of the debt review process, this step involves either a court application or a Clearance Certificate (Form 19). The assessment will determine which one applies.

Court application: If the court hasn’t granted the Debt Re-Arrangement Order yet. Then it’s possible to withdraw from debt review by proving that you’re not over-indebted. In this case, the debt review removal company gathers evidence and submits a court application. If the court approves the application then you can legally withdraw from debt review.

Clearance Certificate: After the court grants the Debt Re-Arrangement Order, the only way to remove the debt review status is by submitting a Clearance Certificate. To get one, you’ll need to settle every account under debt review (except for home loans) to get paid-up letters from the creditors. And send these to a debt counsellor.

Step 6 – Contact creditors and credit bureaus: If everything works out, then the company will contact your creditors and the credit bureaus to update your credit profile. Then, the debt review status gets permanently removed.

Cool. Now you understand the process.

But… you may still have a couple of questions. How long does it take and how much does it cost—we’ll cover those next.

How long does debt review removal take?

The duration of the debt review removal process varies from person to person. Typically, the process takes 20 to 40 days. Some companies report a 10 day turnaround for someone who already has their paid up letters from creditors. While cases that require more administrative assistance tend to take longer.

Remember, there are lots of people involved. Debt counsellors, courts, creditors, credit bureaus, and you. Anyone could cause delays. (My advice: Try to be patient—even when it’s not easy.)

📖 Related content: How long does debt review last (or stay on your name)?

How much does debt review removal cost?

The price to remove debt review varies. Some debt counsellors might start their prices at R1150. Where cost goes up if you need help getting letters from creditors that say you’ve paid off your debts. While other companies charge all inclusive fees that cost more upfront.

Cost of debt review removal: R1,150 – R9,000. Ranging from application fee costs to the total cost for high-end all inclusive services.

In summary

Alright, not so bad right?

Here are the highlights:

- Basically, the process goes, apply online, submit docs, application fee, assessment, more paperwork, contact credit bureaus.

- The process can take a while, but in most cases, it won’t take months.

- Some cases only cost R1,150, while others are more expensive.

Do you qualify, and are you going to apply?

Keep reading on Everycent to learn more about money and finances.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.