Just got your debt review clearance certificate, and you’re ready to apply for credit again?

Not so fast.

There are a couple of things you might want to know first.

Let’s start with how long it takes before you can apply again.

How long after getting a debt review clearance certificate can I apply for credit again?

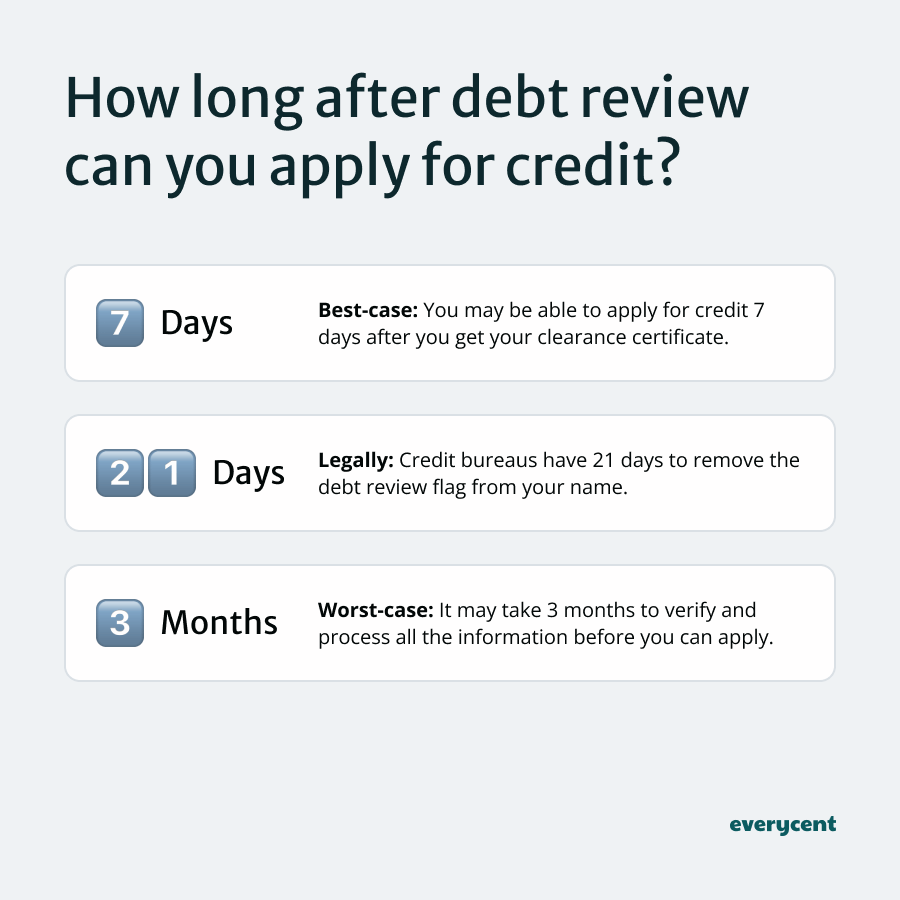

You can apply for credit 7 days after getting your clearance certificate. But, most professionals suggest waiting 3 months or more. The process involves a debt counsellor, creditors, and credit bureaus. It’s fair to expect delays. It may take time for creditors to verify the documents involved. After this, credit bureaus still have 21 days to update a user’s credit profile.

Also, your credit score dictates whether your application gets approved. Start small and build your credit score before applying for bigger loans.

📖 Related content: How debt review clients can get a loan under debt review

Here’s what you need to know about your debt review clearance certificate.

What is a debt review clearance certificate?

A debt review clearance certificate is a formal document issued by a debt counsellor. It certifies that a consumer settled all their debts under debt review. The document confirms that payments fulfil every credit agreement the debt review court order.

It proves the consumer isn’t over-indebted anymore. And allows credit bureaus to remove the debt review status from their credit profile.

Need help removing your debt review status?

Apply to get help with your clearance certificate and get out of debt review.

How to get your debt review clearance certificate

To get your debt review clearance certificate, follow these steps:

- Settle your debts (and fees) according to your debt review plan. Your home loan/mortgage payments should be up to date. But it doesn’t have to be settled.

- Follow up to make sure your debt counsellor and creditors confirm that you’ve met all payment obligations with every creditor.

- After everyone confirms, your debt counsellor issues the clearance certificate.

Stay on top of everyone during this time. Follow up with your debt counsellor and each of your creditors. After they issue the clearance certificate, follow up with the credit bureaus.

Checking-in can help speed things up. But whenever there are several teams of people involved… expect a few delays.

Which brings me to our next point.

How long does it take to get a clearance certificate after debt review?

The time it takes to get your clearance certificate after debt review varies. It depends on the responsiveness of your debt counsellor and creditors. Typically, it takes a few weeks for everyone to verify that all account payments are met.

If the debt counsellor works fast, they can get creditors to respond quicker and reduce the time it takes. But, most big debt counselling companies help thousands of people at a time. Unfortunately, this slows them down.

Give them time and try to follow up regularly.

Frequently asked questions

What will my credit score be after debt review?

Most debt review applicants start and exit debt review with a low credit score. Debt review doesn’t improve someone’s credit score in the short term, while under debt review. But rather, it makes it easier to build their credit score after the debt review process. Initially after debt review, their score remains low.

Need help removing your debt review status?

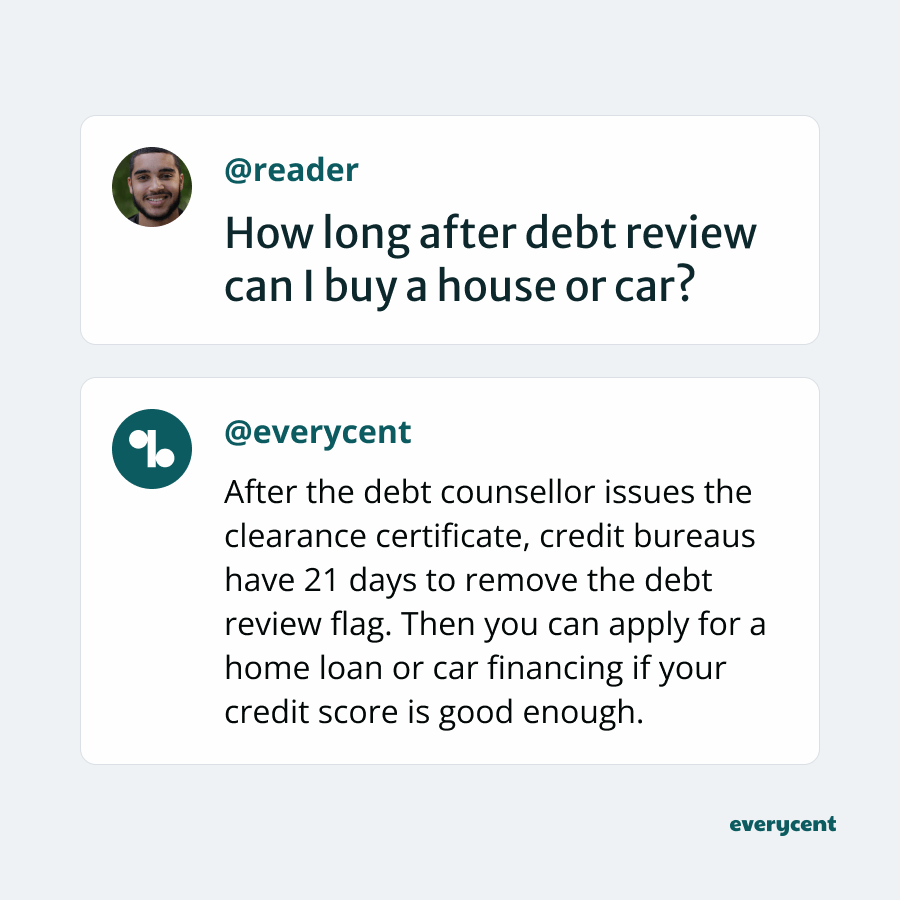

How long after debt review can I buy a house or car?

After the debt counsellor issues the clearance certificate, credit bureaus must remove the debt review status within 21 days. Once you’re unflagged, then you can apply for a home loan to buy a house or financing to buy a car. And although you won’t be denied because of debt review, you may need more time to improve your credit score before you’ll get approved for vehicle financing or a home loan.

📖 Related content:

- What is the credit score required to buy a house in South Africa?

- What is the credit score required to buy a car in South Africa?

How long does it take to clear your name from a credit bureau?

Clearing your name from a credit bureau involves two things. The first is getting the credit bureau to remove incorrect negative information. This usually takes 30 days after you report a problem or log a dispute. The second is clearing negative listings like late or missed payments, defaults, collections or bankruptcy. Which takes 7 to 10 years from the filing date or original violation.

Debt review isn’t permanent. The debt review flag, or status, only lasts while under debt review. After that, it gets removed.

📖 Related content: How long does debt review last?

In summary

There you have it.

That’s how debt review clearance certificates work. And what applying for credit looks like after debt review.

If you’re not under debt review and are having issues repaying your debt… then it may be better to start the process.

It’s not for everyone. But it’s better to avoid collecting negative listings that could stay on your credit record for years. Debt counselling or debt review can help.

Want to learn more? Keep reading on Everycent.