Missing car payments could lead to losing your car.

It’s scary—how on earth can someone who can’t afford their payments keep paying? Luckily, there are ways around this problem.

Today, we share the seven best options for anyone in this situation.

- Renegotiate your loan terms

- Refinance your car loan

- Apply for debt review

- Sell the car and settle the account

- Cut other expenses

- Find ways to earn additional income

- Voluntary surrender

Keep reading—you may still be able to save your car.

What happens if you don’t pay your car instalment?

When someone doesn’t pay their car instalment, they breach their contract with the creditor. This means that the creditor, lender, or bank may proceed to repossess the car and auction it off to get back the money that they’re owed.

First, lenders will try to work with you. If missed payments continue, they can legally begin to take back the car (known as vehicle repossession). It’s important to avoid this by negotiating, applying for debt relief, refinancing, or selling the car to pay off the amount that’s due.

📖 More like this: What happens if you can’t pay rent (landlord and tenant rights)

How many car payments can you miss before repo?

In South Africa, a bank or lender may technically start the repossession process after just one missed car payment. However, the National Credit Act (NCA) requires them to follow a specific legal process before doing so, starting with sending Section 129 Letter of Demand to the debtor to give them a chance to fix the problem.

Most banks will reach out first, then consider repossession after two or three consecutive missed payments.

📖 Further reading: Vehicle repossession procedure in South Africa

Are you struggling to afford your car payments?

Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.

How to reduce your car instalment to make it affordable again

If you’re struggling with car payments, there are several things you can do. Some make your monthly car instalments more manageable.

Here are three ways South African car owners can reduce car instalments:

- Renegotiate your loan terms

- Refinance your car loan

- Apply for debt review

1. Renegotiate your loan terms

How this option helps: This option lowers monthly payments by extending the loan term.

Go to your lender and tell them about your situation to try to renegotiate the terms of your loan to make it affordable again.

For example, extending a 5-year loan to 7 years might reduce monthly payments by 20-30% (depending on the interest rate and remaining balance).

This will reduce the car instalment, but it could mean paying more interest over the loan’s lifetime. Still better than losing the car, right?

Next is refinancing.

2. Refinance your car loan

How this option helps: Refinancing can lower monthly payments with a reduced interest rate or a longer repayment period.

Refinancing could give you a 1-2% lower interest rate based on how good your credit score is and what the current market conditions are.

For instance, refinancing a R200,000 car loan from 10% to 8% interest while keeping the same term might cut monthly payments by R150-R200. Extending the loan term can further lower payments, but again, this increases total interest.

Now, if your credit score has already taken a hit, then refinancing may not be an option. Don’t worry. This next solution can help.

3. Apply for debt review

How this option helps: Debt review restructures your debt payments into a more affordable plan, potentially cutting monthly payments by 30-40%.

Debt review can significantly lower your total debt payments. Including your car instalment.

This option offers other benefits, too. Like legal protection against repossession or garnishee orders and a consolidated repayment which makes it easier to track and repay all your debt. As always, some may consider other parts of the debt review process as drawbacks. Do a bit of homework before you apply.

📖 Further reading: Advantages & disadvantages of debt counselling (debt review)

Each option has long-term financial impacts. It’s vital to seek professional advice to ensure your choices align with your financial goals. Remember, proactive steps and informed decisions are crucial for effectively managing financial challenges.

📖 Further reading: What is debt review?

Let’s look at a few more options.

4 More options if you can’t afford your car payment

The list of things you can do if you can’t afford your vehicle debt continues.

- Sell the car and settle the account

- Cut other expenses

- Find ways to earn additional income

- Voluntary surrender

4. Sell the car and settle the account

How this option helps: Eliminates your debt and ongoing payments by using the money from the sale to clear or reduce the loan.

*Important note: talk to your lender or review your agreement first. There may be clauses in your terms that affect this option.

Selling your car for an amount that matches or exceeds your outstanding loan balance means you can use that money to settle the debt.

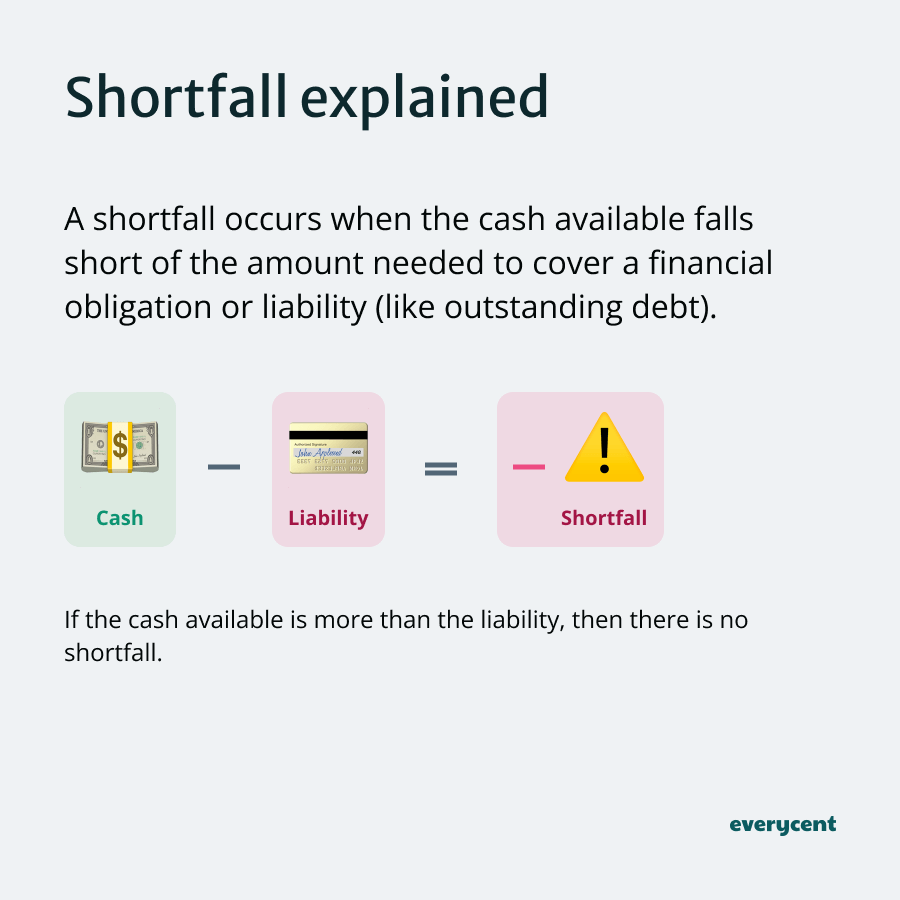

Keep in mind the possibility of a shortfall. For example, if you owe R150,000 but sell the car for R130,000, you’ll need to pay the R20,000 difference.

On the other hand, you may get more than you owe. In this case, you could use the money to buy or trade your financed car in for a more affordable car, or cover other expenses during a difficult time.

5. Cut other expenses

How this option helps: Makes more money available for car payments by reducing unnecessary spending.

Cutting expenses can help allocate more funds to your car payments.

For example, cancelling one or two subscriptions and eating out less can help save R500 each month. That’s R500 extra that you can put toward your car repayment.

Do the maths. How much extra money do you need for your car? And can your budget support it? It’s not the most fun, but it’ll work.

Are you struggling to afford your car payments?

6. Find ways to earn additional income

How this option helps: Extra income gives you more money to manage car payments.

Look for part-time work, freelance opportunities, or side hustle—anything that can bring in a few extra Rands that you can use to pay your car payments.

An additional R2,000 to R3,000 per month can really move the needle for not just car payments but other financial responsibilities as well.

7. Voluntary surrender

How this option helps: It is less harmful to your credit score than forced vehicle repossession and shows you’re actively managing financial issues.

Voluntarily surrendering your car involves returning it to the lender for auction. If the auction doesn’t cover the whole debt, you’re responsible for the remaining balance.

For instance, if you still owe R150,000 and the car sells for R100,000, you must pay the R50,000 shortfall. This option affects your credit score but is generally less damaging than forced repossession. Plus, it also demonstrates your commitment to addressing financial challenges.

Here are stories from other South Africans who found themselves in the same position.

Real stories: navigating financial challenges

Maya Fisher-French, a Personal Finance Editor at City Press, covered the story of two real South Africans, Michael and Neeyna, and shared how they were able to face unaffordable car payments.

Here are their stories.

Michael’s story

- Situation: Michael lost his job and couldn’t make his car payments anymore.

- His approach: He opted to sell his vehicle but was left with a shortfall on his car loan.

- The outcome: Michael kept in contact with his bank and discussed his financial constraints. With R50,000 in savings, he managed to negotiate with the bank, which accepted this amount as a full settlement for a R65,000 shortfall.

The lesson: There’s power in open communication and negotiation. Don’t be afraid to talk to your bank or lender.

Neeyna story

- Situation: Neeyna faced a similar predicament of job loss, leaving her with an outstanding car loan of R51,000.

- Her approach: She had R40,000 available, which she contemplated using to settle the car loan.

- The outcome: Thanks to her consistent payment history, Neeyna was able to negotiate. She and the bank reached a mutually agreeable solution (the details weren’t specified).

The lesson: You can use your good payment history to your advantage. It could help you keep your vehicle.

There you have it. Three ways to reduce your car instalments. Four other options you can consider if you can’t pay your car instalment. And two real-life stories. Which, hopefully, inspires you and gives you hope during this challenging time.

In summary

The first step is to talk to your bank or lender. Let them know what’s going on.

Then, try to reduce your car instalments or find another way to solve the problem.

For anyone with a strong credit record: Negotiate with the bank or explore refinancing. These may be your best options.

For anyone with an average or low credit score: Consider debt review or one of the four alternative options.

You can do it. You’ll get through this. We hope this article has helped shed some light on your options.

Want to learn more? Keep reading on Everycent.