Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

For most, car payments are a considerable expense.

When things change, it’s an expense that can quickly become unaffordable.

Selling the car may be an option, but it’s not as simple when debt is tied to the vehicle.

That’s what we’ll cover today. The right way to sell a financed car before it’s paid off.

Let’s get started.

Can you sell a financed car?

Yes, you can sell a financed car, but you must follow specific steps to do so legally and make sure that the sale complies with the National Credit Act (NCA). Since the car is still financed (and not paid off), the finance company holds the car’s title until the loan is fully paid, which means the seller must settle the outstanding loan amount, either before or during the sale process.

Quick note: If the sale is prompted by financial difficulty, then it may be best to seek professional help rather than try to rush a sale. The vehicle repossession process could complicate the process, and anyone in a tight spot may need to consider other options.

(We’ll share a few at the end of this post.)

Now, back to the sales process. Here’s how you could do it.

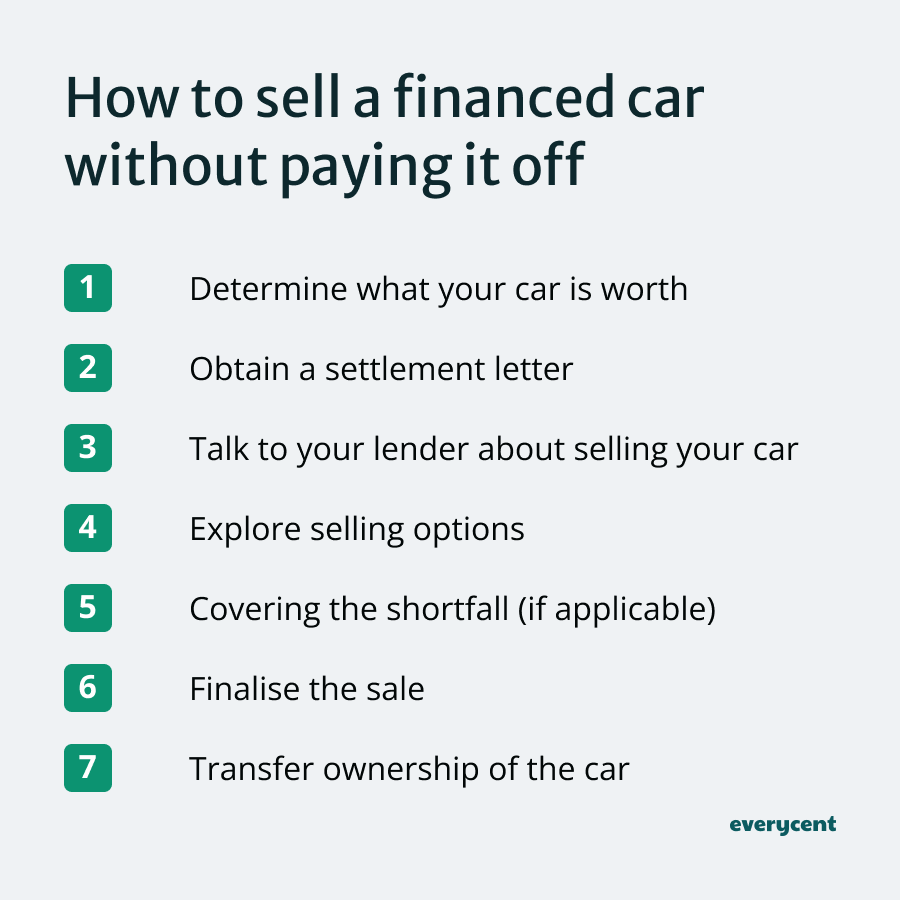

How to sell a financed car without paying it off

To sell a financed car before it is paid off, the person who is still repaying the finance agreement must communicate with their lender to get a settlement amount, determine how much the car is worth, and follow a specific sales process to ensure that the debt is settled and that the transfer of ownership is handled properly.

Here are the steps:

- Determine what your car is worth

- Obtain a settlement amount to determine any potential shortfall

- Talk to your lender about selling your car

- Explore selling options

- Covering the shortfall (if applicable)

- Finalise the sale

- Transfer ownership of the car

1. Determine what your car is worth

Begin by determining the market value of your car. You can use online tools and services to get an estimated value or get a physical inspection for a more accurate valuation.

Both Auto Trader and AA have free online tools that you can try out, or you can browse used car websites for vehicles with similar specifications to get a rough idea.

Then, it’s time to find out exactly how much you still owe.

2. Obtain a settlement amount to determine any potential shortfall

It’s important to communicate with your lender during this process, and this could be the first step. A settlement letter tells you exactly how much you need to repay to settle the outstanding balance on your loan.

Compare the settlement amount to your car’s value to calculate whether there’s a potential shortfall.

Shortfall = difference between an item’s value and the available funds to cover it.

E.g (R100,000 car value) – (R150,000 settlement amount) = – R50,000 shortfall

Plus, remember that settling your loan early may involve penalties or fees—which could add to the total cost.

Are you struggling to afford your car payments?

Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.

3. Talk to your lender about selling your car

Don’t be afraid to discuss your intention to sell with your lender. It’s an important conversation that can clarify any penalties, allow you to negotiate terms, and find solutions for any shortfall.

Your lender can also guide you through the sale to make sure you sell the vehicle legally and don’t breach your contract.

4. Explore selling options

Now that you know the maths and understand the process—it’s time to decide how to sell your vehicle.

Ways to sell your financed car:

- Dealership trade-in: Trading the car in or selling to a car dealership offers a fast and convenient way to sell, though it may be at a lower value. That said, dealerships understand the process and can help make it easier.

- Private sale: Selling privately could have a higher return than dealership trade-ins. But it requires much more effort on your part (and the buyers’), including advertising the car, handling inquiries, negotiating prices, and some paperwork.

Now, before you go through with the sale, consider how you will cover the shortfall (if it applies).

5. Covering the shortfall (if applicable)

If the car’s value doesn’t cover the outstanding loan balance, then there’s a shortfall.

Here are three ways to cover the shortfall:

- Paying out-of-pocket: Paying the difference directly. This is the easiest (if you can afford it).

- Using a personal loan: It’s possible to take out a new loan to cover the shortfall. However, this option introduces new debt, which may come with a higher interest rate. If you’re considering this option, it may be worth doing some research or talking to a professional first.

- Transfer the balance to a new loan: If the ‘sale’ is a trade-in, then you could potentially transfer the remaining loan balance to your new vehicle. Again, this adds new debt and may cost more long-term.

6. Finalise the sale

Once you’ve managed to address any shortfall and secured a buyer, collaborate with your finance company to settle the existing loan.

For private sales, it might be necessary to conduct the sale at the bank or the lender’s office. This ensures the loan is directly paid off and the lien on the vehicle is officially released.

7. Transfer ownership of the car

After the loan is settled and the sale is complete, the vehicle’s ownership must be transferred to the buyer.

This requires notifying the local motor vehicle registration centre and completing all necessary paperwork to officially remove the vehicle from your name and avoid future liabilities.

Tips for the sale process

- Get professional or legal advice if you can. Since there are several complexities, this could help protect you and guarantee that the transaction adheres to South African laws and regulations.

- Make sure everything is well documented. All agreements with the buyer and your finance company should be documented. Having formal agreements in place makes it clear what each party’s responsibilities are, the transfer of ownership, details of the transaction, and other conditions.

Zooming out. If the sale is prompted by financial challenges and unaffordability, then it may be worth exploring other options.

Here are other approaches for you to consider.

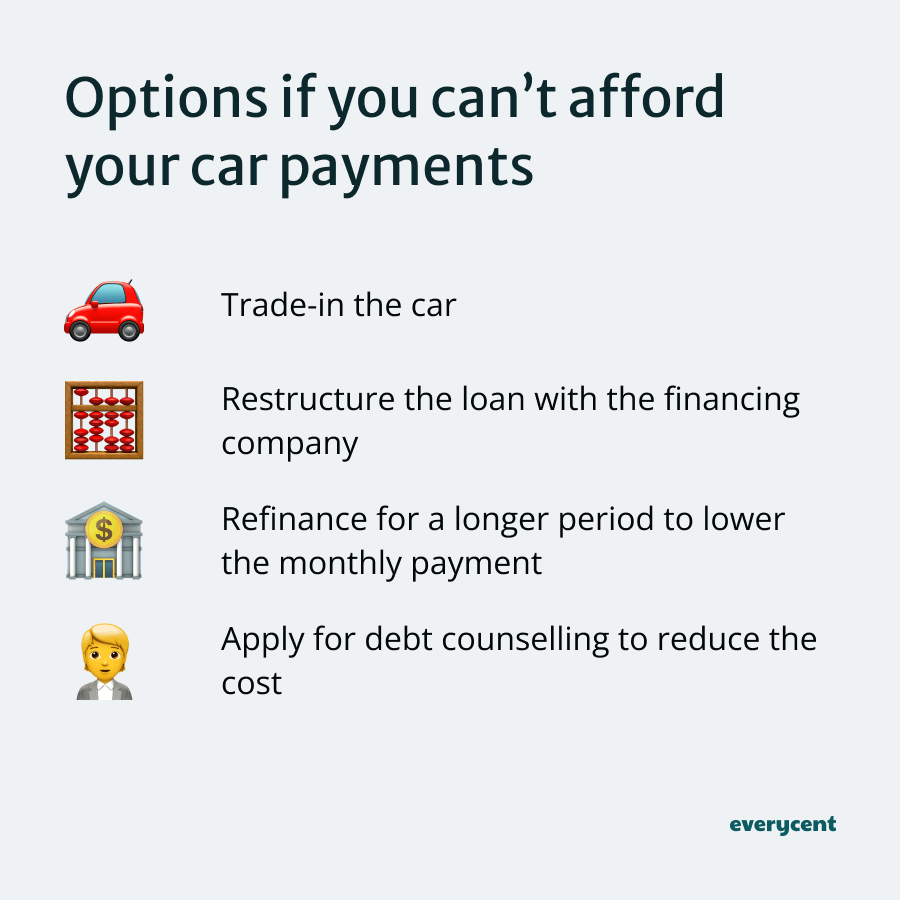

Other options if you can’t afford your car payments

If selling or trading in doesn’t suit you, or you’d like to keep your vehicle, other avenues can help:

- Trade-in the car: Trading -in a financed car follows a similar process. Check out our other post to learn how to trade-in a car that is not paid off.

- Restructure the loan with the financing company: It may be possible to negotiate new terms with your financier to reduce your monthly payments. Even if it means repaying the loan over a longer period (note that this typically costs more overall because you’re paying interest for longer.)

- Refinance for a longer period to lower the monthly payment: If the finance company isn’t willing to restructure the loan, then refinancing could do the trick. Getting a new loan with lower interest rates or better terms could reduce the immediate cost and make the payments more affordable in the short term. Do your homework, talk to the lender and work with a professional if possible.

- Apply for debt counselling to reduce the cost: For anyone struggling to keep up with debt, this can be a great option. Debt counselling and debt review legally restructures debts to make the monthly payments more affordable.

Plus, debt counselling offers other benefits like a consolidated payment and legal protection that can protect you against repossession in most cases.

It’s also worth checking the cost of car insurance in South Africa—perhaps there are options that cost less? That difference could support the existing car payment.

📖 Bonus reading:

- 7 things you can do if you can’t afford your car payment

- Advantages & disadvantages of debt counselling (debt review)

In Summary

The good news is that you can sell a financed car. It’s just a little more complicated.

Furthermore, if the sale was prompted by financial difficulty, now you know that there are other options.

A really important takeaway from this post is that it’s essential to communicate with your financing company and ensure that the transaction satisfies every legal requirement.

Want to learn more? Keep reading on Everycent.

Are you struggling to afford your car payments?

Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.