When you first hear about prescribed debt, it sounds like a magical way to get debt written off.

But there’s more to it.

It’s worth really understanding what prescribed debt is and how it works. We’ll share everything you need to know.

Here we go.

What is prescribed debt in South Africa

Prescribed debts are typically contractual and civil debts like credit card debt, retail accounts, personal loans, etc.. which should effectively be ‘written off’ after a reasonable period of inactivity or non-acknowledgement, typically three years. The criteria and time frames vary depending on the type of debt, but once a debt becomes prescribed, it may no longer legally be recovered by creditors.

Prescribed debt was established to prevent indefinite uncertainty surrounding debt repayment and to encourage creditors to claim payment within a reasonable period.

Basically, the introduction of prescribed debt is another way to support consumer rights during debt collection.

You can refer to the Prescription Act 68 of 1969 for the legal specifics.

To some, this may sound like a ‘get out of jail free card’, but there’s more to it.

How prescribed debt works

For debt to be considered prescribed under South African law, several criteria must be met. If the criteria for inactivity or non-acknowledgement without hiding or avoiding the debt, then the debt becomes prescribed.

Thereafter, as long as the debt remains prescribed, the debtor is no longer legally obligated to pay, creditors may no longer take legal action to recover the debt, and it may not appear in credit records.

However, if any obligation to pay the debt is acknowledged through communication or payment, then the prescription status resets along with its obligations and creditors’ rights to take legal action to recover the debt.

📖 Related posts on legal action that creditors can take:

- What is an S129 Letter of Demand?

- What is a garnishee order?

- Vehicle repossession process in South Africa

Understanding the criteria for prescribed debt

Let’s take a closer look at the types of debt that can prescribe, what is meant by inactivity or non-acknowledgement, and learn more about the effects of acknowledgement.

Which debts don’t count as prescribed debt

Not all debts are subject to prescription, and understanding which debts can become prescribed and which cannot is crucial for effective financial management.

Examples of debts which do not qualify or typically do not become prescribed:

- Public sector and government debts: This includes municipal debts, TV license fees, and debts related to taxes, fines, or penalties. These may exhibit varied prescription periods when owed to governmental entities or public bodies.

- Tax obligations: Debts owed to the South African Revenue Service (SARS) for taxes do not prescribe like consumer debts.

- Home loans: Mortgage debt and home loans have a longer prescription period and do not easily fall into prescription.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Examples of debts which can become prescribed:

- Retail accounts

- Credit card accounts

- Overdrafts

- Telkom accounts

- Personal Loans / Payday Loans

- Gym memberships

- Cell Phone accounts

- Monies owed on vehicle finance

- Internet accounts

Remember, these debts still need to meet the specific criteria for prescription.

Inactivity, non-acknowledgement, and prescription periods

The criteria for prescribed debt considers various time frames [or prescription periods] depending on the type of debt, and looks at three primary conditions.

First, whether the debt has been acknowledged. Second, whether the creditor has taken any legal action to recover the debt. And finally, whether the debtor has been hiding or avoiding repayment.

If the type of debt is eligible to prescribe and meets the prescription criteria then it may no longer legally be recovered by creditors.

Here is an overview of the criteria:

- Timeframe: A specific period, typically three years for most debts, must elapse without debtor acknowledgement. Certain debts, like mortgage bonds and court judgments, have longer prescription periods.

- Debtor action: Any payment or written acknowledgement by the debtor resets the prescription clock.

- Legal proceedings: The initiation of legal action by the creditor pauses the prescription period until resolution.

How does acknowledgement or payment affect prescription

Any acknowledgement of the debt that can be proven, whether through payment, a written statement, or verbally, effectively resets the prescription clock.

This means that the time period within which the debt can become prescribed starts over from the date of acknowledgement or payment.

For debtors: Any form of acknowledgement or payment towards the debt, even if minimal, can extend the period during which they are legally obligated to repay the debt. Potentially prolonging their financial obligations for years beyond the original prescription period.

For creditors: It provides an opportunity to refresh the prescription period and gives them more time to legally recover the debt.

How to check if debt is prescribed

The best way to determine whether you have prescribed debt is to start by reviewing your credit report. If you find accounts that may meet the requirements of prescription, then you should gather and review relevant documentation, including communication, related to the debt. By reviewing the documentation for payments or written acknowledgement, you will be able to tell whether the debt truly meets the requirements of prescription.

It’s also wise to go through the Prescription Act 68 of 1969 for the specific prescription periods that apply to different types of debt.

As always, if you can, seek legal advice that can provide clarity on the status of the debt and the best course of action.

Struggling to pay your debt bills?

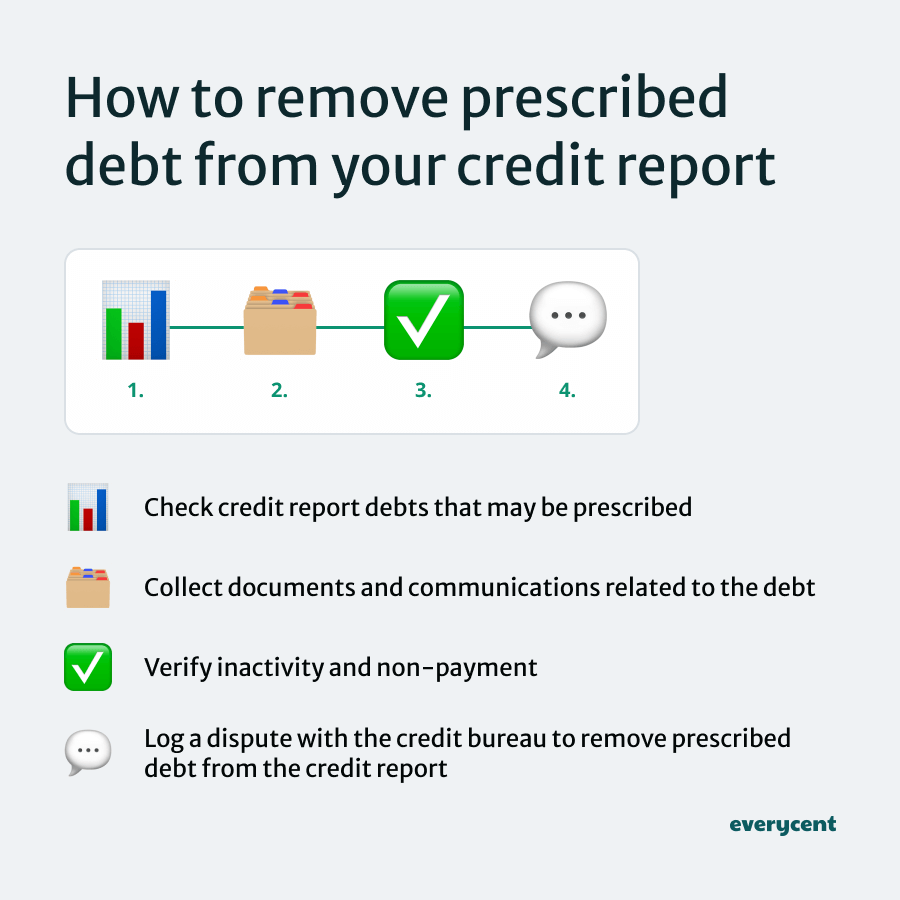

How to remove prescribed debt from your credit report

Consumers need to log a dispute with the credit bureau to remove prescribed debt from their credit report. Submit evidence that the debt has prescribed to the relevant credit bureau like Experian, TransUnion, or XDS by contacting them or via their website and allow 20 business days for an investigation.

If the credit bureaus confirm that the debt has indeed prescribed they will remove the entry from the credit report.

In summary

Understanding prescribed debt is very important.

Recognizing when a debt has prescribed can protect you from unwarranted debt collection attempts and help maintain an accurate credit report.

As always, it’s important to know your rights so you can assert them. Now, you should have a clear understanding of what prescribed debt is, in South Africa.

Want to learn more? Keep reading on Everycent.