Debt counselling has been around since 2007. Still, not everyone knows what it is (or understands it, for that matter). We’ll change that today.

The bottom line is that it is an excellent tool for anyone struggling to keep up with their debt, and it can make a huge difference when there’s a stack of bills and money is tight.

We’ll cover everything and share examples here and there to drive it all home.

Let’s start at the top.

What is debt counselling?

In South Africa, debt counselling refers to a formal process that helps over-indebted consumers (people with too much debt) to pay back their debt and regain financial stability by rebalancing how much they owe with what they earn.

In most cases, by reducing the amount of money, the person has to repay on their debt each month.

Who can apply for debt counselling?

Anyone struggling to repay their debt and who is considered over-indebted can apply.

Over-indebted means that the person’s debt exceeds their current disposable income.

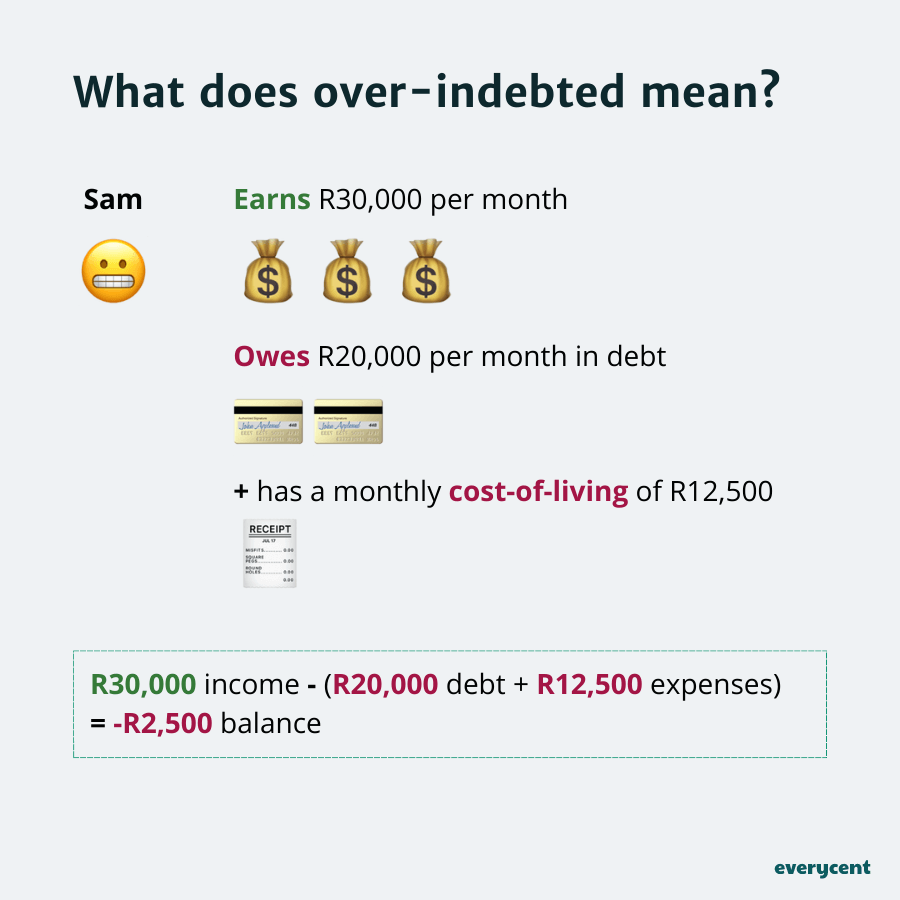

Here’s an example:

- Sam earns R30,000 each month;

- She owes R20,000 in monthly debt repayments;

- And her cost-of-living is R12,500

Since Sam’s (monthly debt + expenses) are greater than her income, she is considered over-indebted and can apply for debt counselling.

R30,00 income – R32,500 debt and expenses = -R2,500 balance

(If you’re eager to apply, then you can skip a couple of paragraphs and jump straight to: how to apply for debt counselling)

How does debt counselling work?

An over-indebted person applies and works with a debt counsellor to assess their finances. The debt counsellor then works with several other parties (including creditors, payment distribution agencies, and the magistrate court) to develop a new debt repayment agreement (one that is more affordable and easier to stick with.)

⭐ Bonus read: what is a debt counsellor?

We’ll demonstrate with another practical example in a moment. But first, let’s go over the process.

(Remember, the debt counsellor is the one taking care of most of the work.)

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Here’s what the debt counselling process involves:

- An initial assessment

- Negotiations with creditors

- Developing a new restructured payment plan

- Getting a court order to verify that all parties approve

- Making monthly repayments under debt review until the debts are settled.

(Unofficial step 6: host a debt-free party in your honour. Try not to put it on the credit card 😉)

Debt counselling is regulated by the National Credit Regulator (NCR), so everyone involved has to play by the rules.

This is really important because it means that it is safe (just make sure that you’re working with registered entities).

You may also have noticed that we mention debt review in step five. Debt review and debt counselling are closely related (and often used interchangeably) with slight differences. We recommend checking out the following posts if you want to learn more:

Now, here’s that second example we promised earlier. Let’s welcome back, Sam!

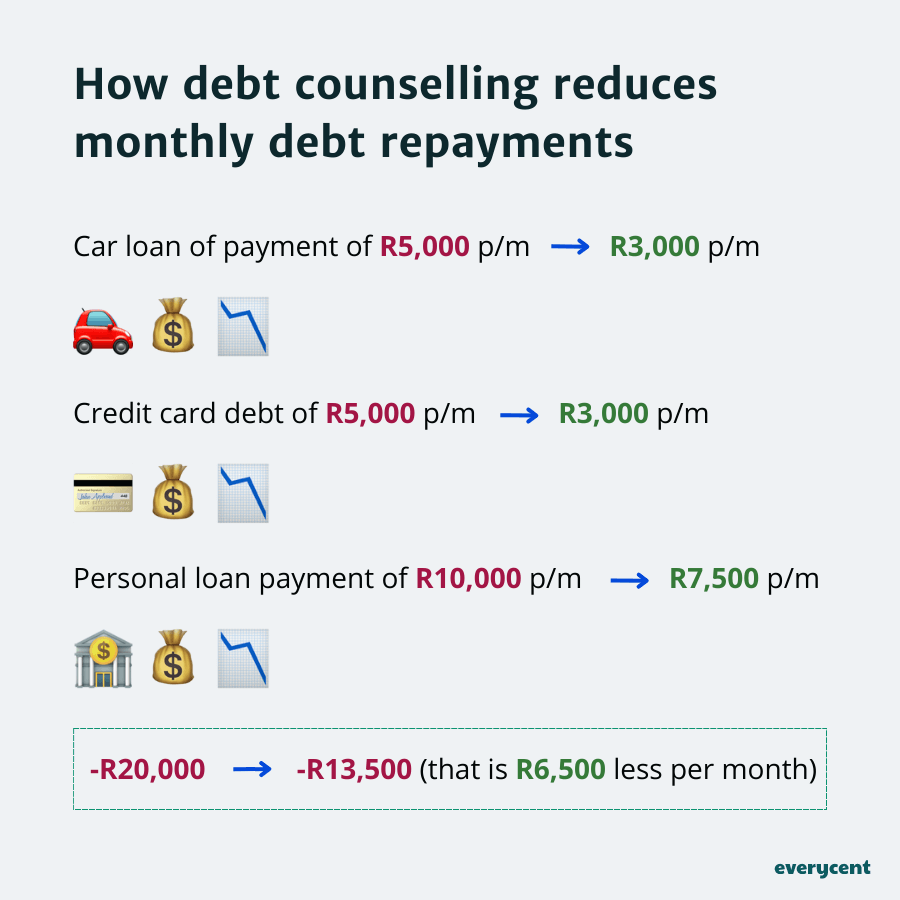

Example of how debt counselling can reduce monthly debt repayments:

Here’s a breakdown of Sam’s debt before debt counselling:

- A car loan of R100,000 with a monthly repayment of R5,000

- Credit card debt worth R50,000 with a monthly repayment of R5,000

- A personal loan of R150,000 with a monthly repayment of R10,000

Total repayment = R20,000 per month

Debt counselling makes debt repayments more affordable. Here’s the breakdown during debt counselling:

- Her R5,000 car loan repayment drops to R3,000 per month

- The credit card debt repayments go down from R5,000 to R3,000 per month

- Her personal loan repayment of R10,000 is reduced to R7,500 per month

New reduced total = R13,500 per month (that’s R6,500 less)

Now, Sam can sleep again.

As you can see, debt counselling is a great way to avoid winding up in a tight spot with creditors.

Like not being able to afford your car payments or after getting served a Section 129 letter of demand, to help prevent that you end up with a garnishee order against your name.

That is a basic example. There’s more nuance to the process and other advantages (plus a few potential disadvantages) to consider. We’ll cover everything throughout this post.

Next, we’ll pull back the curtain and reveal the guys and gals behind the scenes.

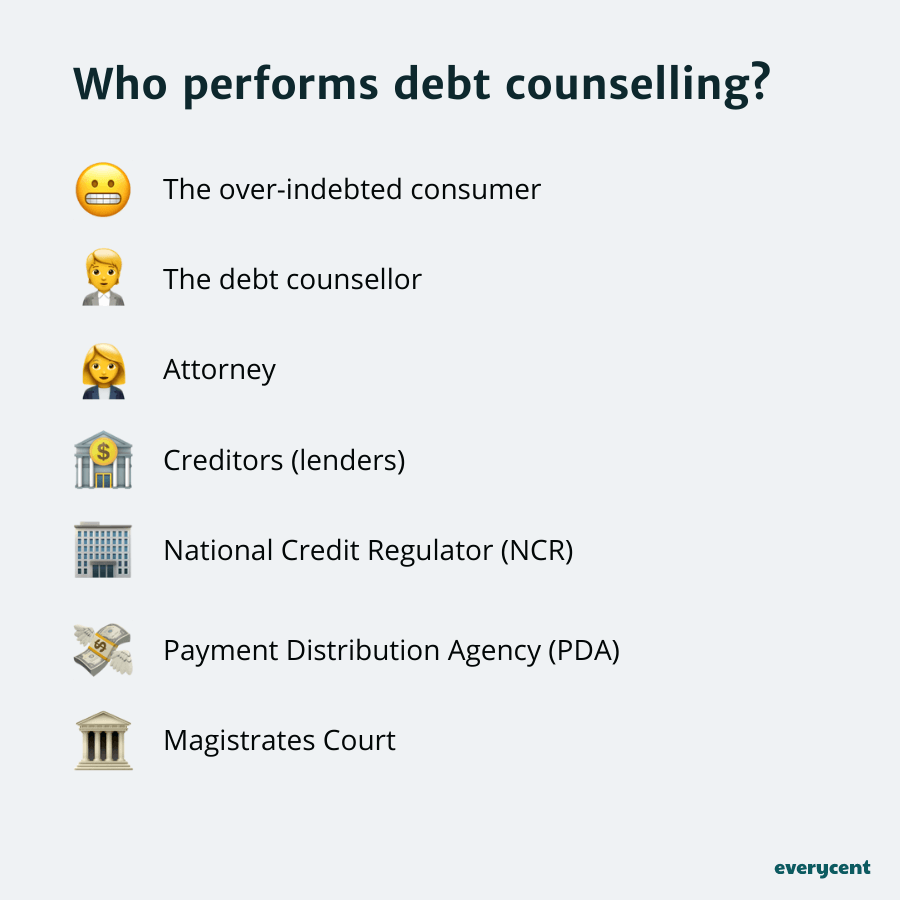

Who performs debt counselling?

Ultimately the debt counsellor is the one that does the debt counselling, but it’s not a solo job. There are a lot of people involved.

(How nice? Everyone cares.)

This is the list of everyone involved in the debt counselling process. Of course, you might not be familiar with what each party does, so we’ll include a short description.

- The over-indebted consumer — the person with too much debt.

- The debt counsellor — the person (or company) that guides the consumer through debt counselling.

- Attorney — does the legal processing.

- Creditors — the people whom the consumer owes money.

- National Credit Regulator (NCR) — the government body that regulates everything.

- Payment Distribution Agency (PDA) — an organisation that collects the consumers’ repayment and distributes it amongst the creditors.

- Magistrates Court — the ones that make it legally binding.

With us so far? Now, let’s talk about the application process.

If you want to sign up. Then, this is what you’ll want to do.

How to apply for debt counselling

Here are the steps you can take to apply for debt counselling in South Africa.

- Find a debt counsellor you trust (do a couple of Google Searches or check the NCR’s database of debt counsellors).

- Apply online or contact the debt counsellor.

- The debt counsellor will take it from there.

Important tip: verify that the debt counsellor is registered with the NCR.

It helps to do your research and gather your financial documents. This way, you’ll understand what debt counselling entails and have everything you need for your assessment (but you could always dig these up later.)

Struggling to pay your debt bills?

The advantages and disadvantages of debt counselling

Debt counselling has a lot of benefits. But like everything else that we love (Will Smith in almost everything), it’s not perfect (Will Smith slapping Chris Rock during the 94th Academy Awards).

Side note: we have an entire post dedicated to the pros and cons of debt counselling. Check it out if you want to learn more.

Here’s why you’d want to sign up:

Advantages of debt counselling

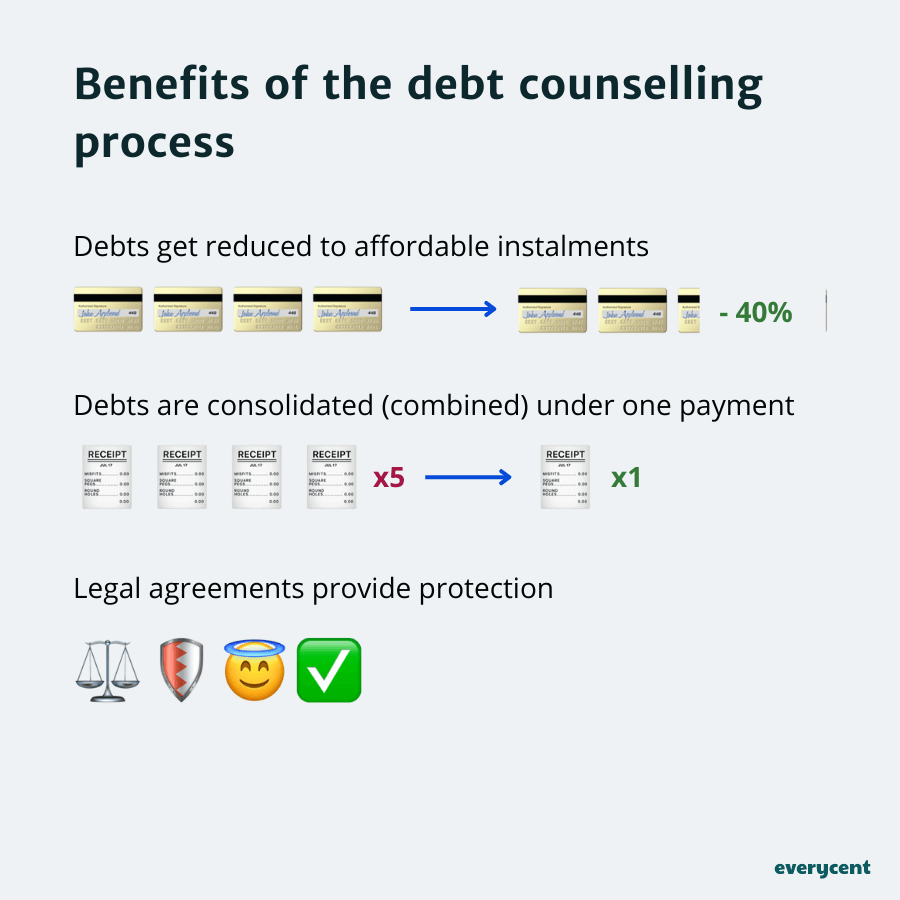

- Lower debt repayments — you can afford to pay for your debt and cover your cost of living.

- Lower interest rates —this one isn’t always applicable, but when it applies, the total amount owed could be significantly less than the original total.

- Legal protection — this is a biggy. It means that creditors won’t be able to pursue legal action (this can save a lot of money and reputational harm).

- Protect your assets — say goodbye to the fear of having your stuff repossessed.

- One simplified repayment — make one payment instead of 4, 5, or 20. The debt counsellor and PDA will make sure each creditor gets their share.

- It’s easy to follow — once everything is set up, the applicant must simply make their monthly payments.

That’s six amazing benefits.

But, as we said earlier, debt counselling has its dark side (the disadvantages).

Here’s why it’s not for everyone.

Disadvantages of debt counselling

- Fees —debt counselling isn’t free. Here is a list of the debt counselling fees.

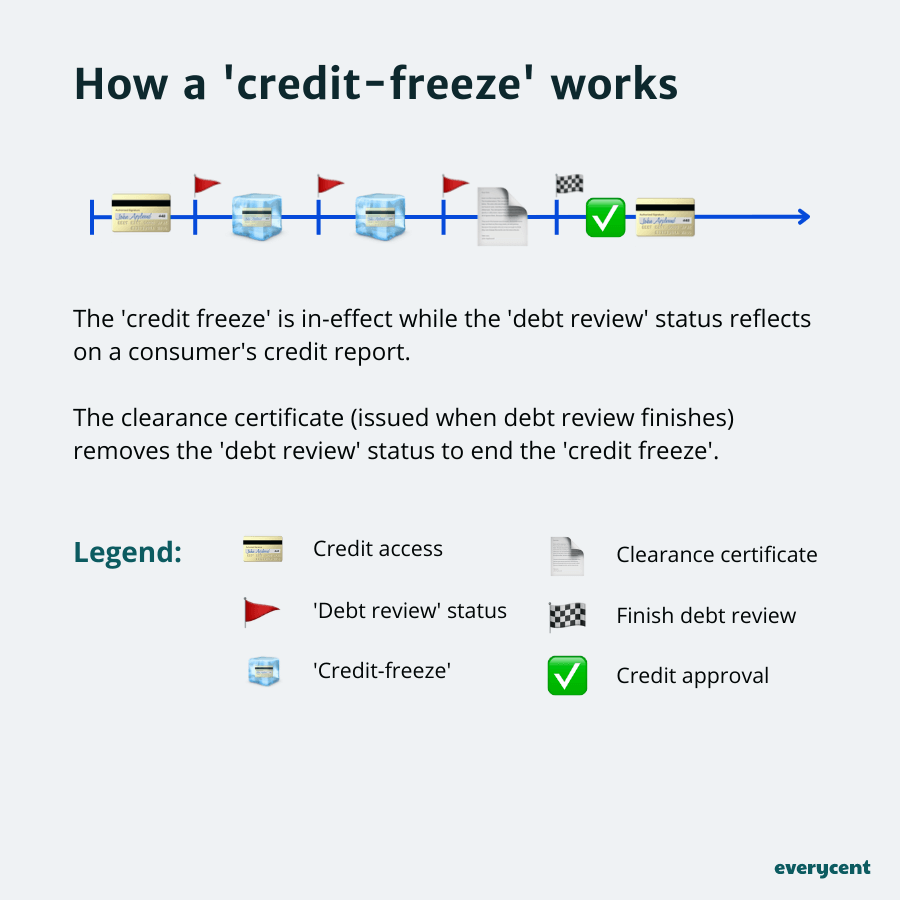

- “Credit-freeze” — the ‘debt review’ status limits access to credit. The upside is that this allows applicants to focus on their existing debt.

Now, the next question you may have, is: how long does debt counselling (debt review) last? (this post will answer your question.)

*Plus, there’s a potential impact on credit record — anyone with a bad credit score can basically ignore this point, but if you have a decent credit score, then making ‘reduced’ payments could affect your credit score while undergoing debt counselling.

*Consider the long-term benefit of catching up with what you owe. A clean slate will make improving one’s credit score a walk in the park.

Other possible letdowns include not covering all types of debt and not everyone qualifying.

So, what do you think—debt counselling is interesting, right?

It’s a beneficial tool for anyone caught on in a debt spiral.

In fact, that is the whole reason why debt counselling exists in South Africa. Here’s a quick history lesson featuring a timeline of the history of debt counselling:

The history of debt counselling in South Africa

| 2005 | South Africa introduced the National Credit Act (NCA) and established the National Credit Regulator (NCR) to regulate the South African credit industry and ensure compliance with the NCA. |

| 2007 | Debt counselling is introduced to help over-indebted South Africans. |

| 2010 | The NCA gets an update. Improving the debt counselling process and ensuring a safer experience for applicants. |

| 2013 | The NCR establishes a new accreditation system for debt counsellors. |

| 2017 | The NCA gets another update. |

| 2018 | The NCR makes the debt counselling process more efficient by establishing a new system. |

| Now | The process has helped countless South Africans. |

Final thoughts

Since its inception, debt counselling has continued to grow in popularity. In fact, debt counselling inquiries grew 30% in 2022 (that’s a lot). And with good reason, SA has a lot of debt, and the service is effective.

We’d say that most debt counselling applicants, who know precisely what they’re signing up for, come out happier on the other side.

Now you know everything about debt counselling. Pat yourself on the back and find the next topic you want to learn about.

Want to learn more? Keep reading on Everycent.