Thinking about not paying your debt?

It’s a good thing you decided to learn more about the consequences first. Things can get ugly. “How ugly?” you ask?

Buckle up. Here’s what happens when you don’t pay your debt.

What happens if you can’t pay your debt in South Africa?

Not paying your debt in South Africa can lead to additional fees and possible legal action. Depending on the case, the court order could deduct money directly from your income or seize your vehicle, property, or assets. Not paying your debts also hurts your credit score. Defaults and judgements can stay on your credit report for years.

Both lenders and borrowers have a role in the process. And each side has their rights. All this is written in the National Credit Act 34 of 2005. We’ll give you the highlights to make it easy.

The process and consequences can vary. But, it generally follows this outline.

In the first 30 days

Lenders may start charging late fees immediately and notify credit bureaus. This notification can damage your credit score. Although the timing varies by lender, this typically happens in the first 30 days.

Between 30-60 days

At this point, the account becomes delinquent. Creditors report delinquency to credit bureaus. Which can hurt your credit score for up to seven years and affect your ability to get credit.

After 60 days:

By now, most lenders will be doing debt collection. This leads to more persistent attempts to contact you and formal notices. Between 90 and 180 days the account status generally escalates to in default. It all depends on the lender’s policy and the terms of your agreement.

After 180 days:

After six months, most lenders sell the debt to a collection agency. Agencies continue to try to collect payments and eventually take legal action. If they succeed, the court could issue a garnishee order or warrant of execution. These court orders give the owner of the debt the right to seize income or property to recover the debt.

Are you missing debt payments or paying late? Check to see if you qualify to reduce the cost of your debt and free up money for other expenses.

I’m sure this brings up some questions. Don’t worry, we’ll answer them in sec.

Here are a few related topics you may want to check out:

- What is an S129 letter of demand?

- What to do when you get summons for debt in South Africa

- What is a garnishee order?

- Vehicle repossession process in South Africa

- Consumer rights and debt collection in South Africa

Now, let’s answer a few questions. Then, we’ll share what you can do if you can’t pay your debts. We’ve got a couple of life-savers for you to consider.

What happens if you don’t pay back a bank loan?

When you don’t pay back a bank loan, the loan incurs fees, and lenders go through the debt collection process. To recover the debt, the lender or a collection agency may file a lawsuit. If the court grants a court order, then your assets or income gets seized to recover the money you owe.

This process creates negative listings on your credit report. All hurting your credit score along the way.

What happens if you don’t pay your car instalment?

Not paying your car instalment is a breach of contract. It could lead to the repossession of the vehicle. First, the lender sends reminders. Then, the company may decide to take legal action. If the court grants a warrant of execution, then the owner of the debt can legally repossess the vehicle.

It’s better to try and renegotiate the loan terms or find other ways to settle the account. Applying for debt counselling (debt review) or voluntarily surrendering the car are also options. Either way, it’s better to do something about the situation than to watch the vehicle repossession process unfold.

📖 Bonus reading: 7 things you can do if you can’t afford your car payment

What happens if you don’t pay your phone contract?

Not paying your phone contract can make the network cut off your service and hurts your credit score. The longer the contract isn’t paid the more severe the impact on your credit score. It may also lead to debt collection and further legal action.

If you hurt your credit score by not paying, then you’ll have trouble getting another contract later on.

What happens when you default on debt review payments?

Failing to make payments under debt review allows creditors to legally terminate the debt review process. When debt review is terminated, it reinstates the original terms and allows creditors to take legal action once again. Depending on the court ruling, creditors may garnish your income or seize your property to recover the debt.

Communication is key. Don’t just default on debt review payments. It’s not an effective strategy to get out of debt review.

In this situation, the best thing to do is to talk to your debt counsellor. Give them a heads-up and find out what you can do. They may be able to negotiate monthly repayments to reduce them even further.

Are you missing debt payments or paying late?

Can you go to jail for debt in South Africa?

No, you cannot be sent to jail for owing debt in South Africa. But, you can be imprisoned for ignoring court orders. Not paying your debt is a civil offence. While contempt of court, like ignoring court orders regarding your debt is a criminal offence which may lead to imprisonment.

Ignore debts [and court orders] long enough, and jail time becomes a possibility.

Messy, isn’t it?

Let’s shift our focus. Here’s what you CAN do if you’re in a tight spot and can’t pay.

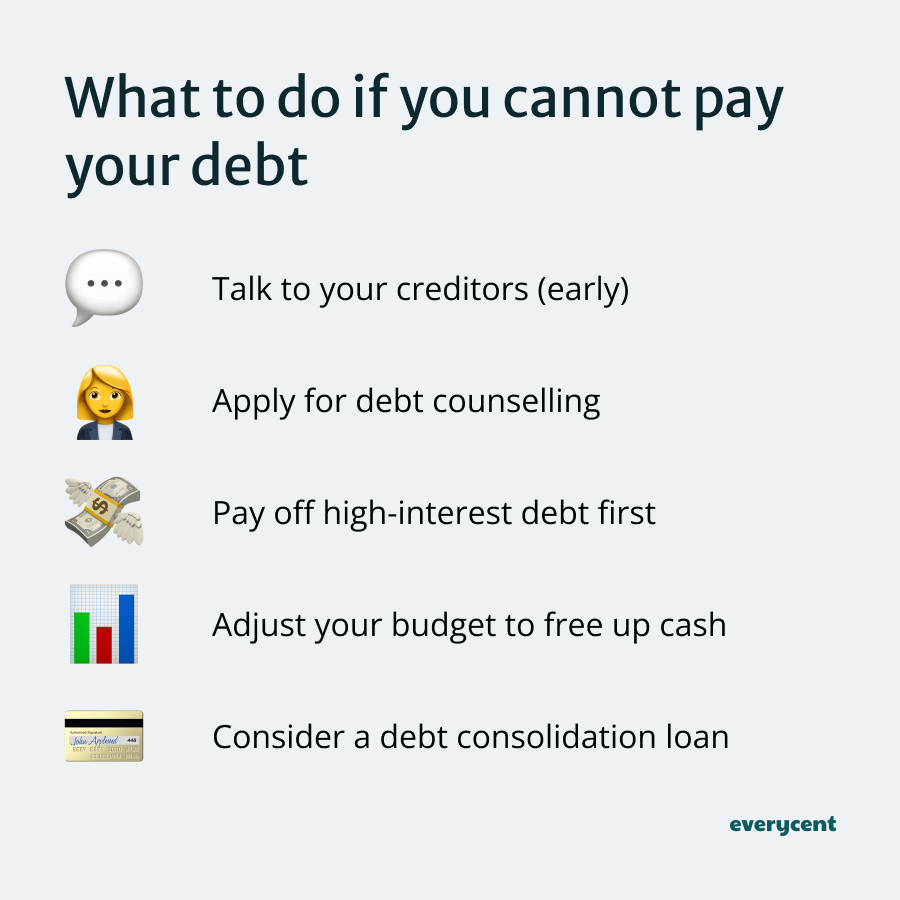

What to do if you cannot pay your debt

When debt becomes unaffordable, you have two strategies: A) find ways to make the debt cost less, or B) find ways to free up more cash.

Here’s a list of things you could do:

- Talk to your creditors (early): As soon as you realise you can’t pay, tell your creditors. Contact them and explain the situation. Many creditors will work with you to arrange a more manageable repayment plan.

- Apply for debt counselling: Debt counsellors can help in a number of ways. They lower the cost of your monthly debt instalment and provide legal protection. Amongst other things. Anyone who’s in a tight spot should consider this route. It can make a BIG difference long term.

- Consider a debt consolidation loan: Consolidating debts under a new loan with better terms is another option. This can make the debt easier to manage. Sometimes, it could mean you’ll pay more by the end, so remember to read your terms and do your maths.

- Pay off high-interest debt first: By paying off high-interest debts, you get rid of the debt with the most severe consequences. This could be your home loan or car finance. It’ll also help you save money on interest payments and help build momentum.

- Adjust your budget: Try spending less each month. Create a strict budget that prioritises essential expenses. Then, use the “extra” money to pay off your debt.

📖 Bonus reading: Advantages and disadvantages of debt counselling (debt review)

In summary

While there is some variation in how it plays out. Not paying your debt usually leads to the same things:

Damage to your credit score and legal action down the line.

The best thing to do is to find a way to pay. Whether that’s by talking to creditors, adjusting your budget or applying for debt counselling (debt review).

Want to learn more? Keep reading on Everycent.