Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Earning money while you sleep — that’s the dream, isn’t it?

The real question is, how do you do it? How can you make passive income?

That’s what we’ll look at today.

Plus, we’ll explore passive income opportunities that are readily available for South Africans.

How to make passive income in South Africa

There are several ways to make passive income in South Africa. The list of passive income opportunities includes ideas like generating income from content (or sponsorship), earning interest, renting out property or equipment, brokering services, selling digital products, and more.

But wait? It seems like there might be some work involved.

Well, that’s the thing.

Only a few passive income opportunities are truly passive.

Allow us to explain.

What is passive income?

Passive income is money that you earn from investments, ventures, or assets that don’t demand your constant attention (require minimal effort to maintain). Unlike active income, where earnings are directly tied to the work you put in.

Think of it as cash flow on cruise control.

Here’s the deal, though… All passive income opportunities require some work (some more than others).

The truth about passive income

Although the term “passive income” describes income that doesn’t require active, day-to-day work. 90% of passive income-generating concepts require either upfront work, or periodic maintenance, monitoring, or reinvestment.

For example, renting out a property requires getting the asset, plus management and maintenance; And publishing a book entails writing and marketing.

Basically, the setup phase requires a good chunk of effort, and then there might be a few ongoing tasks afterwards.

That’s cool. It still beats trading time for money.

And that’s how we’ll approach making a passive income in South Africa.

Steps for making passive income in South Africa

Let’s get practical.

Follow these four steps to start earning more and more passive income:

- Identify the right opportunity

- Learn how to make it work

- Build and scale the operation

- Reinvest

We know, “Build and scale the operation” sounds like a lot of work.

But that’s what it takes to earn a passive income. Either A) a fair amount of upfront work or B) money (or capital) that can do the work for you.

Just trust us on this one. Following this strategy can also help you to become a rich South African.

Sidenote: the steps below are geared toward someone who doesn’t have capital that they can use to generate passive income.

But there may still be some worthwhile info for people with money, too. So, don’t skip it.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.

1. Identify the right opportunity

Your first mission is to spot an opportunity that doesn’t demand too much time or a large sum of money (unless you already have money at your disposal, then you can ignore the capital requirements).

Selling digital products, offering services, renting things out, creating content, or offering courses or education are a few popular options.

Using capital to pay for labour also works—so the right business idea can also work.

The goal: Maximise the output per unit of input (or time).

Do some research, and learn how others have done it by reading blogs (or Twitter/X) and listening to podcasts.

Once you identify a viable option, move on to phase two.

📖 Related content:

2. Learn how to make it work

Next, it’s time to sharpen your skills and learn about the industry or mechanics of the venture that you packed in step one.

Again, you can learn just about anything on the internet. Start there.

But, try and talk to other people that have already done it, or are doing something similar as well.

It can save you from making mistakes that they’ve already made.

Now comes the fun part.

3. Build and scale the operation

Remember that part about requiring some work?

Well, this is it.

Doing research and learning is easy. Actually, doing the work is a little harder.

At this stage, you might need to:

- Invest money (not easy);

- do several tasks repeatedly for a consistent period of time before seeing money come in (challenging);

- find people who are willing to buy and convince them to do so (hard);

- work more (exhausting)

Stick with it! The only way this doesn’t work is if you give up. Once you’re making money, you can make the process more hands-off (if it isn’t already), or leverage the income to scale earnings (whether inside or outside of the venture you chose).

This is where we hit the ‘passive’ phase.

4. Reinvest

Once you start seeing a steady flow of income, then it’s time to either scale your operation or reinvest elsewhere.

- Scale your operation — now, depending on the income opportunity that you choose, you’ll either start generating more money from existing assets, or you can introduce labour to reduce your personal time cost.

- Reinvest elsewhere — if your venture is making money but demands a lot of attention, it’s time to invest in real passive income-generating assets like real estate, businesses, stocks, or another hands-off venture.

There you have it.

The (not so passive) way to make passive income in South Africa.

Want more hands-off options?

We’ll cover those next.

Best passive income opportunities in South Africa

In case you don’t feel like doing much work, here are a few time-tested passive income opportunities that don’t require a lot of work.

- Real estate investments

- Dividend-paying stocks

- Peer-to-peer lending

- Digital products (e-books, online courses)

- Affiliate marketing

- Royalties from intellectual properties (books, music, patents)

- Renting out equipment or property (e.g., cameras, drones, parking spaces)

📖 Related content: Best investments in South Africa

Renting out equipment or property

Renting out equipment can be a great way to earn passive income.

There are several options like vehicles, sound equipment, decor, party supplies, storage or parking space, or whatever you can think of.

Dividend-paying stocks

Buy stocks from companies that pay out dividends (portions of profits shared with stockholders). Usually, it requires a substantial amount of stock before you start seeing significant dividend returns.

Peer-to-peer lending

Platforms like RainFin allow you to lend money to individuals or small businesses online. In return, you earn interest.

Selling digital products

Ever heard of the phrase: “Build once, sell twice”?

When you create a digital asset or product, you can resell it thousands of times without having to pay manufacturing or labour costs each time.

Think e-books, online courses, subscriptions, or even photography that people can purchase and download.

Affiliate marketing

Affiliate marketing is a way to earn money from product sales of-, or subscriptions to other companies’ products that you- promote.

Affiliates typically earn a commission for every sale made through your referral link, so it requires some work to generate traffic.

Royalties from intellectual properties

Write a novel, compose a hit song, or invent and patent a new tool/concept to earn a royalty every time your creation is bought or used.

The beauty of this stream is that once the hard work is done (like writing the book), you can continue to earn from it for years to come.

Renting out equipment or property

Renting out equipment can be a great way to earn passive income.

There are several options like vehicles, sound equipment, decor, party supplies, storage or parking space, or whatever you can think of.

Each of these avenues comes with its own set of challenges and rewards.

Some might require a substantial initial investment (like real estate), while others might just need your time, expertise, or creativity (like writing a book or developing an app).

Find what works for you, then dig in!

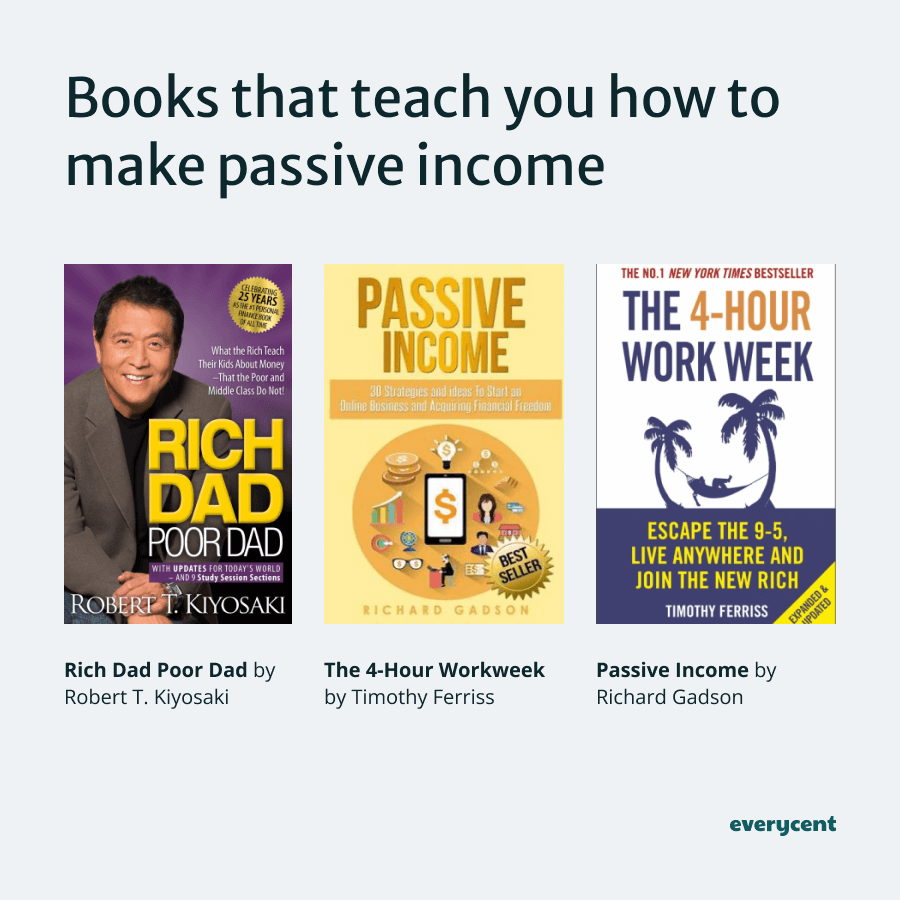

If you want to learn more about passive income, here are a few books that have made thousands of millionaires between them.

Books that teach you how to make passive income

- “Rich Dad Poor Dad” by Robert T. Kiyosaki — is a personal finance masterpiece that covers several topics and talks about property investment or how to build wealth the right- vs wrong way.

- “The 4-Hour Workweek” by Timothy Ferriss — is a great resource for anyone who wants to learn more about automating tasks and outsourcing work so you can do less. Plus, it’s an awesome source of inspiration.

- “Passive Income: 30 Strategies and Ideas To Start an Online Business and Acquiring Financial Freedom” by Richard Gadson — a hands-on guide for building an online business that generates passive income.

Final Thoughts

That’s a lot to take in.

How’d we do?

We debunked the myth of passive income and shared a valuable blueprint for setting yourself to maximise your earnings and level up toward true passive income.

Doing the work (or taking the risk if you’re using capital) won’t be easy, but passive income works with time. It’s meant to get easier as time passes. Either because you’re getting smarter (and have more knowledge to leverage), or cause you’re getting wealthier (and have more money to leverage).

Now, get after it. We’re rooting for you.

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.