Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Ever heard the phrase: “Make your money work for you”?

That’s why we invest. We want our money to make more money. And keep doing it year over year, over year.

But just investing isn’t enough. You need to pick the right investments.

That’s what we’re going to cover today. The best investments in South Africa—what each option is, why it’s a popular way to invest, and how you can do it.

Here’s the list.

(In no particular order.)

Best Investments in South Africa

Here are the best investment options available in the country:

- Tax-Free Savings Accounts (TFSA)

- Fixed-term savings or fixed deposits

- Flexible Savings Accounts and Money Market Funds

- Exchange Traded Funds (ETFs) or Unit Trusts

- A Stockbroking Account for stocks

- Government bonds (RSA Retail Savings Bonds)

- Property

- Retirement annuity (RA)

Everyone has different needs. So, what works for you may not be the best option for your neighbour.

Let’s go over each investment option one-by-one. Getting to know each one will help you decide what’s best for you. Then, you can use the list to decide where you want to invest—and put your money to work.

Tax-Free Savings Accounts (TFSA)

What is it? A Tax-Free Savings Account (TFSA) lets South Africans save money without paying taxes on interest, dividends, or capital gains.

Right now, every South African can invest R36,000 each year, for a total up to R500,000 in their lifetime. And SARS won’t tax you on the returns (interest, dividends, or capital gains.)

Why it’s a popular investment option: TFSAs are ideal for long-term savings because you don’t get taxed on the returns. (Unlike other investment options—which are taxable.)

How to invest: First, decide which investment option you want to use (keep reading). Then, choose a bank, management company, or investment platform that offers tax-free investments of that type. Finally, open an account and start investing. (Remember the limits.)

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

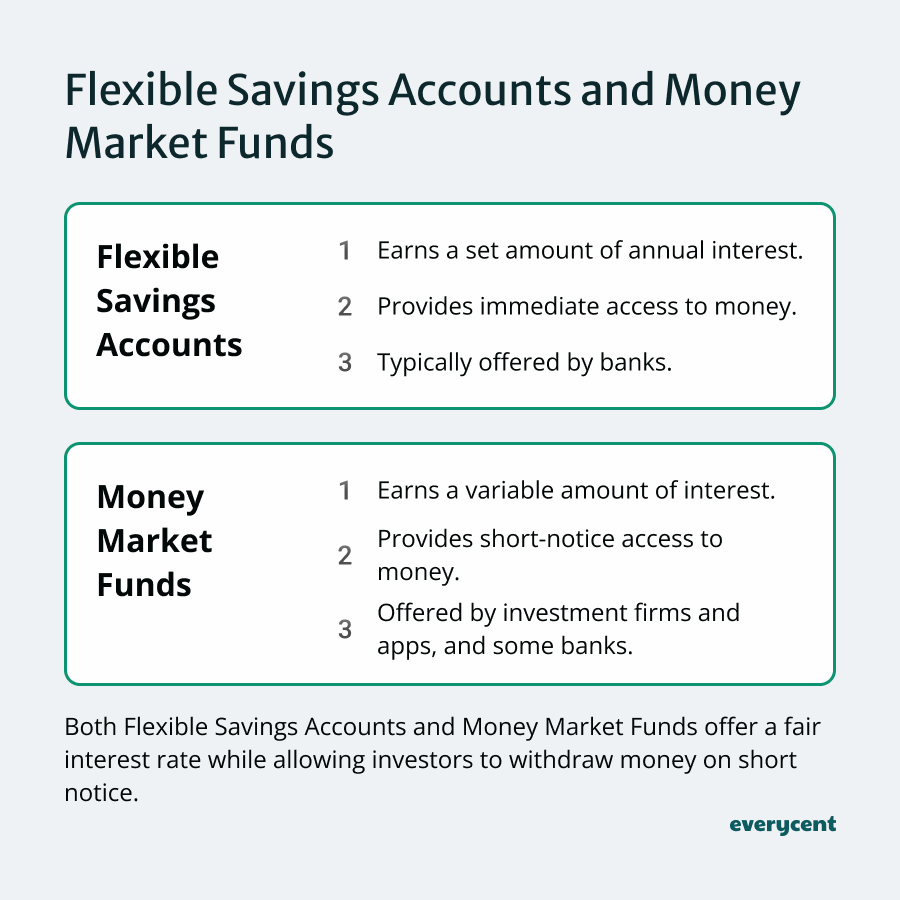

Flexible Savings Accounts and Money Market Funds

What is the difference?

Flexible Savings Accounts: Banks offer these accounts to allow you to deposit and withdraw funds anytime while earning interest.

Money Market Funds: Investment firms or apps, mutual fund companies, and some banks offer Money Market Funds. These funds attempt to provide higher yields than savings accounts. This makes it a little more risky (though still safe). Returns could be more than a flexible savings account or less. And withdrawals may be less immediate depending on the structure of the fund.

Both Flexible Savings Accounts and Money Market Funds offer a fair interest rate while allowing investors to withdraw money on short notice.

Why it’s a popular investment option: These two investment options offer liquidity (the option to withdraw/sell) with a reasonable interest rate. They are ideal for maintaining emergency funds or saving for upcoming expenses without the constraints of a fixed term.

How to invest:

Flexible Savings Accounts: Open an account with any major bank or financial institution. You can usually start with any amount and access your funds as needed.

Money Market Funds: Start with some research. Choose a service provider and fund and use an app or speak to someone at the company to get started.

Fixed-term savings or fixed deposits

What is it? Banks offer fixed-term savings or fixed deposits. You deposit money for a fixed amount of time. Usually, several months to years. And banks repay a higher fixed interest rate in return.

Why it’s a popular investment option: It’s one of the safest investment options available. As long as the bank doesn’t under—investors get a healthy guaranteed return on their investment.

How to invest: Most banks [including yours] offer fixed-term savings or fixed deposit account options. Do some homework to decide whether you want to use your bank or another. Then, decide how much you want to invest and for how long.

📖 Related content:

- How to become rich in South Africa

- Online side hustles in South Africa

- How to make passive income in SA

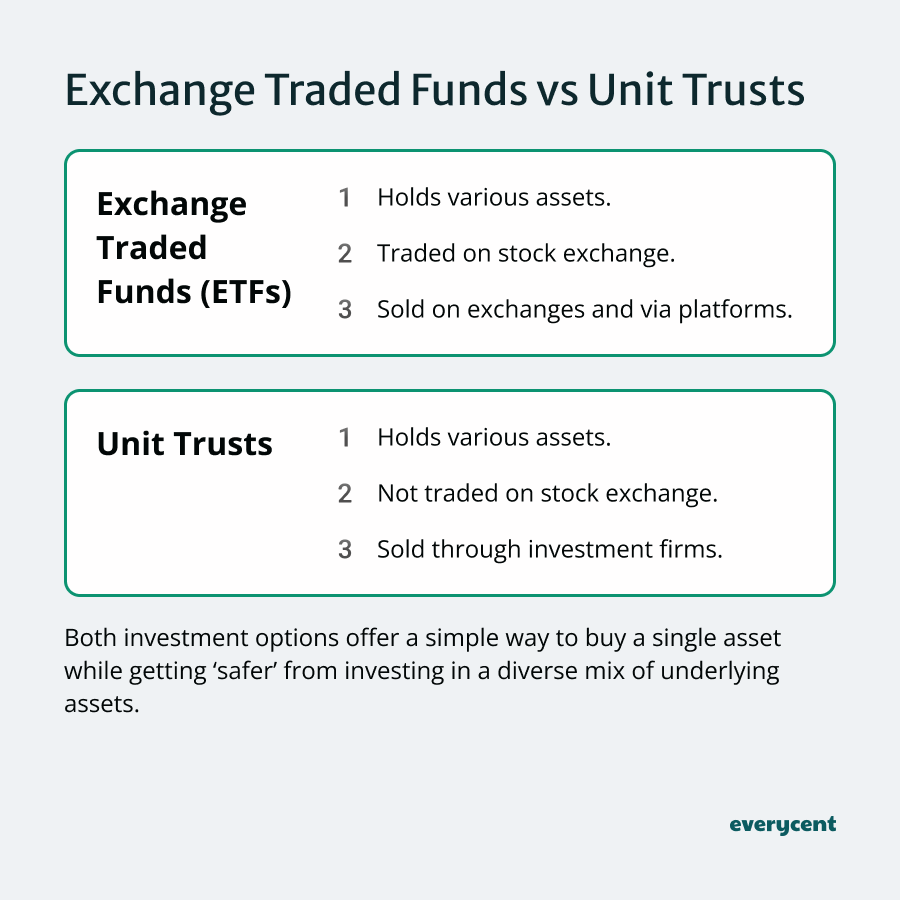

Exchange Traded Funds (ETFs) or Unit Trusts

What is the difference?

Exchange-Traded Funds (ETFs): ETFs are like baskets of different investments. They hold various assets like stocks, commodities, or bonds in a fund. ‘Exchange-Traded’ means you can buy and sell ETF shares on stock exchanges — similar to buying stocks.

Unit Trusts: Unit Trusts also use money from lots of people. And invest in stocks, bonds, or other securities. The primary difference is, unlike ETFs, you cannot buy or sell Unit Trusts on a stock exchange. This asset is typically bought and sold through a fund management company like Allan Gray.

Both investment options offer a simple way to buy a single asset while getting ‘safer’ from investing in a diverse mix of underlying assets. Instead of investing in one company or commodity, you get to invest in many. This generally makes it safer.

Why it’s a popular investment option: Both investment options offer a simple way to buy a single asset while getting ‘safer’ from investing in a diverse mix of underlying assets. Instead of investing in one company or commodity, you get to invest in many. This generally makes it safer. (Good for long-term investment.)

How to invest:

Exchange-Traded Funds (ETFs): Anyone can buy and sell ETF shares through an online trading platform like EasyEquities or many popular fund management accounts. Download the app to get started or contact a company that offers ETFs to find out how to invest.

Unit Trusts: Invest through financial institutions, fund managers, or specialised investment platforms. Companies like Allan Grey, Ninety One, Sygnia, and many others all offer Unit Trusts.

A Stockbroking Account for stocks

What is it? A stockbroking account allows you to buy and sell stocks and other securities on a stock exchange through a licensed brokerage. Today, for most of us beginners, this would be an app.

Why it’s a popular investment option: Stocks can produce some of the best returns. NVIDIA [the computer hardware company] grew over 500% between 2023 and 2024. But that’s not always the case. Stocks are also more risky.

How to invest: If you’re inexperienced. Be careful. Try using a demo account on a platform like Easy Equities first. Investment platforms [or apps] make it easy to buy and sell stocks. Anyone can do it nowadays. (Most beginners are better off investing in safer assets like ETFs at first. Adjust how much you invest according to your risk tolerance.)

Bonds (RSA Retail Savings Bonds)

What is it? Government-issued bonds offer South Africans guaranteed fixed rates of return over a specific period. Essentially, you’re lending money to the government and in return, you get repaid with interest.

Why it’s a popular investment option: It’s considered one of the safest investment options available. Because it is backed by the government. And it’s unlikely that the government will default on its debt. Additionally, investors can buy inflation-adjusted bonds. A great way to protect the value of money against high inflation periods.

How to invest: Invest directly with institutions like RSA Retail Savings Bonds or through Bond Funds with investment companies. Visit the official website or the nearest National Treasury office to learn more and get started. There’s usually a minimum investment, and the terms typically range from two to five years.

Property

What is it? When you buy a house, apartment, commercial unit, or land… you’re investing in property. Real estate [or property] investments can generate income and returns through rent or by going up [appreciating] in value.

Why it’s a popular investment option: Property is a very popular investment for those who want to own their own home. And in most cases a good idea. On the other hand, investing with the intent to rent can produce mixed results. Sometimes, it’s a great investment, but it’s not a guarantee.

How to invest: Start by doing your homework. Do some market research to identify promising locations and property types. Use reporting solutions like Lightstone to get an accurate overview of various locations and markets. Then, you’ll likely need to apply for financing. Typically through banks or mortgage finance companies.

Retirement Annuity (RA)

What is it? A Retirement Annuity, or “RA,” is like a private savings plan for when you retire. It helps you save money in a way that cuts down on taxes. Why? Because you can deduct the money you put into it from your taxes. (Up to a certain amount.) And you only start paying taxes on the investment when you start using it in retirement. It’s worth mentioning that it’s not easy to withdraw

Why it’s a popular investment option: RAs are great for anyone who wants to make sure they have a steady source of money when they stop working. They help you save regularly and offer tax benefits.

The downside is that RAs aren’t very flexible. Your investment is generally locked in. And, because it’s managed there are fees to take note of. (Every option in this list has fees btw—some are just higher than others.)

How to invest: You can buy a retirement annuity from insurance companies, big banks, or financial advisors in South Africa. Decide how much you want to invest each month and commit.

In Summary

There you have eight of the best investments in South Africa. Everyone has their own style and needs—so what’s best for you may not be best for someone else.

Personally, I’ve read several finance books and listened to lots of podcasts about money. You know what keeps coming up?

- It’s important to diversify. (Don’t put all your eggs in one basket.)

- Not losing money is just as important, if not more important, than your gains. A steady 11% growth rate over a long period of time tends to beat big ups and downs.

Start as soon as possible, track your progress, and find out what works for you.

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.