Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

Getting rich isn’t as hard as it is made out to be.

While it isn’t easy either, it can be quite simple.

All you need is the right path (and there are plenty!)

Today, you’re gonna learn how to become rich using one of four time-tested, proven paths to success.

Let’s get into it.

How to become rich in South Africa

The best way to get rich in South Africa is to choose a path with a high probability of success.

The four best ways to make millions in South Africa:

- Building cash flow

- Selling a business

- Getting a high-paying job

- Saving and investing

Want to make your first million Rand?

This is how you can do it. Choose the route that fits your risk tolerance and the phase of your financial journey. After that, all that’s left to do is stick with it and see it through.

Let’s go over each of the proven ways to become rich. Plus, check out examples of people you might know who built their wealth using each of these four ways.

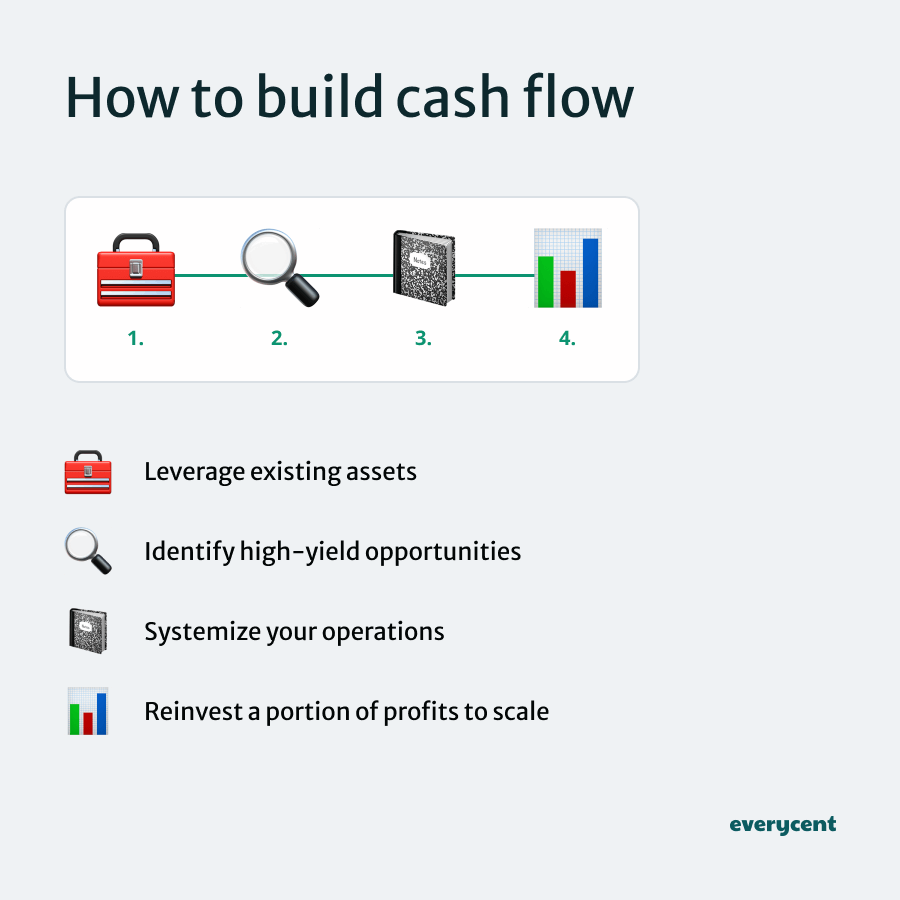

Building cash flow

Building cash flow is about creating steady income streams, usually through business or investments.

Many believe that entrepreneurs who want to become rich by starting a business should decide whether they want a lump sum of wealth from selling or a consistent stream of income from building cash flow.

Here’s how you might approach it:

- Leverage existing assets

- Identify high-yield opportunities

- Systemize your operations

- Reinvest a portion of profits to scale

1. Leverage existing assets: Use what you’ve got to get started. Consider your skills, expertise, network, and things you own (like real estate for rental income or intellectual property for licensing fees) as pillars of your cash-flow strategy.

2. Identify high-yield opportunities: Seek out business ideas or investment opportunities with the potential for regular income. This might mean starting a service-based business with recurring billing or investing and buying property or shares in other businesses.

3. Systemize your operations: Create systems that ensure your business can run without your constant input. Systems will help create more predictable income and help you to identify new opportunities.

4. Reinvest a portion of profits to scale: Channel profits back into the businesses and ventures. Reinvesting can help fuel growth, which should lead to more revenue and bigger profits.

Famous example: Robert Kiyosaki

Although not a South African figure, Robert Kiyosaki, author of “Rich Dad Poor Dad”, is a great example of building wealth through cash flow.

How did he do it? By buying property.

His philosophy of financial education, investing in assets, and understanding the market have influenced many in their journey to financial freedom.

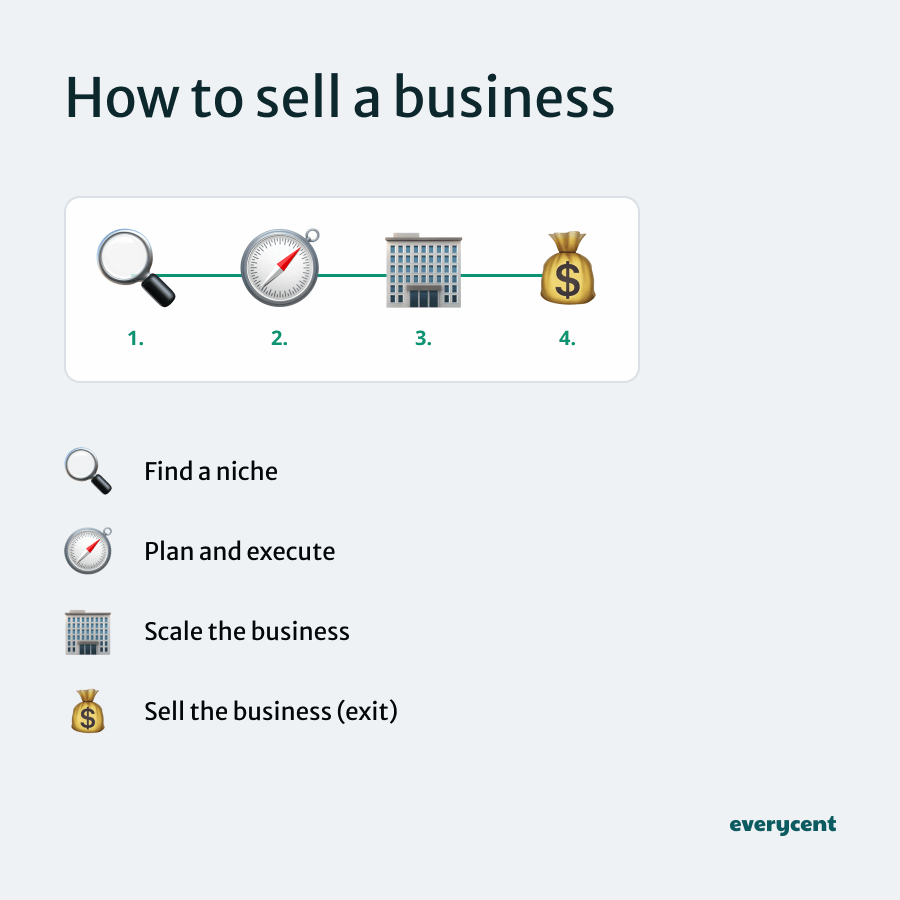

Selling a business

Selling a business is a great way to make A LOT of money all at once. You start with a plan, work hard to turn it into a reality, then sell it as an asset and cash in big. It’s a path many entrepreneurs in South Africa (and across the world) follow to amass wealth.

Here’s how you might go about it:

- Find a niche

- Plan and execute

- Scale the business

- Exit strategy

- Sell the business

1. Find a niche: Look for a market gap or something you’re passionate about. Whether it’s technology, retail, or services, your business should offer something unique or superior to what’s already out there.

“The riches are in the niches.”

2. Plan and execute: Do your research and your maths. Will this make money, and can you afford to sustain the business till it does? If the opportunity makes sense and you can handle the risk, then it’s time to figure out how you’re gonna do it and get to work.

3. Scale the business: Start simple, get everything working, and then look for ways to scale. This might involve hiring more employees, adding new products, selling in new markets, or using technology for efficiency.

4. Exit strategy: Remember, you want to become rich, right? This means you’ll have to build your business with an exit in mind (selling the business). This means you have to make it attractive to potential buyers or investors (solid financial records, a strong customer base, and a scalable model are all things buyers look for in a business.)

5. Sell the business: The best part. Selling. This is a complicated process, so most average South Africans will do well to work with a mentor or guide or an investment banker to help with the final sale.

Famous example: Elon Musk

South-African-born Elon Musk sold his first business, a software company called Zip2, for nearly $300 million.

Elon followed the five steps above from start to finish with Zip2—and it made him rich.

What did he do with the money? He used the capital to fund even bigger businesses, SpaceX and Tesla.

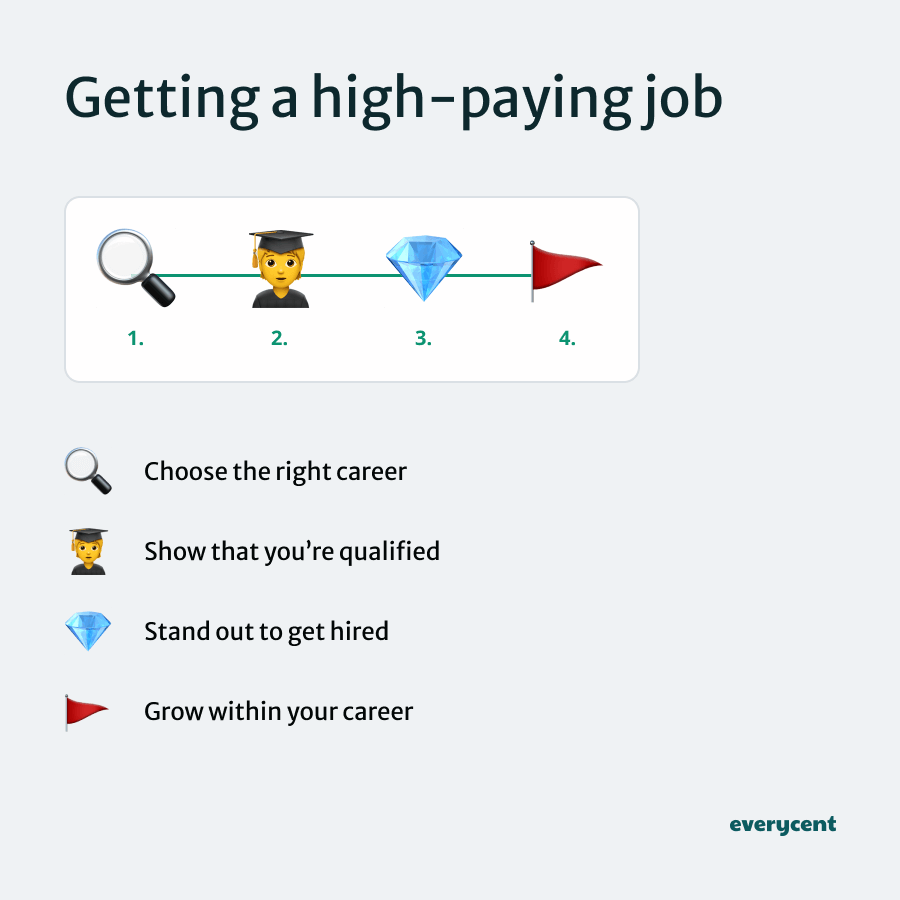

Getting a high-paying job

One straightforward route to wealth is through a high-paying job. There are several high-paying jobs in the market. All you need to know is which jobs to choose and how to work towards getting one.

How to get a high-paying job:

- Choose the right career

- Show that you’re qualified

- Stand out to get hired

- Grow within your career

1. Choosing the right career: Identify a lucrative career that matches your skills and interests using platforms like PayScale or Indeed. Ensure it’s in demand and aligns with your professional goals.

2. Show that you’re qualified: Start building the necessary skills to show companies that you’re ready to get hired. For jobs that require a diploma or degree, enrol to start studying. For jobs that care about proof-of-work, start building your portfolio and doing work for free.

3. Stand out to get hired: Customise your applications, create a professional online presence, and go the extra mile to stand out from other applicants.

Plus, try to use your network (build one if you don’t have one) and recruitment agencies to stay ahead in the job market.

4. Grow within your career: You got the job! Now, it’s time to grow. Use salary negotiations and strategic career moves to keep climbing in your career.

Another great way to grow is by adding real value to your company. When the company grows as a direct result of your efforts, so does your paycheck.

Famous Example: Tim Cook

Tim Cook, although not a South African example, is a prime case of climbing the corporate ladder to wealth.

Starting from an early job at IBM, Cook’s relentless pursuit of knowledge, knack for technology, and strategic career moves led him to become the CEO of Apple, one of the world’s most valuable companies.

Tim got FILTHY rich by getting a high-paying job.

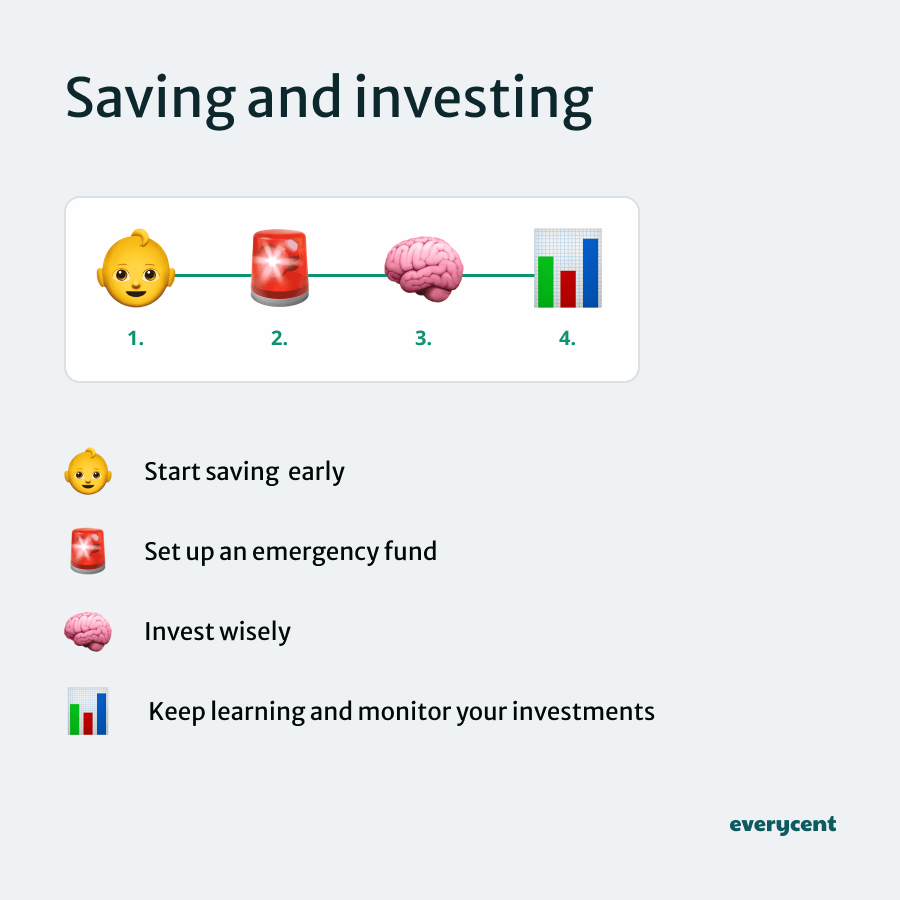

Saving and investing

Anyone can become rich by saving and investing (wisely). This path to building wealth has the highest probability of success. It just takes time.

Here’s how it works:

- Start saving as early as possible

- Create a budget

- Emergency fund

- Invest wisely

- Keep learning

- Be patient and stay disciplined

1. Start saving as early as possible: The sooner you start saving, the more time your investments will have to grow. Build a habit of “paying yourself first”. This means saving/investing a portion of your money before you spend a cent.

2. Create a budget: Track your income and expenses to check how much you can save and invest each month. If you really want to become rich, then cut back on expenses and reduce your cost of living to maximise the amount that you’re able to save and invest. It’ll pay off.

📖 Related content:

3. Emergency fund: Before diving into investments, build an emergency fund to cover unexpected expenses. Most experts recommend 6 months’ worth of living costs.

4. Invest wisely: Saving isn’t enough; you need to invest. Make your first investment in a book that will teach you some of the basic concepts. Then, start building your investment portfolio.

5. Keep learning and monitor your investments: Stay educated by listening to podcasts or reading news that shares information that may impact your investments. Keep an eye on your portfolio, and rebalance your investments regularly.

6. Be patient and stay disciplined: Avoid the temptation to follow short-term market trends. Long-term, disciplined investing is often the most reliable way to grow wealth.

Famous example: Anne Scheiber

Anne Scheiber is a regular American who turned a modest income into a fortune through long-term, patient investing.

Beginning with a few thousand dollars, she accumulated over $22 million by the time of her death (1995), primarily through savvy stock picks and reinvesting her dividends.

When you give it enough time, compound interest picks up momentum, and savings start growing exponentially. Anne is a great example of this.

B.t.w., her $22 million in 1995 would have the buying power of $44 million today.

How crazy is that?

How to become a millionaire in South Africa

Let’s put these methods into a South African context and see how each path could potentially lead you to becoming a millionaire.

How to make a million rand in South Africa:

| Method | Example Scenario | Monthly Earnings / Contribution | Years to Reach a Million Rand | Additional Notes |

| Getting a High-Paying Job | Job in technology or finance. | R20,000 | 50 months (just over 4 years) | Excludes taxes and expenses. Assumes saving 100% of earnings. |

| Selling a Business | Starting and growing a tech startup in Cape Town. | N/A | N/A | Sell a business for R10 million. Time to million depends on growth and sale timing. |

| Building Cash Flow | Investing in rental properties across Johannesburg with a net income from rent. | R20,000 net income from rent | 4 years, 2 months | Assumes consistent net rental income and no additional expenses or investments. |

| Saving and Investing | Saving R5,000 monthly with an annual return of 10%, compounded monthly. | R5,000 | Approximately 14 years | Compounding monthly. Total savings after 14 years would be approximately R1,004,000. |

It’s worth noting that although the title of millionaire has a certain quality to it, a lot of households should aim to save/invest/accumulate significantly more than a million Rand before retirement.

📖 Related content: Online side hustles you can start in South Africa

Consider your expenses and cost of living, then work out what would be a good number for you.

Here are a couple of tips to keep in mind.

Getting rich tips in South Africa

To make your journey towards wealth in South Africa more effective, consider these tips:

- Stay informed

- Diversify your income

- Manage debt wisely

- Take calculated risks

- Learn from mistakes

- Learn from others (seek professional advice)

Stay informed: Keep up with local and global economic trends that can impact your investments and job market (try subscribing to a newsletter like the Daily Investor or BusinessTech.)

Diversify your income: Don’t rely solely on your day job. Consider other income opportunities and passive income streams.

Manage debt wisely: Avoid high-interest debt and understand the terms of any loans or credit you use.

Take calculated risks: Whether in your career or investments, sometimes taking well-considered risks can lead to significant rewards.

Learn from mistakes: Everyone makes financial mistakes. Learn from them rather than repeating them.

Learn from others (seek professional advice): Consider consulting with financial advisors or mentors who can provide valuable guidance tailored to your situation.

📖 Further reading: This one is for anyone with lots of debt. Check out what is debt counselling?)

Now, are you ready?

In summary

It isn’t easy, and it won’t happen overnight.

But there are lots of ways to become rich in South Africa.

Try following one of the four paths:

- Building cash flow

- Selling a business

- Getting a high-paying job

- Saving and investing

Identify the one that could work for you, find others who got rich this way, and emulate what they did.

Now go build your wealth. We’re rooting for you!

Want to learn more? Keep reading on Everycent.

Struggling to pay your debt bills?

Check to see if you qualify to lower your debt instalment and free up money for other expenses.