Thanks for checking out this post. We help South Africans manage debt, protect their assets, and restore their finances.

When someone is ‘blacklisted, creditors don’t want to talk to them, and interest rates are sky-high.

Being ‘blacklisted’ is far from ideal. It makes almost anything related to finances more difficult.

But how do you know whether you’re ‘blacklisted’ or not?

Luckily there are simple ways to check if you are ‘blacklisted’ in South Africa. And we’re gonna tell you everything you need to know.

Let’s get started.

What does being ‘blacklisted’ mean?

In South Africa’s credit industry, the term ‘blacklisted’ is used to describe an individual with a bad credit profile.

This means their credit record has negative information, such as missed payments, defaults, judgements or excessive debt. As a result, lenders see them as a high-risk borrower and may be reluctant to give them credit, which effectively means that they are ‘blacklisted’.

It’s worth mentioning that the concept of a ‘blacklist’ is more of a colloquial term; there isn’t an official ‘blacklist’ today. We’ll keep referring to ‘blacklisted’ because that’s what readers are familiar with. But using a phrase like ‘restricted credit access’ would be better.

Are you missing debt payments or paying late?

Check to see if you qualify to reduce the cost of your debt and free up money for other expenses.

How to check if you are ‘blacklisted’ in South Africa

To check if you are blacklisted in South Africa, all you need to do is request a copy of your credit report and review it for negative listing and poor credit score indicators.

Here’s how to check if you are ‘blacklisted’:

- Choose a credit bureau to use.

- Create an account to access your credit report.

- Review your credit report.

- Dispute errors.

Step 1: Choose a credit bureau

South Africa has several major credit bureaus, including TransUnion, Experian, Compuscan (now part of Experian), XDS (Xpert Decision Systems), and ITC Credit Bureau.

You have the right to request one free credit report once a year.

Step 2: Create an account to access your credit report

Next, you’ll have to sign up to get your credit report. Just follow the on-screen registration process and provide the necessary information like your name, ID number, contact information, and password.

Step 3: Review your credit report

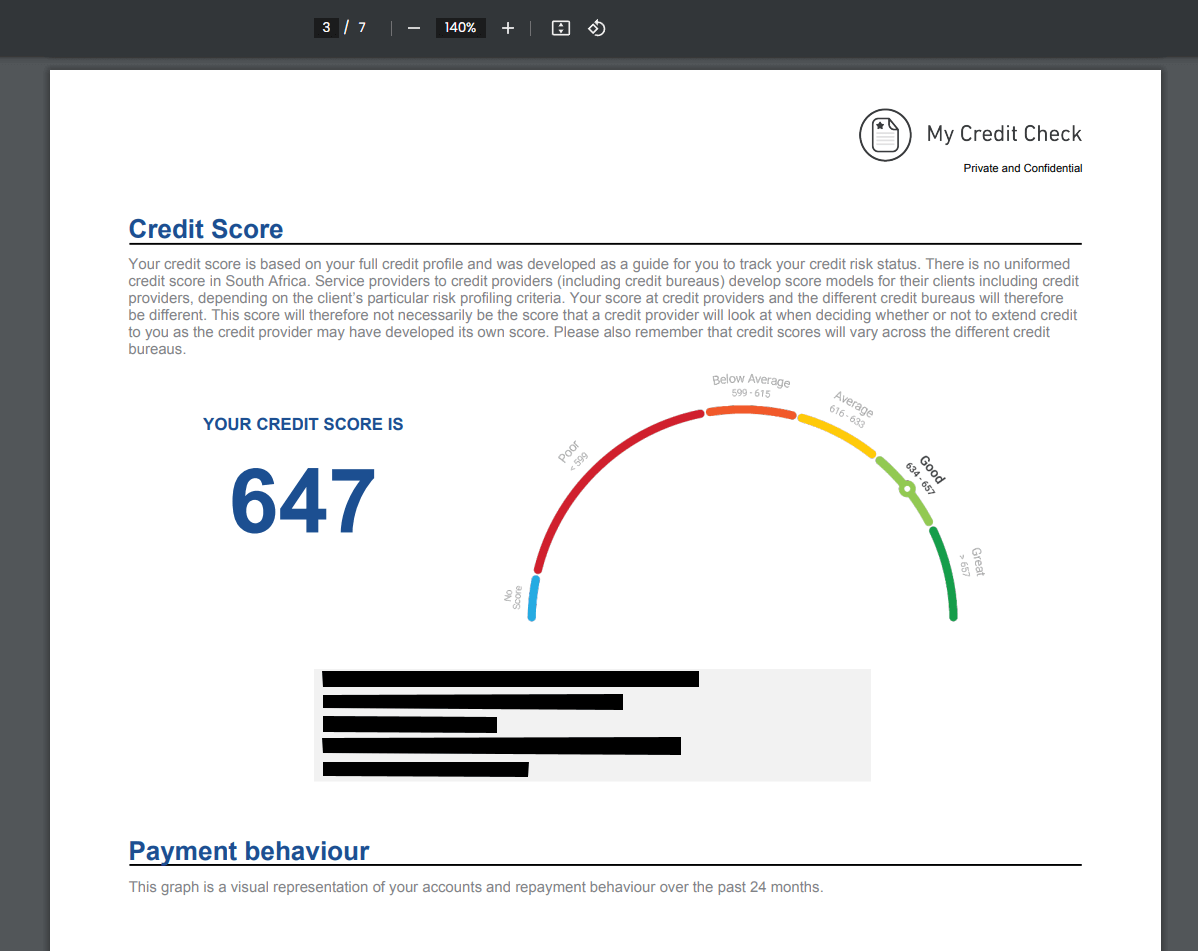

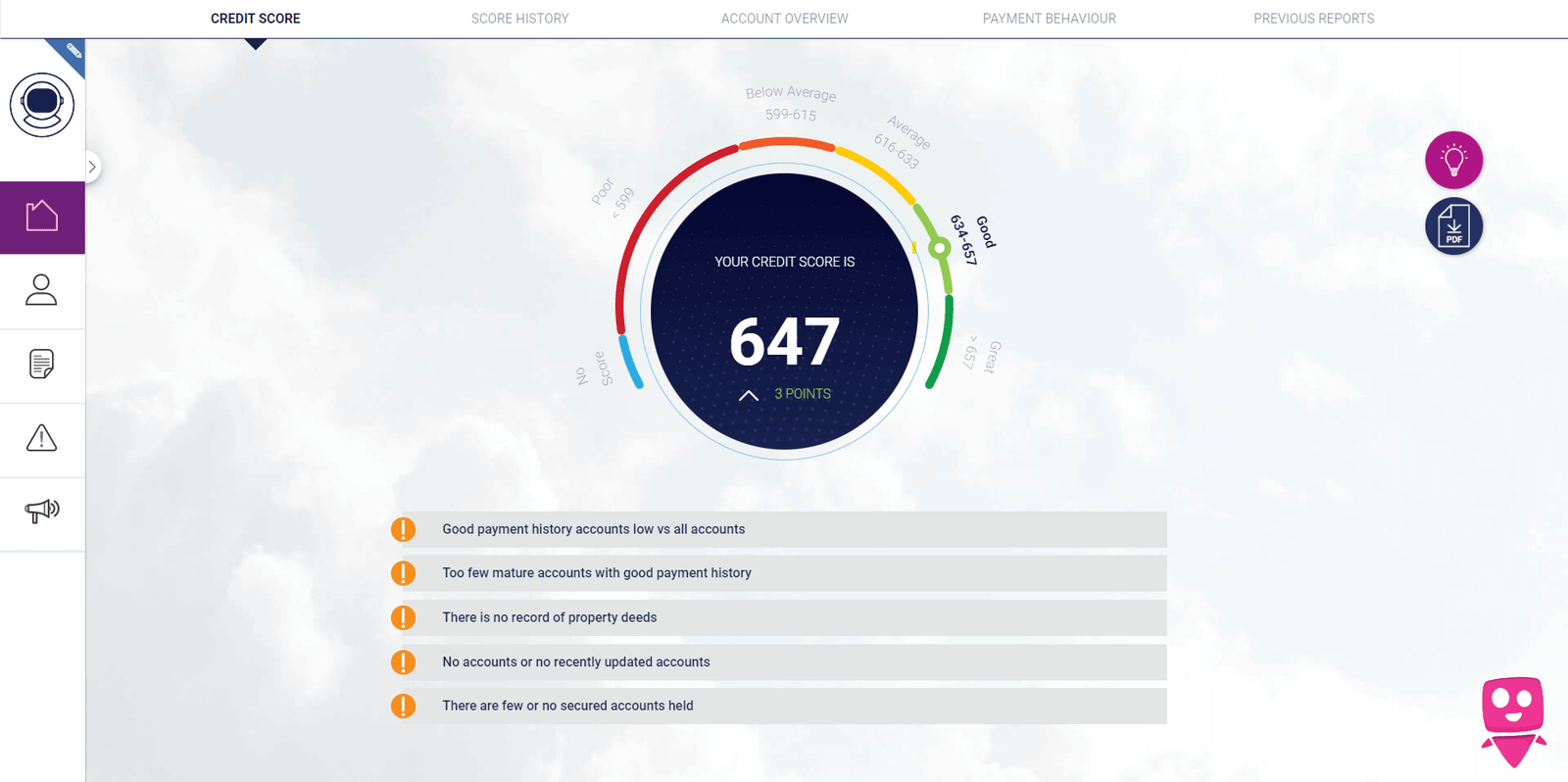

Now that you have an account, you’ll be able to request a PDF, view a dashboard, or both (different credit bureaus offer other options).

Carefully review your report to identify negative information, ‘flags’, or listings. Does the report show a low credit score? Are there missed payments or judgements? These are the things that could reveal whether you have restricted credit access (‘are blacklisted’).

Step 5: Dispute errors

If you find errors or outdated information on your credit report, you can dispute these with the credit bureau. The bureau is then obliged to investigate and correct any inaccuracies.

Make a habit of regularly reviewing your credit report to ensure that it’s accurate and up-to-date.

Here’s a detailed breakdown of how it works with several popular credit bureaus.

How get a credit report from major credit bureaus

Nowadays, it is easy to check if you are ‘blacklisted’ for free online. Here’s how to use Experian and TransUnion to check your credit report

Experian

In 2019, Experian bought Compuscan. Since the acquisition, Experian provides free credit reports and free credit scores on My Credit Check.

TransUnion

With TransUnion, you can create an account to access your TransUnion Credit report for free once a year.

Here’s the link to TransUnion’s annual free credit report.

These credit reports include your credit score, payment behaviour and negative information, including notices, defaults, judgments and debt collections in a simple and easy-to-understand format.

Other platforms that offer similar services:

- ClearScore

- Kudough

- Splendi

- Just Money

Though, since these services are generally incentivised to offer other services, signing up may mean that you’ll receive promotional material or get a sales call offering a service—this isn’t always a bad thing, but it’s worth noting nonetheless.

How to dispute errors on your credit report

According to the National Credit Act (NCA), South African consumers have the right to dispute any factually incorrect information on their credit report and to have the information corrected.

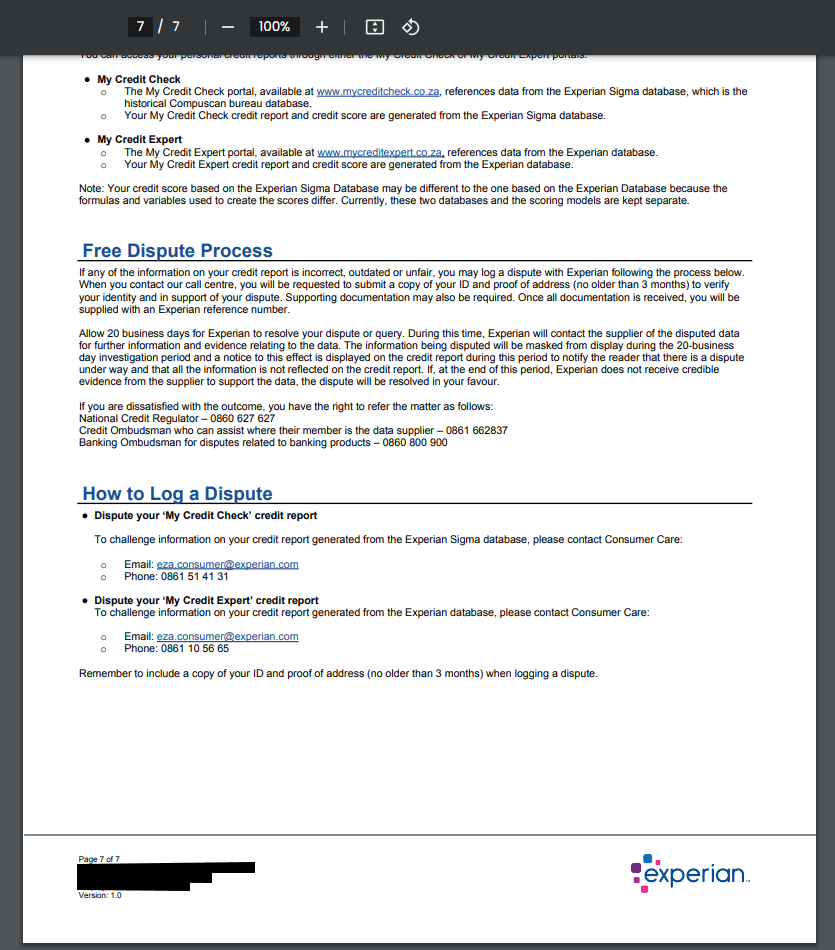

To log a dispute, you could contact the credit bureau or use the feature in your credit portal (if the bureau has one). Check to see if your credit report contains more info about logging a complaint or do a quick web search to get the credit bureaus contact details and reach out directly.

‘My Credit Check’ credit reports tell you how to log a dispute at the bottom of your report.

If you’re unhappy with the outcome of the dispute, then you can refer the matter to the NCR or the relative Ombudsman.

- Banking Ombudsman – 0860 800 900 (for bank account information)

- Credit Ombudsman – 0861 662 837 (for retail and other non-bank information)

- National Credit Regulator – 0860 627 627

How do you get ‘blacklisted’ and how does it appear on a credit report?

In South Africa, when someone demonstrates poor credit behaviour, like missing payments or paying late, it leads to negative listings on their credit report. Having too many negative listings on their credit report effectively ‘blacklists’ a consumer since credit providers use credit reports to assess the consumer’s creditworthiness.

Negative listings may include information such as:

- Missed or late payments — refers to payments that were not made by the agreed monthly repayment date or payments that weren’t made at all (can stay on a report for up to 2 years.)

- Notices — official notices related to debt, such as letters of demand from creditors.

- Debt collection listings — refer to debts that have been handed over to a debt collection agency for recovery (can stay on a report for up to 5 years.)

- Writs of execution — refers to court orders to repay a debt (can stay on a report for up to 10 years.)

- Judgments and repossessions — refers to legal action taken to seize assets, like repossessing a vehicle, to recover outstanding debt (can stay on a report for up to 5 years.)

Having too much debt in relation to their income may also influence someone’s creditworthiness.

Plus, other factors or flags like an active debt review status may also influence someone’s credit access.. However, debt counselling or debt review restricts credit access only during the process as a way to help consumers recover from being over-indebted, which, unlike the points above, is actually a good thing.

📖 Bonus reading:

How do you check someone else’s creditworthiness (‘blacklisted’ status)?

Credit reports are confidential, which means consent is required to check someone’s creditworthiness in South Africa. To check someone else’s creditworthiness, they must provide consent that allows the requesting party to access a report. With consent, a credit report may be requested from- and subsequently shared by a credit bureau.

Here’s how credit providers typically approach this:

- The credit provider gets consent during the application process (for example, in the terms of a loan application).

- The consent forms may be used to request a copy of the counterparty’s credit report from a credit bureau.

- The credit bureau grants access to the credit report information.

This process helps mitigate risk and make informed decisions about granting loans, extending credit, or even entering into a formal relationship like a business partnership.

Final thoughts

Now you know what ‘blacklisting’ is all about, plus how to check whether you have restricted credit access.

Follow the steps to review your credit report, address some of the things that may be impacting your score, dispute errors (if any) — and make a habit of regularly or annually reviewing your credit report.

If your credit score is a little lower than you expect, check out how to build a good credit score in South Africa.

Want to learn more? Keep reading on Everycent.

Are you missing debt payments or paying late?

Check to see if you qualify to reduce the cost of your debt and free up money for other expenses.