Thinking about getting car insurance? Switching insurers? Or just want to compare your premium?

You may have noticed its not that easy to find out how much car insurance costs.

(Without getting a quote)

This post will help. Let’s get started.

How much is car insurance in South Africa?

The cost of car insurance in South Africa typically varies between R310 and R1,450 per month. Lower costs start near R130, and higher costs can go above R2,500+ per month. The cost is influenced by the type of insurance, the car’s value, and other risk factors, such as the driver’s claim history.

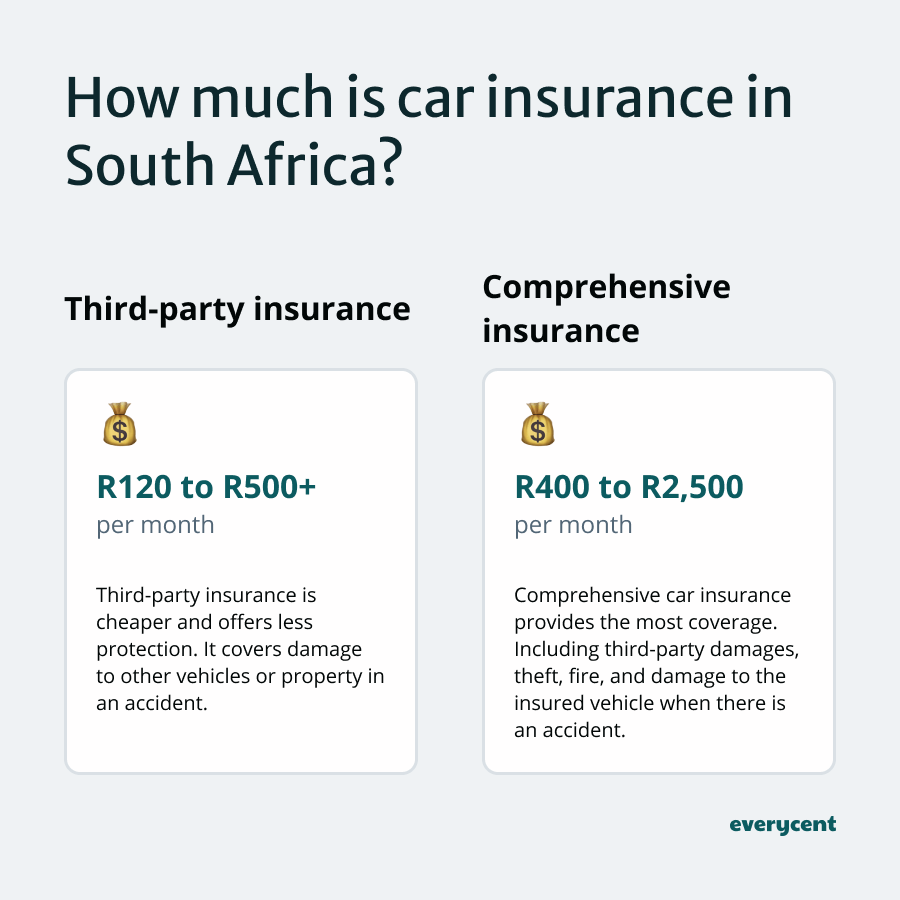

There are two main categories. Third-party insurance, which generally costs less, and comprehensive car insurance, which costs more. But also provides better coverage.

Third-party insurance cost

Third-party insurance can cost between R120 and R500+ per month. Depending on the car’s value and the driver’s risk profile. Third-party insurance is cheaper and offers less protection. It covers damage to other vehicles or property in an accident.

In SA, we also get ‘third-party, fire and theft insurance’, which costs a bit more. But adds extra coverage for things like theft and… yep, you guessed it… fire damage.

📖 Related content: What is third-party insurance (pros, cons, and comparisons)

Comprehensive insurance cost

Comprehensive insurance ranges from R400 to R2,500+ per month. The cost varies based on the car’s make and model, the driver’s risk profile, and the insurance excess fee. Comprehensive car insurance provides the most coverage. Including third-party damages, theft, fire, and damage to the insured vehicle when there is an accident.

(It costs more because it covers more.)

📖 Related content: Comprehensive car insurance—what is it & where to get it…

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

The types of car insurance explained

There are three primary types of car insurance and several variations. The three primary types are comprehensive-, third-party-, and third-party, fire, and theft insurance. Variations include GAP insurance, collision insurance, and add-ons like roadside assistance or towing.

Types of car insurance:

- Third-party insurance

- Third-party, fire and theft insurance

- Comprehensive insurance

Third-party insurance: This is the minimum level of coverage. It covers damage you cause to other vehicles or property in an accident but does not cover damage to your own car.

Third-party, fire and theft insurance: This type of insurance is a middle ground between third-party and comprehensive insurance. It covers damage to other vehicles or property, as well as your own car in case of fire or theft, but not accidental damage to your own car.

Comprehensive insurance: This offers the most coverage. It includes third-party liability and protection against theft, fire, and damage to your own car from an accident, no matter who is at fault.

Average car insurance cost

The average cost of car insurance in South Africa ranges between R310 and R1,450. The cost varies widely depending on the insurance type, vehicle value, driver’s risk profile, and excess. But, since most insured people drive mid-to-upper value cars and opt for comprehensive car insurance this range provides an accurate estimation.

Average car insurance cost:

- Overall = R310 to R1,450

- Comprehensive = R400 to R2,500

- Third-party = R120 to R500

Remember, these are estimates. The math is based on research and assumptions. It’s the best we can do, but it should give you a good idea of where your premium falls.

If you want to work out your own estimates—try this…

Struggling to pay your debt bills?

How to estimate the cost of a car’s insurance premium

To estimate an annual and monthly car insurance premium based on vehicle value and risk, follow these steps:

- Calculate the base premium: Determine the initial cost based on the vehicle’s value.

- Adjust for risk profile: Modify the base premium based on personal risk factors.

- Calculate monthly premium: Divide the annual premium by 12 for the monthly cost.

Rate and risk factors explained

- Rate: The rate is a percentage value set by the insurer. It is typically 5% to 10%, based on the car’s value.

- Risk factor: A decimal or percentage value assigned based on things like the driver’s claim history, age, driving history, and location. Usually expressed as a percentage (e.g., 20% or 0.2).

Formulas for calculating a car’s insurance premium:

1. Base Premium

Start by calculating the base premium by multiplying the vehicle value with the rate. Since most insurers don’t advertise their rate publicly, you may have to guess or make one up.

Vehicle Value × Rate = Base Premium

For example, if your car is valued at R200,000 and the rate is 5%:

Example: R200,000 × 0.05 = R10,000 base premium per year

2. Adjusted Premium

Next, we’ll multiply the base premium with the risk factor. Again, you don’t the risk factor real insurers will use. Just guess how risky insurers may see you as. Then assign a value between 0.1 (low-risk) to 0.4 (high-risk)

Base Premium × (1 + Risk Factor) = Adjusted Premium

For our example, we’ll carry over the base premium of R10,000 and assume a risk factor of 0.1 (10%):

Example continued: R10,000 × (1+0.1) = R11,000 adjusted premium per year

3. Monthly Premium

Lastly, we’ll calculate the monthly cost. This one is easy. There are 12 months in a year. So, divide the annual adjusted premium by 12.

Monthly Premium = Adjusted Premium ÷ 12

Example continued further: R11,000 ÷ 12 ≈ R917 Monthly Premium

This next part can help you figure out how insurers determine ‘risky’. They look at these factors.

Factors that impact the cost of car insurance in South Africa

- Driver’s age and experience: Younger, less experienced drivers usually pay more.

- Vehicle type and value: Expensive or high-performance cars generally cost more to insure.

- Location: Areas with high crime rates or lots of accidents, cost more to cover.

- Driving and claims history: A history of accidents or frequent claims raises the insurer’s risk, and therefore the cost.

- Usage: How often the car drives and the purpose of its trips could also affect premiums.

- Security features: Cars with advanced security systems might have lower premiums.

- Car modifications tend to increase insurance premiums since they affect the risk and cost of repairs.

Insurers look at all these factors. Each insurer has its own risk criteria. They assign a risk profile or risk rate based on these factors, which influences the overall cost of the insurance premium.

📖 Related content:

- How to claim on insurance

- Tyre insurance in South Africa

- What credit score is required to buy a car in South Africa?

- What is a good credit score in South Africa?

In summary

There you have it. Here are the big takeaways…

- The cost varies A LOT.

- Factors like insurance type, the value of the vehicle, and the driver’s risk profile influence the cost.

- According to research and some math, we estimate most cars cost from R310 to R1,450 to insure.

If you feel like you’re paying too much, why not shop around? Get a few quotes to compare prices. Switching can save a lot of money every month and year. It’s worth taking a look around.

Want to learn more? Keep reading on Everycent.