We all know that insurance matters. We also know that insurance can be pricey.

What you may not know is how different types of insurance compare and what the cheapest insurance covers.

That’s what we’re checking out today. We’re going deep on the most affordable insurance (generally)—third-party insurance.

Here we go.

What is third-party insurance?

Third-party insurance is a type of insurance that covers the cost of damage to other vehicles or property (known as a ‘third-party’) in an accident. For example, it covers the damage to someone else’s car. This type of insurance is generally more affordable than other options that provide more coverage, like third-party, fire, and theft insurance or comprehensive insurance.

That sums it up. But we can go deeper…

What does third-party insurance cover?

Third-party insurance covers damage to other vehicles or property (things like buildings or traffic lights) in an accident. On the other hand, it does not cover any of the insured person’s personal damage.

Third-party insurance covers:

- Damage to another vehicle. For example, someone else’s car.

- Damage to another person’s property. For example, a wall or roadside barrier.

Again, third-party insurance does not cover personal damage. It only covers the damage to third parties (or other people). If someone gets hurt, the Road Accident Fund (RAF) in South Africa can cover medical expenses.

Insurance policyholders can also cover things like fire or theft with an extended policy known as ‘third-party, fire, and theft insurance’.

📖 Related content:

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Third-party, fire, and theft insurance

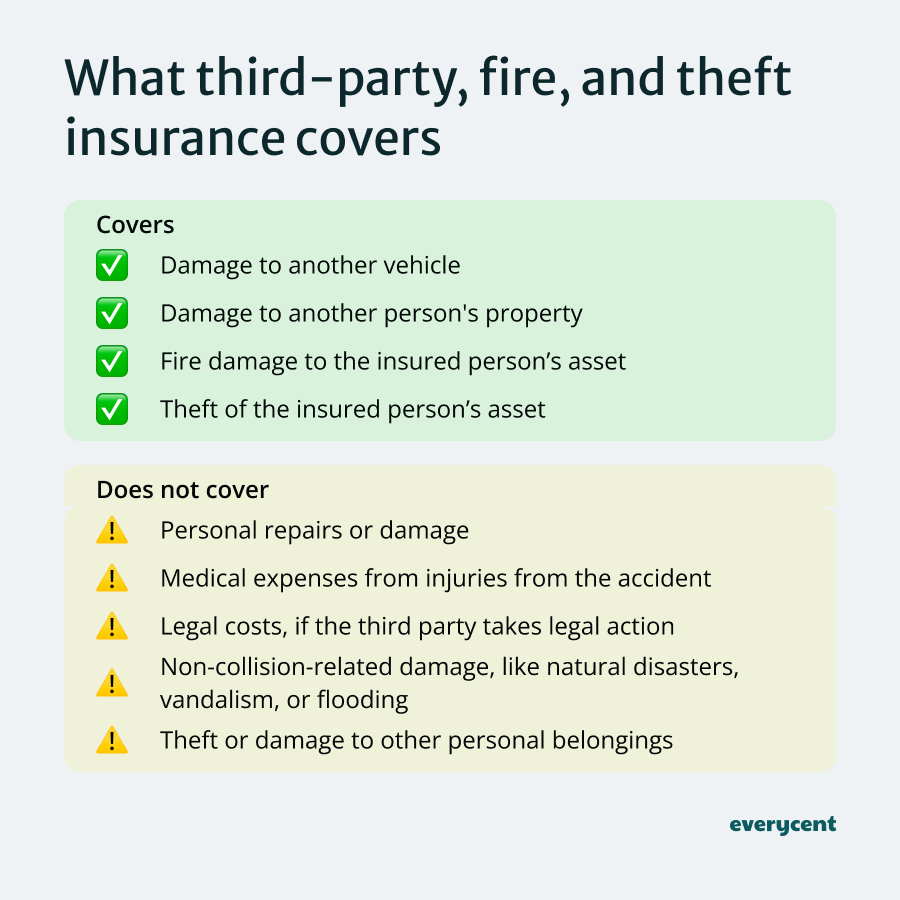

Third-party, fire, and theft insurance is an extended version of third-party insurance. In addition to third-party damage or injury, it covers fire damage and theft. Where fire damage and theft cover the insurance holder personally. For example, it pays out when someone steals the insurance holder’s car.

- Third-party covers damage to other people’s property or vehicles in an accident.

- Fire covers damage to the insured person’s car caused by fire. Including accidental and criminal fire damage.

- Theft covers the cost of replacing something if it’s stolen or the cost of repairing damage from attempted theft.

Here’s an example.

Example of third-party insurance coverage:

Sam is driving home from work when she accidentally drives into the car in front of her at a stoplight. The other driver’s bumper is damaged and needs repairs.

Luckily, Sam has third-party insurance, so her insurer will cover the costs of fixing the other driver’s car. But, because Sam only has third-party insurance, she’ll need to pay for the damage to her own car herself.

What is not covered?

Third-party insurance and third-party, fire, and theft insurance do not cover personal damages in an accident. For example, it does not cover things like car repairs for the insurance holder’s own car. The same applies to any medical expenses from personal injuries.

What third-party, fire, and theft insurance doesn’t cover:

- Repairs or damage to the insurance holder’s own property or vehicle.

- Medical expenses from injuries from the accident.

- Legal costs. For example, if the third party takes legal action.

- Non-collision-related damage. For example, natural disasters, vandalism, or flooding.

- Other personal belongings. For example, personal items stolen from a car or items damaged in an accident.

Advantages and disadvantages of third-party, fire, and theft insurance

Third-party, fire, and theft insurance has several advantages and disadvantages. The biggest pro is its price compared to comprehensive insurance. It also provides some peace of mind and protection against certain risks. The disadvantages include limited coverage and greater risk.

Here are the pros and cons of third-party, fire, and theft insurance:

Advantages:

- More affordable than comprehensive coverage

- Protects against several major risks like fire, theft, and damage to another person’s property.

Disadvantages:

- Offers limited cover compared to comprehensive insurance.

- Riskier because of coverage gaps like medical, natural disasters, and personal damage

Struggling to pay your debt bills?

Third-party, fire, and theft insurance vs comprehensive insurance

Third-party fire and theft insurance adds fire and theft coverage to the fundamental coverage that only third-party insurance covers. Whereas comprehensive insurance covers these risks and more. Including personal damage and natural disasters.

Here’s how both types of insurance compare:

| Feature | Third-party, fire, and theft insurance | Comprehensive insurance |

| Third-party damage | ✅ Yes | ✅ Yes |

| Damage to insurance holder’s vehicle (accident) | ❌ No | ✅ Yes |

| Fire damage to insurance holder’s vehicle | ✅ Yes | ✅ Yes |

| Theft of insurance holder’s vehicle | ✅ Yes | ✅ Yes |

| Own vehicle damage (other causes) | ❌ No | ✅ Yes |

| Medical expenses | ❌ No | ⚠️ Add-on |

📖 Related content: What is an insurance excess fee? (and how to use it wisely)

In summary

Any insurance is better than no insurance.

Third-party insurance is generally the most affordable. Next up is third-party, fire, and theft insurance. Which costs and covers a little more. After that, there’s comprehensive insurance. Which costs and covers the most.

Again, having third-party insurance is better than not having any. But, it could expose you to several risks. Including the cost of any personal damage. Like repairing your own car after an accident.

Weigh the pros and cons, and if necessary, consider adjusting your budget so you can afford a more comprehensive option. It may protect you from a life-changing expense in the future.

Want to learn more? Keep reading on Everycent.