Debt review is the go-to for South Africans who can no longer keep up with their debt.

It’s a regulated way to get back on track and repay existing debts for anyone with too much outstanding debt.

Sounds good so far. But what exactly is it, and is it a good idea to apply?

Here’s what you need to know.

What does it mean to be under debt review?

When a person is under debt review, it means they’re going through a formal process that helps them to manage their debt.

What happens is, a debt counsellor reviews their financial situation and negotiates with creditors to create a restructured payment plan with terms that suit the person under debt review’s budget and affordability.

Often this means a lower monthly payment over an adjusted term.

Here’s an example:

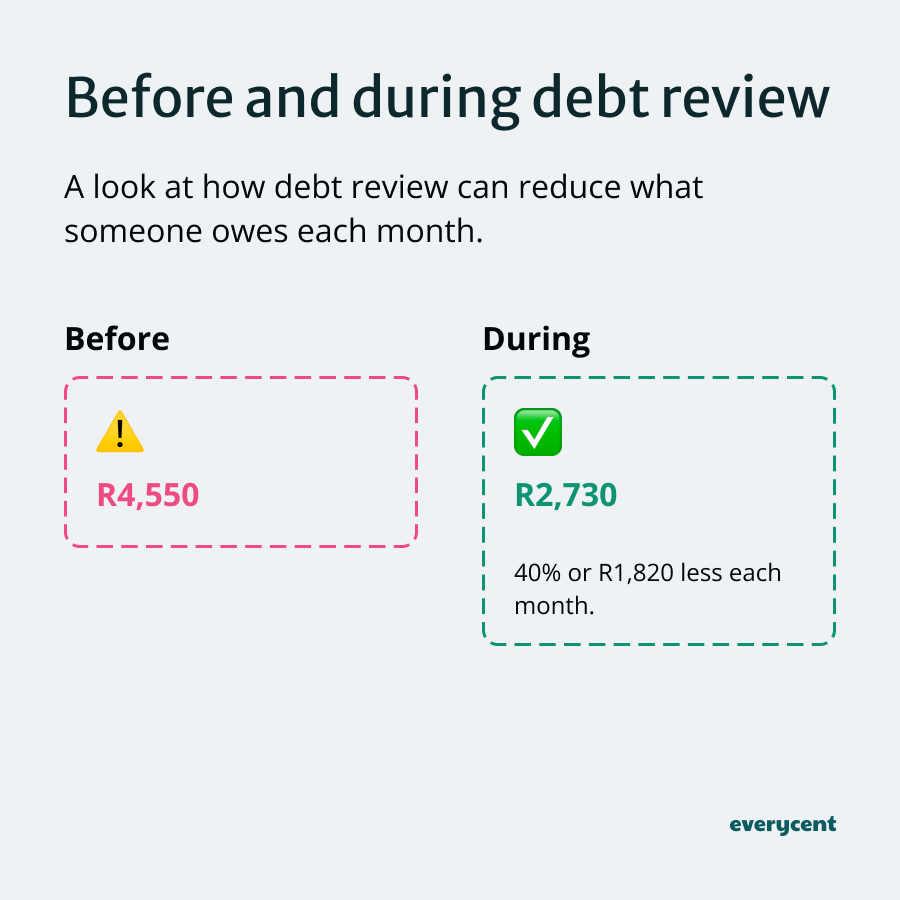

Let’s look at Ashley’s case, as an example. As a teacher in Johannesburg Ashley faces a debt crisis due to unexpected medical bills and rising living costs. Overwhelmed by credit card and loan repayments, she opts for debt review.

Her debt counsellor works out a deal with her creditors to lower her monthly payments, so that the amount fits her budget Everyone accepts and Ashley can continue to pay her debt despite her unforeseen debt crisis.

What Ashley owes each month goes from a total of R4,550 per month, down to R2,730 each month.

Everyone wins.

The truth about debt review

Debt review can be a lifesaver, but it’s important to know what it involves. The process restricts applicants from taking on more debt (no new loans) until they repay their existing, restructured debts and are no-longer legally considered over-indebted.

It’s a legal process under the National Credit Act, which means it’s regulated and safe.

So, who can apply?

Who qualifies for debt review?

Debt review isn’t for everyone. It’s meant for those who genuinely can’t meet their debt obligations.

To qualify for debt review, the applicant must:

- Must be deemed over-indebted: It’s important that expenses and debt payments exceed income, pricing that the applicant can’t comfortably repay their debt.

- Have a steady Income: A regular income is necessary to make consistent payments under the new plan.

- Must be a South African citizen (or resident): The process is only for South African consumers.

- May not already be handed over to an attorney: It’s too late to apply when creditors are already within their rights to pursue legal action.

- Must be old enough to apply: Applicants must be 18 years old or older.

Remember, debt review isn’t a shortcut or a universal solution. It’s a structured, personalised process for South Africans who are in trouble and need assistance

It helps them manage debt responsibly and work towards financial freedom.

Here’s how it works.

How does debt review work?

The way debt review works is, a person who can’t afford to repay their total monthly debt applies for debt review so that they may get a restructured (lower) repayment plan, have their debt consolidated, and benefit from legal protection. Debt review is a legal process that’s regulated by the National Credit Regulator (NCR) under the National Credit Act in South Africa.

Debt review gives debtors a way to repay their debt and get out of trouble, and it gives creditors a way to get the money that they’re owed without having to repossess the borrower’s belongings. It works because it’s a legal process, and both sides have to play their part.

Here are the steps.

Debt review process step-by-step

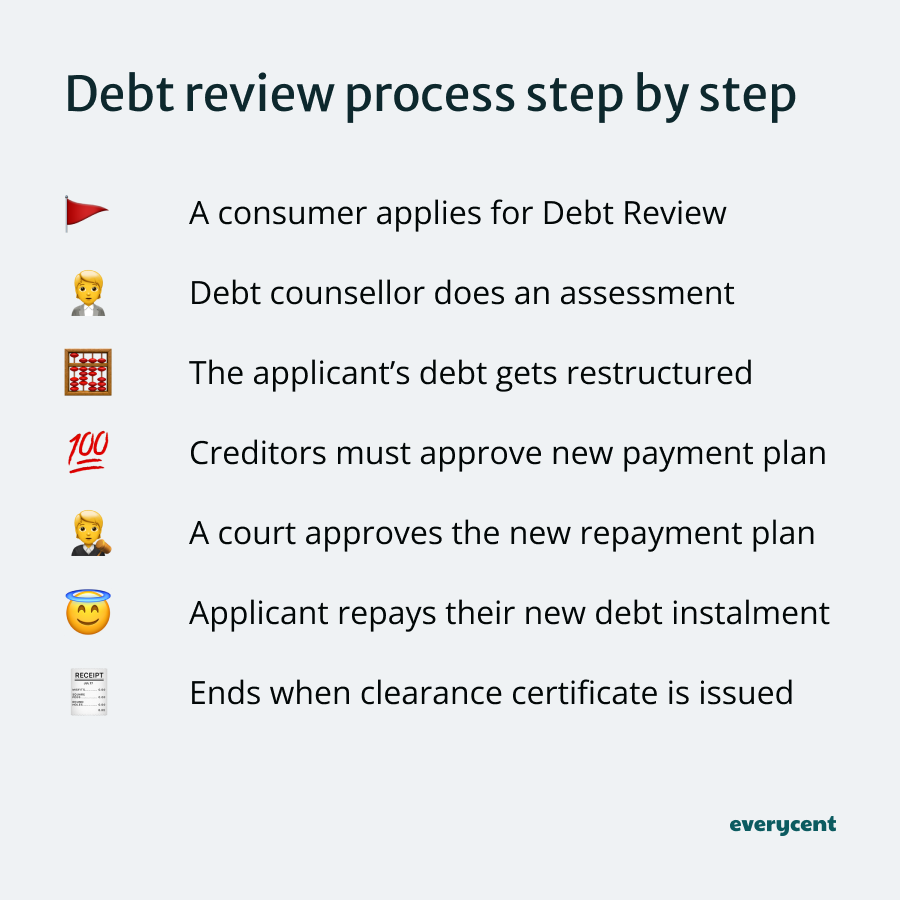

The debt review process involves these steps:

- A consumer applies for Debt Review: It starts with your application to a registered debt counsellor. This step legally protects you against actions from creditors for the debts being reviewed.

- The debt counsellor assesses their financial situation: A counsellor evaluates your financial status, including income, essential living expenses, and debts. This assessment determines if you’re over-indebted and eligible for debt review.

- The applicant’s debt gets restructured: If you’re over-indebted, the counsellor creates a revised budget to cover living costs and offer fair, affordable debt repayments.

- Creditors approve the restructured payment plan: Your counsellor negotiates with creditors for reduced payments and extended terms. This proposal aims to make your debt more manageable.

- A court order approves the new repayment plan: The court approves the restructured payment plan, legally binding the new arrangement and preventing creditors from asset claims or defaults for non-payment.

- The applicant repays their new monthly debt instalment: With the court order, you start the new payment plan, usually through a Payment Distribution Agency, which allocates funds to your creditors.

- The debt counsellor issues a clearance certificate and ends the process: After completing all payments, you receive a clearance certificate, lifting credit restrictions and clearing your credit record of the debt review indicator.

This process ensures fairness and transparency, balancing consumer and creditor interests. It’s a systematic approach for South Africans to regain financial stability.

📖 Further reading: Advantages & disadvantages of debt counselling (debt review)

How much does debt review cost?

Debt review costs are included in the restructured repayment plan. Consumers pay a restructuring fee and legal fees at the start. Then, continue to make monthly debt payments, which include an aftercare fee of up to 5% or a maximum of R450, which goes to the Debt Counsellor each month.

For example, if a consumer’s monthly debt payment is R5000, the aftercare fee would be R250, and the restructuring would be R5,000.

Let’s take a closer look at the fees.

Debt review fees

Debt review costs are regulated by the National Credit Regulator (NCR) to ensure fairness.

We have a detailed post that reviews the cost of debt counselling (debt review) if you want to know more, but these are the ones you should know of.

Debt review fees in South Africa:

- Application Fee: R50 for completing and submitting the application form, payable upfront.

- Administration Fee: R300 per debt counselling application, also payable upfront.

- Restructuring Fee: For an individual applicant, the fee is either the distributable amount or a maximum of R8,000, whichever is less. For couples married in Community of Property, it’s the distributable amount or a maximum of R9,000, whichever is less.

- Monthly Aftercare Fee: This is 5% of the distributable amount or a maximum of R450, whichever is less, payable monthly from the third month onward as long as aftercare services are provided.

- Legal Fees: These vary and should be agreed upon upfront with the attorney. They are only payable under certain conditions, like creditor rejection of the repayment plan or the need for a court application.

These fees are part of the restructured payment plan, so there are no upfront costs. Plus, all fees are regulated by the NCR—so debt counsellors aren’t allowed to fiddle with the cost.

By now, you should have a good idea of what debt review entails, but you may have a few more questions.

Here’s what everyone wants to know.

Frequently asked questions

How long does debt review last? The length of debt review varies, typically ranging from 36 to 60 months. It’s flexible and based on each person’s debt amount and repayment ability.

How long does debt review stay on your name? Debt review stays on the applicant’s name for the duration of the process. Once they’re done and get their clearance certificate, the debt review status is permanently removed (usually within days to a week after getting the certificate).

How to check if your name is under debt review: To verify debt review status, ask your Debt Counsellor, request a credit report and check for a debt review flag or status indicator, or contact the National Credit Regulator (NCR).

Is debt review a good idea?

Whether debt review is a good idea depends on your unique financial situation. Let’s look at when it might be beneficial and when it might not be the best choice.

Debt review could be right for you if:

- You’re overwhelmed by debt: If debt payments exceed your income and you’re struggling financially, then debt review can reduce your debt to make it affordable.

- You need protection from creditors: When facing legal action or constant harassment from creditors, debt review can provide legal protection. This includes protection against legal processes, like vehicle repossession.

- You want structured financial discipline: Debt review offers a clear way to get out of debt. It makes debt more affordable and easier to repay with one simple payment.

However, debt review might not be ideal if:

- Your financial problems are temporary: There are better ways to solve short-term financial issues that don’t require restructuring debts and undergoing a binding legal process.

- You can handle debt on your own: If you can afford your debt, negotiate with creditors or consolidate your debt without formal intervention— debt review may be necessary.

- You plan to incur more debt: Debt review restricts credit access and prevents applicants from borrowing more money (unless the debt counsellor permits it).

📖 Further reading: Debt counselling vs review vs consolidation (which is best?)

In Summary

Debt review is a significant decision with long-term effects.

It’s a powerful tool for anyone with too much debt who needs a way to recover.

Remember, it’s not for everyone, and it’s not a shortcut.

Assess your financial condition, future credit requirements, and other debt management options before deciding whether debt review is right for you. Now you know what to expect.

Want to learn more? Keep reading on Everycent.