A good credit score can make your life easier.

…and it can save you A LOT of money. That’s right. Several thousand Rand on each loan.

The question is, what’s considered a good credit score in South Africa?

And the short answer is 670 or above 670. But there’s more to it.

Check this out.

What is a good credit score in South Africa?

A good credit score in South Africa is generally considered to be 670 or above. Scores range from 0 – 999, and most financial services providers report 670 – 749 as a good credit score. While 750 – 999 is excellent. A credit score in these ranges means lenders view the borrower as lower-risk. Which can lead to better interest rates and loan terms.

Here are the ranges SA’s two biggest credit bureaus report as ‘good’:

- TransUnion: 681–766

- Experian: 660–750

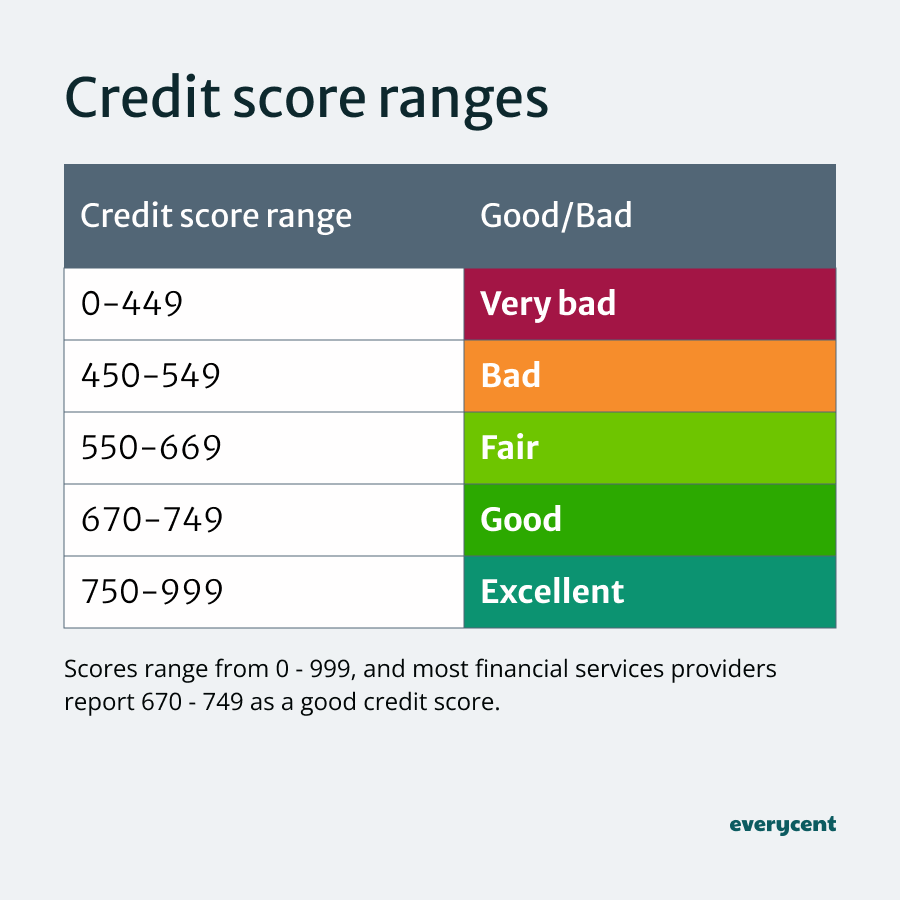

Credit score ranges

- 0-449 = Very bad

- 450-549 = Bad

- 550-669 = Fair

- 670-749 = Good

- 750-999 = Excellent

0-449 = Very bad: This range signals a very high risk of default (not paying). Most people in this range struggle to get approved for any form of credit.

450-549 = Bad: Still risky for banks and other lenders. This range indicates a high risk of late payment or defaulting. It will still be hard to get unsecured credit, and it’ll probably be expensive.

550-669 = Fair: Now, we’re at a moderate (or medium) risk level. Getting approved gets easier, but interest rates remain high, and loan terms remain strict.

670-749 = Good: Most lenders consider people in this range low-risk. This means getting credit should be easy, and loan terms start to get a lot better.

750-999 = Excellent: And finally, the best of the best. These are people who pay on time, have a good credit history, have secured assets, and keep it up for years. They’re the lowest-risk borrowers. As such, they get great terms and low interest rates.

Okay, those are the ranges. Where do you fall?

If you don’t know, here’s how you can easily check and track your credit score.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

How to check your credit score in South Africa

South Africans can quickly check their credit score using either an online platform or app, banking apps, or on credit bureau websites. Online platforms include Experian’s My Credit Check and ClearScore. As for banking apps, most banks offer a built-in feature nowadays. And lastly, credit bureau websites like TransUnion’s website allows South Africans to download detailed reports

Here are three ways to check your credit score:

- Online platforms and apps

- Banking apps

- Credit bureau websites

Online platforms and apps: That’s right. There’s an app for it. Experian is one of the biggest credit bureaus in South Africa, and they have an app called My Credit Check. There are lots of other apps you can use. Though, these other apps tend to use data from credit bureaus like Experian or TransUnion anyway.

Popular apps = My Credit Check and ClearScore.

Banking apps: Many South African banks now include credit score monitoring in their mobile apps. And in most cases—it’s free.

Popular banks = Capitec, FNB, and Absa.

Credit bureau websites: If you prefer TransUnion, then you can get a free credit report once a year from the company’s website. Here’s the link.

Now, you know how to check it.

The next step would be learning how to build a good credit score. 👈 Check out this article.

Let’s end with a couple of FAQs.

Struggling to pay your debt bills?

Frequently asked questions

What is a good credit score to buy a car?

670+

A credit score of 670 or higher is a good score for buying a car. Lower scores around 600 may also be approved depending on the specific lender’s criteria and circumstances surrounding the car’s purchase. But 670 is high enough to qualify for lower interest rates which will help reduce the cost of the car.

📖 Check out: What credit score is required to buy a car in South Africa?

What is a good credit score to buy a house?

670+

In South Africa, a credit score of 670 or more is a good credit score range for buying a house. Scores above 670 will get better terms. Which will reduce the cost of interest and allow you to save money while paying off your home loan or bond.

A credit score of around 640 is widely regarded as the minimum credit score required to buy a house using a home loan. Some applicants may get approved with scores between 600 – 640, while scores of 640+ have a strong chance of approval.

📖 Check out: Want to buy a house in SA? Here’s the credit score you need

In summary

A good credit score unlocks more opportunities, and it does so at a lower cost.

One or two percentage points of interest make a huge difference.

Build your credit score and stay on top of your debt and accounts to make sure your score stays strong. It’s the right thing to do financially.

Keep reading on Everycent to learn more about money and finances in South Africa.