Time to trade in your car?

There are two reasons why you might want to trade in your car before it’s paid off:

- You want to upgrade or change cars.

- You can’t afford the car anymore.

It’s a little more complicated when the car isn’t paid off. But we’ll make it easy for you. This post shares everything you need and clearly explains the process.

Sidenote: If you’re looking for more info specifically on cars you can’t afford, check out these posts as well.

📖 Bonus reading:

- 7 things you can do if you can’t afford your car payment

- How to sell a financed car without paying it off

Here we go.

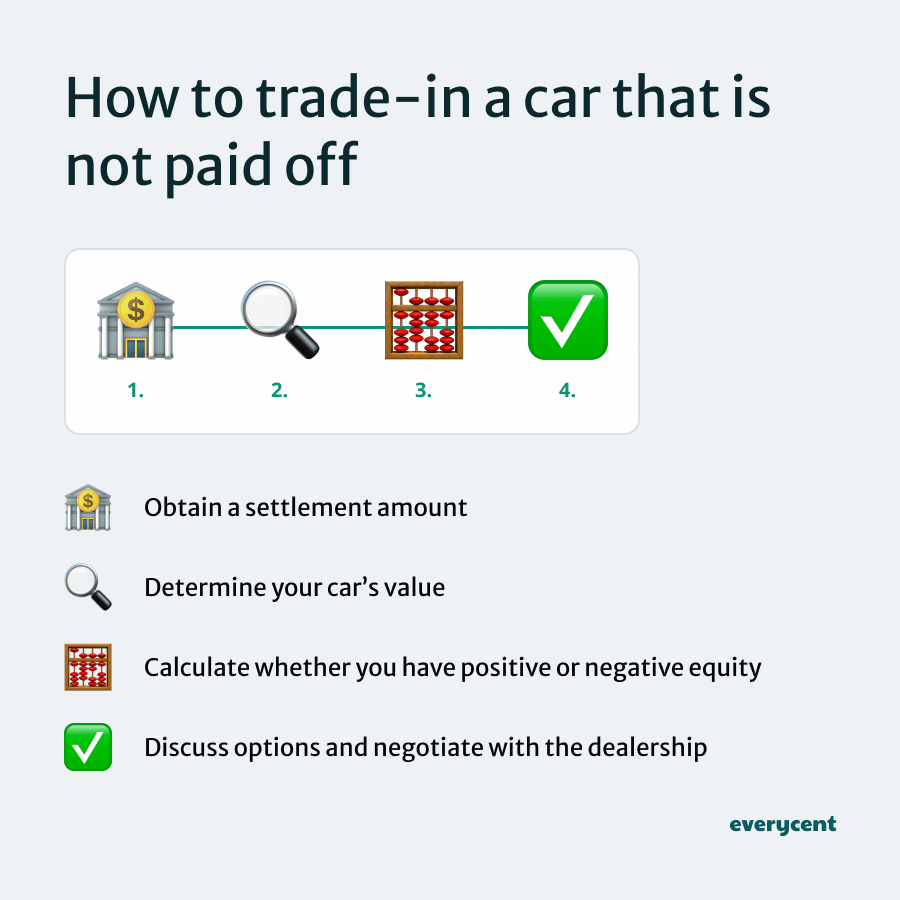

How to trade in a car that is not paid off in South Africa

In South Africa, to trade in a financed car that isn’t paid off, the person who is still repaying the finance agreement must communicate with the lender to get a settlement amount. Then, determine the car’s value and compare it to the settlement value to determine whether they’ll receive credit toward the new car or have to pay in to settle the outstanding debt.

This means trading in a car that you haven’t fully paid off involves a few extra steps compared to a standard trade-in.

Nevertheless, it’s doable.

Firstly, what is a vehicle trade-in? Trading in a vehicle is a popular way to upgrade or switch cars by ‘trading in’ your current vehicle for credit toward the new vehicle.

Most car owners prefer trading in because it is easier than selling privately, which can be a hassle.

Here’s how it works for a financed car.

Are you struggling to afford your car payments?

Try a quick 22-second online assessment to see if you qualify to reduce your monthly car and debt repayments.

How do trade-ins work (when your car isn’t paid off)?

You can trade in a car that is still under finance by getting a settlement letter from the finance company or dealership before getting your car’s trade-in value assessed (known as an appraisal). The car’s valuation will calculate whether the car is worth more or less than the settlement amount and determine whether you’ll get credit toward a new car or must pay in to settle the loan.

Factors like the car’s make, model, year, mileage, condition, and current market demand influence how much the car is worth.

(These factors decide your fate.)

If the trade-in value of the car is higher than the outstanding balance: The dealership will use part of the trade-in value to pay off the loan. The remaining balance (positive equity) can then be used as a down payment towards your next car.

If the trade-in value of the car is less than the outstanding balance: You can either pay the difference out of pocket to clear the loan or roll the remaining debt (negative equity) into the loan of your next car, if the lender allows it.

In the second scenario, you’d be financing the price of the new car plus the negative equity from your old car.

Here are two simple examples:

Example of positive equity: (R200,000 car value) – (R100,000 settlement amount) = R100,000 positive equity (that can be credited toward a new car.)

Example of negative equity or shortfall: (R100,000 car value) – (R150,000 settlement amount) = – R50,000 negative equity or shortfall that needs to be settled.

Next, we’ll share all of the documents you’d need to trade in your vehicle. Then, we’ll go over the process step-by-step.

Stick with us. Here are the docs.

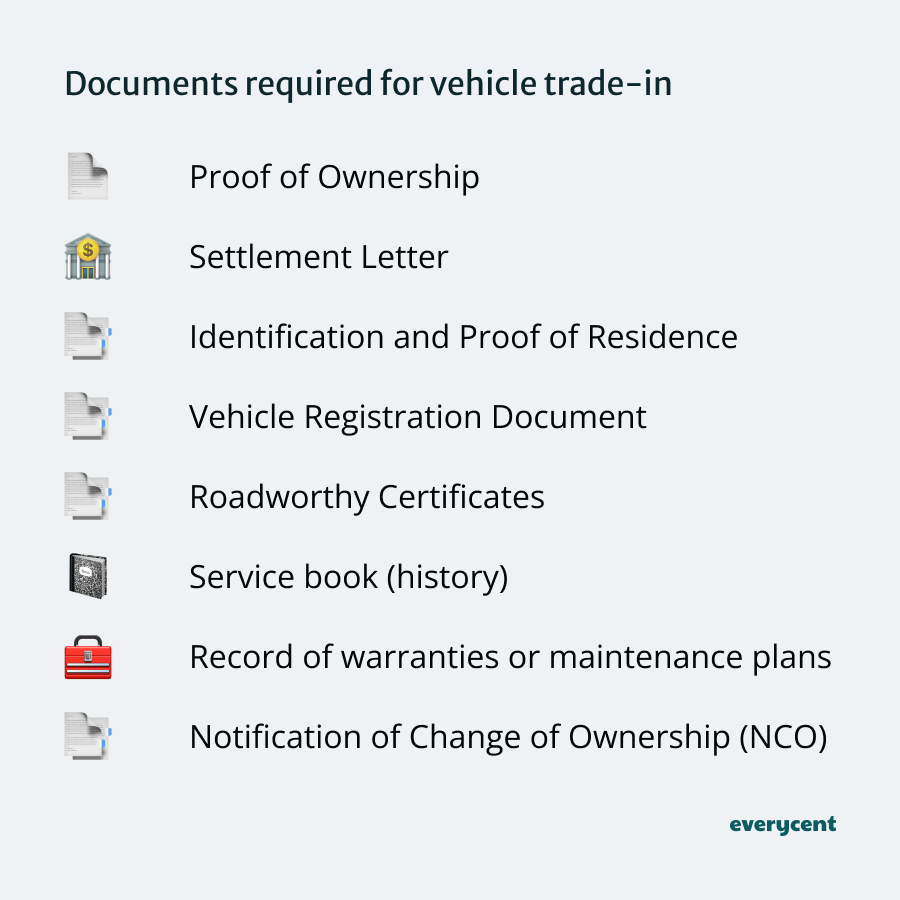

Documents required for vehicle trade-ins

For a smooth trade-in process, prepare the following documents:

- Proof of Ownership: Confirms you legally own the vehicle.

- Settlement Letter from the finance company: Since the car is financed, this from the credit provider shows the remaining vehicle loan balance.

- Identification and Proof of Residence: Needed for the legal transfer of ownership and finance agreements.

- Vehicle Registration Document: Verifies the vehicle is registered in your name.

- Roadworthy Certificates: Boost the trade-in value by showing your car has been well-maintained.

- Service book (history): Provides a detailed record of all the service checks and maintenance work the car has undergone. This highlights the car’s condition and reliability, which can boost its value.

- Record of existing warranty, service, and maintenance plans: Indicates any ongoing coverage or prepaid services that can be transferred to the new owner, adding value to the car.

- Notification of Change of Ownership (NCO): The official document that must be submitted to the Department of Transport to notify them that the vehicle will have a new owner.

Preparing these documents in advance can streamline the trade-in process and potentially boost the car’s perceived value.

Now, these are the steps in the trade-in process.

Are you struggling to afford your car payments?

The trade-in process for a financed car (that’s not paid off)

- Obtain a settlement amount

- Determine your car’s value

- Calculate whether you have positive or negative equity

- Discuss options with the dealership

- Negotiate the deal

- Obtain a settlement amount: First, reach out to your finance company for a settlement letter. This document shows your vehicle’s current payoff amount, as required by the National Credit Act 34 of 2005. It ensures your agreement is transparent and legally compliant.

- Determine your car’s value: Next, have your car appraised at a dealership or by an independent evaluator. This helps you understand how your car’s market value stacks up against the settlement amount. Initially, you could estimate the value using online tools like Auto Trader and AA’s car valuation estimates.

- Calculate whether you have positive or negative equity: Subtract the settlement amount from your car’s trade-in value to find out your equity. If you have positive equity, you can use it [as credit] toward your next vehicle. If it’s negative, you’ll need to cover that shortfall (pay the outstanding balance).

- Discuss options with the dealership: If there’s a shortfall, talk to the dealership about rolling the negative equity into your new car’s financing. But remember, this could mean higher monthly payments for your new loan or a longer repayment period to accommodate the additional cost.

- Negotiate the best deal: Work on negotiating the best deal for both your trade-in and the purchase of your new car. Treat these negotiations separately to maximise value from each. There’s almost always room for some negotiation, which can help you agree on better financial terms or lower costs.

In summary

The most important thing to consider when you trade in a financed car is your equity and how it impacts the trade-in.

A positive balance will offset the cost of your new purchase, while a negative balance will add to the cost.

Keep your financial goals and means in mind, do the maths and decide what is best for your situation.

Want to learn more? Keep reading on Everycent.