Let’s face it. Spending a couple million out of pocket isn’t exactly doable for most of us…

So how does anyone afford to buy a house?

The answer; home loans.

Find out how to qualify for a home loan, how much you need to earn, and how to save a bit of cash when you buy your home.

Let’s get into it.

How to qualify for a home loan

To qualify for a home loan, applicants need a stable income, a healthy credit score, and a deposit (typically 10-20%). Banks do an affordability assessment based on income vs expenses, and review every applicant’s creditworthiness.

This way, banks can calculate whether home loan applicants can afford the monthly repayments. Meeting these criteria improves your chances but doesn’t guarantee approval.

Home loan qualifying criteria

Banks look at a couple of things during their assessment. Including the applicant’s income, expenses, credit score, debt-to-income ratio, the loan amount, and the deposit.

Home loan qualifying criteria:

- Stable income and employment history

- Balanced expenses and affordability

- A good credit score

- Deposit size

- Manageable debt-to-income ratio

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Stable income and employment history: Banks want to see proof of stable, consistent income. They generally look at bank statements and payslips, but may review other docs when someone is self-employed, for example.

Balanced expenses and affordability: Lenders look at monthly living costs such as rent, utilities, insurance, debt repayments, and other essential expenses. They want to see that the income can manage the existing expenses and handle the new repayment. This evaluation is conducted as part of the affordability check required under the National Credit Act.

A good credit score: Lenders check applicants’ credit scores to check how they manage debt. Defaults, judgements, and other negative listings present more risk to lenders, which could lead to rejection or higher interest rates to balance the risk.

Deposit size: Larger deposits offset the size of the home loan and balance and make repayments more affordable. A deposit that adds up to 10% of the home’s price makes a big difference. The more you can afford to deposit, the better.

Manageable debt-to-income ratio: Banks calculate the proportion of income dedicated to debt repayments to determine the applicant’s debt-to-income. This means, keeping existing debt low in relation to earnings makes it easier to qualify for a larger home loan amount.

Before applying, check your credit score through trusted South African credit bureaus, such as TransUnion or Experian, to get a sense of your credit health.

Basically, if you want to qualify… take care of your credit score, balance your income and expenses (including debt), and save for a deposit.

These things don’t need to be perfect. But striving to hit those benchmarks can improve anyone’s finances, so why not?

That’s the qualifying criteria. Let’s talk a bit more about income and what you need to earn to qualify.

📖 Related content: Credit score required to buy a house in South Africa

How much do you need to earn to qualify for a home loan?

The income (or minimum salary) required to qualify for a home loan varies depending on the loan amount, deposit, interest rate, and repayment terms. Generally, monthly repayments should not exceed 30% of the applicant’s gross monthly income. For example, buying a home worth R1 million typically requires a gross minimum income of about R30,000 per month.

Like we said, it varies. But that’s a good benchmark.

Let’s check out a couple of common scenarios.

Minimum salary to buy a house in South Africa

There is no fixed minimum salary to buy a house in South Africa. Banks look at affordability by assessing income, expenses, creditworthiness, and deposit and repayment terms. However, in most cases, the minimum gross monthly income should be roughly three times the monthly bond repayment amount.

Here are a couple of example scenarios:

*Based on a 20-year home loan term, with a 10% deposit, at an estimated 11% interest rate.

| Home price | 10% deposit | Estimated monthly repayment | Approximate gross monthly income required |

| R500,000 | R50,000 | ~ R5,160 | ~ R17,200 |

| R750,000 | R75,000 | ~ R7,740 | ~ R25,800 |

| R1,000,000 | R100,000 | ~ R10,320 | ~ R34,400 |

| R1,500,000 | R150,000 | ~ R15,480 | ~ R51,600 |

| R2,000,000 | R200,000 | ~ R20,640 | ~ R68,800 |

That’s the gross monthly income typically required to qualify for homes at those price points.

Remember, these figures are estimates and may vary depending on the factors we keep bringing up (credit score, monthly expenses, etc.).

How banks calculate bond affordability

To calculate bond affordability, banks assess the applicant’s creditworthiness by reviewing their income, expenses, debt, and the home loan requirements. Then, banks compare the home loan requirements: the loan amount, deposit, and desired loan term to the applicant’s affordability. They want to make sure that the monthly repayments won’t exceed what the borrower can afford. The benchmark is roughly 30% of the borrower’s gross monthly income.

Banks have their own systems, and it can get complicated. That’s finance for you.

But luckily, this next part will simplify it.

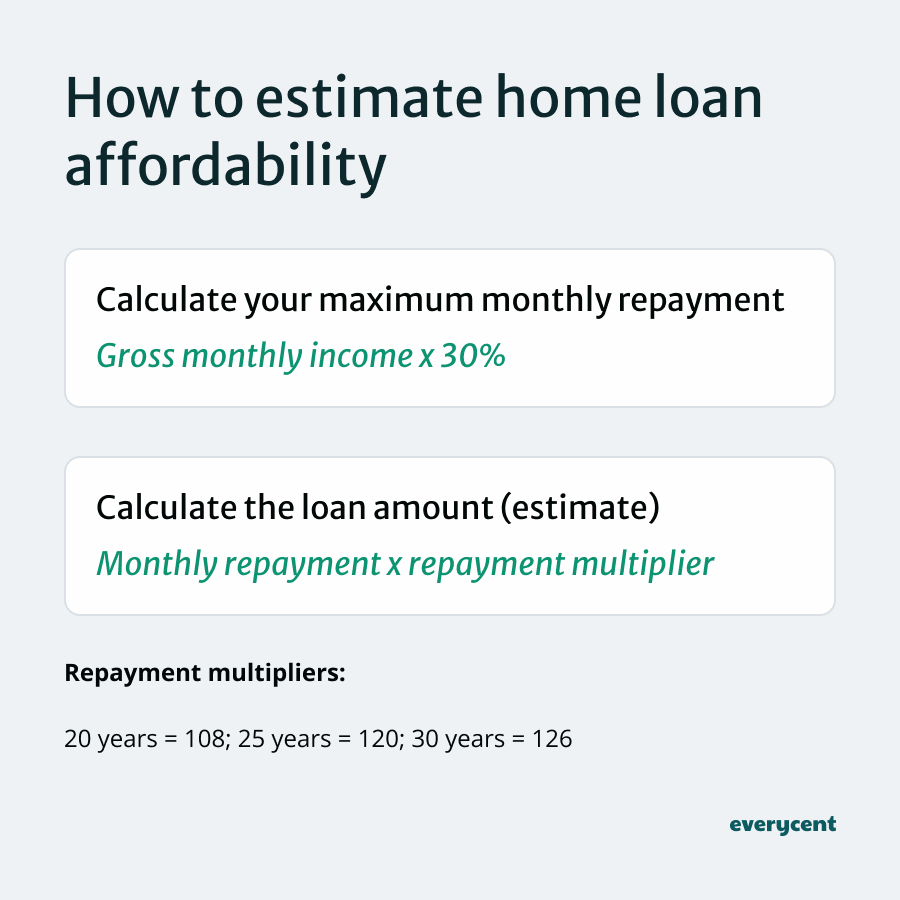

What home loan do I qualify for?

To get a good idea of what home loan amount you qualify for, multiply your gross monthly income by 30% to get an estimate of your repayment affordability. Then, multiply the repayment amount by 108 for a 20-year loan, 120 for a 25-year loan, or 126 for a 30-year loan. This will give you an estimate of your home loan affordability over any of those repayment periods with an 11.5% interest rate.

Here are the steps:

- Calculate your maximum monthly repayment

- Calculate the loan amount (estimate)

1. Calculate your maximum monthly repayment: Multiply your gross monthly income by 30%.

For example, if your gross income is R30,000, your maximum monthly repayment would be:

R30,000 × 30% = R9,000 monthly repayment

2. Estimate the loan amount: Multiply your maximum monthly repayment by the repayment multiplier for your chosen loan term. The multipliers below are based on an 11.5% interest rate:

- 20 years: Multiply by 108

- 25 years: Multiply by 120

- 30 years: Multiply by 126

E.g. For 20 years, it would be:

R9,000 monthly repayment × 108 = R972,000 home loan

This will give a general idea of the loan amount you might qualify for.

You can also try an online bond calculator. This way, you can play with the deposit, interest rate, and repayment term.

At the start of this post, we mentioned telling you how you can save a bit of cash when you buy your home.

That’s next.

Struggling to pay your debt bills?

Benefits of a larger deposit

Making a larger deposit, starting at 10-20% of the home price and beyond, helps save money in multiple ways—by reducing the overall loan amount, lowering monthly repayments, and reducing how much debt can accumulate interest.

Big deposit benefits:

- Lower total interest paid over time: Having a smaller loan balance means there is less debt that can generate interest costs. This could save thousands to millions depending on the loan and deposit amounts.

- Reduces the loan amount: A larger deposit reduces the loan-to-value (LTV) ratio, which means you’ll need to borrow less money from the bank. This lowers your monthly repayments, which can help make your budget more manageable or help you to pay off the loan faster (which also reduces how much interest you’ll pay).

- Improves the chances of approval: A lower LTV ratio presents less risk for lenders. This may make it easier to get approved.

- May lower interest rates: Banks often offer better interest rates for loans with lower LTV ratios. This means a larger deposit can reduce interest costs upfront by securing a lower interest rate.

What a hack, right?

Let’s go over what we’ve learnt.

📖 Related content:

In summary

Qualifying for a home loan might seem complicated, but with a couple of simple steps, anyone can do it:

- Save up for a deposit

- Balance your expenses and income, and try to reduce your existing monthly debt repayments.

- Check and try to improve your credit score.

- Find a place that you can afford.

Want to learn more? Keep reading on Everycent.