Debt review has been fun. (Or, maybe, not.) Either way… it’s time to get out. You’re done.

How on earth do you do it?

It can get a little complicated, depending on the timing. There are a couple of things to keep in mind. But don’t worry. We’ll explain EVERYTHING.

Here’s how you do it.

How to get out of debt review

There are three ways for South Africans to get out of debt review. Firstly, by proving they’re not over-indebted and withdrawing from debt review before the court grants a Debt Re-Arrangement Order. Getting out of debt review after that requires a Clearance Certificate. The second way to get out is by finishing the debt review process and getting a Clearance Certificate. And the third, involves settling the accounts and using a debt review removal service to obtain and submit the Clearance Certificate.

Confused? Don’t worry. It’ll all make sense soon.

Let’s start at the beginning.

Can you cancel debt review?

Yes, South Africans can cancel or withdraw from debt review under the right conditions. Early on, before the court grants a Debt Re-Arrangement Order, consumers can withdraw by proving they’re not over-indebted. This involves paperwork, the debt counsellor, and the magistrate’s court. After the court grants a Debt Re-Arrangement Order, withdrawal requires a Clearance Certificate. Which means the consumer will have to repay their debts to get paid-up letters from creditors to submit to the debt counsellor.

Now, it might start to make sense. Let’s look at these two conditions. Before and after the court grants the order.

A. Before a magistrates court grants a Debt Re-Arrangement Order

Before a Magistrates Court grants a debt re-arrangement order, you have the opportunity to withdraw from the debt review process.

When does this apply? If the debt counsellor has already declared you over-indebted but no court order has been formalised.

In this case, you and the debt counsellor, can present new or additional facts to the magistrate’s court to challenge the initial determination of over-indebtedness.

(You’ll still have to pay any applicable debt counselling fees.)

B. After a magistrates court grants a Debt Re-Arrangement Order

Once a debt re-arrangement order is granted, it gets a lot harder to cancel. At this point, Section 71 of the National Credit Act applies. This means the only way to get out of debt review is by getting a clearance certificate.

In case you don’t know, a clearance certificate is a legal document that a debt counsellor issues. Before they can issue your clearance certificate, you’ll need to prove your debts (except for home loans) are settled or up to date. This means creditors will have to provide ‘paid-up letters’ as proof.

Need help removing your debt review status?

Apply to get help with your clearance certificate and get out of debt review.

What about other workarounds? The NCR’s Withdrawal Guidelines can answer a few questions. Here are the highlights.

Things to keep in mind

- Can a consumer withdraw voluntarily? No. (This was established in the Van Vuuren judgement [an important court case].)

- Can a debt counsellor cancel debt review? No, debt counsellors do not have the power to simply withdraw someone from debt review. They can suspend their services (using a Form 17). But this won’t remove the debt review status.

- What happens if the consumer doesn’t pay? The debt review status remains in effect even if the consumer doesn’t pay. (Not paying is a bad idea. Check out: What happens if you don’t pay your debt in South Africa?)

- What happens if the debt counsellor did not follow the proper debt review application process? The consumer can lodge a complaint with the NCR. If the consumer can prove that the debt counsellor did not follow the correct process, then the listing could be removed.

- What if creditors terminate their agreements from debt review? This only means that the benefits of debt review won’t apply to the terminated credit agreement any longer. The consumer remains under debt review and the original credit agreement becomes enforceable once again.

Okay, now it’s time to get practical. Let’s talk about the steps.

Steps to get out of debt review (and remove the debt review flag)

To remove the debt review status after a court grants a Debt Re-Arrangement Order requires a clearance certificate. Debt counsellors can issue a clearance certificate after the consumer proves they’ve settled the debt under the debt review plan. To get proof, the consumer must pay off the debt and request paid up letters from each creditor, then submit the letters to the debt counsellor.

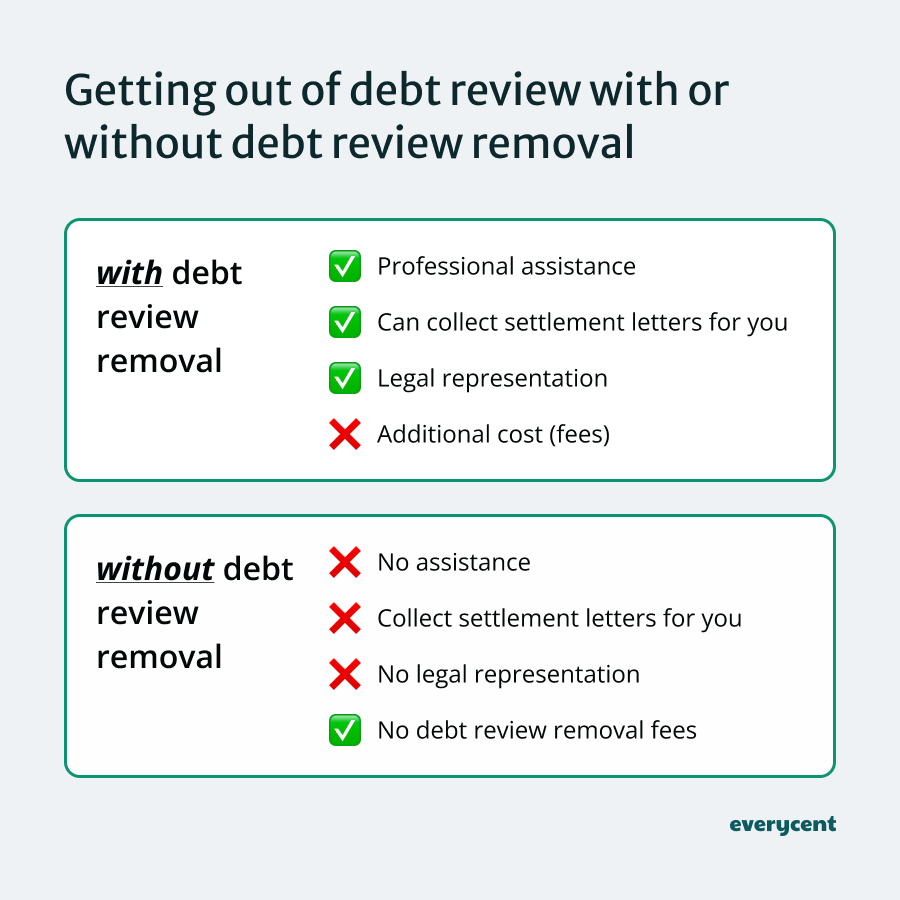

There are two ways to do it:

- With debt review removal services

- Without debt review removal services

Debt review removal

What is debt review removal? It’s a service that helps remove the debt review flag. In most cases by collecting paid up letters and issuing a clearance certificate. But it may also apply to consumers who want to prove they’re not over-indebted, to remove the debt review flag, before the court grants a Debt Re-Arrangement Order.

How much does it cost to remove debt review through debt review removal?

The cost of removing debt review can vary. Some debt counsellors list debt review removal services starting from R1150. If consumers need help getting paid up letters from creditors then the service costs more. While others charge a flat fee. Typically several thousand Rand. Where all costs are included.

Now, let’s go over the two approaches. First, with debt review removal. Then, without additional services. (On your own.)

How to get out of debt review with debt review removal services

If you have settled your accounts or can prove that you’re not over-indebted before the court grants a Debt Re-Arrangement Order… then you’re eligible for debt review removal.

Follow these steps:

- Choose a reputable service provider: Select a debt review removal service that is well-regarded.

- Ask about the fees: Before committing to any service, ensure you understand the cost. Find out about all the fees associated with the debt review removal process.

- Provide the necessary documentation: You will need to provide financial documents. This may include documents like statements, debt review documents, and paid up letters from credit providers.that your service provider requires.

- The service provider may help collect paid-up letters: In cases where the debt is settled and you’re struggling to get a Clearance Certificate. The debt review removal service provider will help collect paid-up letters. (This usually costs extra.)

- Debt review removal or withdrawal: Depending on the situation, the last step involves either proving that you’re not over-indebted or getting a Clearance Certificate. The service provider will walk you through the process. Then, they’ll contact credit bureaus to update your credit report.

Using a debt review removal service can make it easier. But it won’t be free.

The DIY route on the other hand, could save a bit of money. It’ll just be a lot of work. Be prepared for a constant back and forth between creditors and debt counsellor.

Here’s how you could do it yourself.

How to get out of debt review without debt review removal services

Follow these steps if a court already granted a Debt Re-Arrangement Order and you want to legally withdraw:

- Assess your finances: Can afford to pay off all your restructured debts? If the answer is yes, then you can proceed.

- Talk to your debt counsellor: Tell your debt counsellor about your intent and check whether you’re able to exit the debt review process. They can provide some guidance and could initiate the process for you.

- Pay and settle your debts: Pay off all your debts under debt review in your restructured payment plan. You have to settle everything in full, except for your home loan. Then you can get paid up letters and continue.

- Get your paid up letters and Clearance Certificate: When you settle all of the debts, creditors can provide paid up letters. Submit each paid up letter to the debt counsellor. They’ll verify everything. Then, they can issue a debt review Clearance Certificate (Form 19).

- Have credit bureaus update your credit profile: Your debt counsellor should tell all credit bureaus to remove the debt review flag from your credit profile. (Keep an eye on your credit report and follow up.)

Need help removing your debt review status?

There you have it. It’s a little daunting, isn’t it?

What matters is… there are ways to get out of debt review.

And if you can’t. Remember, it may not be such a bad thing. Debt review can be a useful tool. Perhaps you could go with the flow and use it to get out of debt by sticking with the process.

📖 Related content:

- How long after getting a debt review clearance certificate can I apply for credit again?

- Advantages and disadvantages of debt counselling (debt review)

In summary

Important things to remember:

- The process differs before or after the court grants a Debt Re-Arrangement Order.

- Once it’s official, the only way to get out is with a Clearance Certificate. And you’ll need paid-up letters from creditors to get yours.

- And not paying only makes things worse. Creditors could terminate their agreements under debt review and enforce their original contracts. (Which could result in legal action)

I sincerely hope this helped answer your questions and that you know what to do next.

Want to learn more? Keep reading on Everycent.