Want to know how much debt counselling costs? You’re in the right place.

This post has it all. Fee structures, definitions, examples, and more.

Let’s get into it.

Quick recap: debt counselling is a regulated process that offers several benefits that help over-indebted consumers (people with too much debt) repay their debts. Among the benefits are more affordable repayment terms and legal protection.

Debt counselling (debt review) fees

This is the NCR’s latest debt counselling fee structure guidelines.

| STEP | SERVICES | AMOUNT (excl. VAT) | PAYMENT TIMELINE |

| 1. Application fee | Completion and submission of Form 16. | R50 (as prescribed) | Upfront and in full. |

| 2. Administration fee | (a) Consultation

(b) Form 17.1 process (c) Data capturing for *DHS (d) Rejection process per Form 17.2(a) (if applicable) |

R300 per debt counselling application | Upfront and in full. |

| 3. Determination fees | The following fees are aligned to the outcomes of the full assessment of the individual’s financial situation. | ||

| 3.1 Restructuring fee | Attending to the form 17.2(b) process, which includes, but is not limited to:

(a) Proposal preparation (b) Loading the plan on the counsellor’s **PDA program (c) Negotiating with creditors (d) Submitting the final proposal (e) Presenting documentation to attorneys for the court application (f) Updating the system (*DHS) (g) Transferring the consumer (h) Working with attorneys on the court application/***NCT application — (2) Withdrawal by the consumer (Form 17.W process) |

For one applicant:

(a) The fee is either equal to the ****distributable amount or a maximum fee of R8,000 (whichever amount is less) — For consumers married in Community of Property: (a) The fee is either equal to the ****distributable amount or a maximum fee of R9,000 (whichever amount is less) |

Payable in month 1

(after drafting and submitting the proposals) |

| 3.2 Reckless lending fee | (a) Reckless lending assessment

(b) Supplying reckless lending documentation to the attorney to draft the affidavit on assessment outcome. |

R1,500 per debt counselling application | Payable in month 2

(after completing the written outcome of the reckless lending assessment) |

| 4. Aftercare fee | Services include the following:

(a) Form 17.2(c) process; (b) Financial review; (c) Attending to payment queries; (d) Clearance process; (e) withdrawal (Form 17.W process; (f) Updating the system (*DHS) |

For the entire debt counselling process:

(a) The fee is equal to 5% of the ****distributable amount or a maximum fee of R450 (whichever amount is less) |

Payable every month after Month 2 for every month in which aftercare services are rendered. |

| 6. NCT submission fee | Submission of the NCT application | R500 (excluding the NCT filing fee) | Charged and payable in Month 2 after the completion of the restructuring process |

| 7. Attorney fee | (a) Drafting the court application;

(b) Attendance at court |

To be agreed upon upfront with the attorney and communicated in writing during the application process. | Payable only after:

(a) one or more creditors reject the repayment plan; (b) the attorney drafts the court application; (c) the attorney attends the court application hearing |

| *DHS = Debt Help System

**PDA = Payment Distribution Agency (registered with the NCR) ***NCT = National Consumer Tribunal (Section 26 of NCA) ****Distributable amount = the amount payable to creditors per the debt repayment plan. |

|||

Remember, the National Credit Regulator (NCR) sets the maximum fees, so all debt counsellor fees will resemble some variation of this table. But the fees may not be higher.

📖 Further reading: check out these posts on debt counselling if you want to learn more:

- What is debt counselling?

- What is debt review?

- What is a debt counsellor?

- Debt counselling vs debt review vs debt consolidation loans

Debt counselling (debt review) fee definitions

The debt counselling fee structure provides a brief description of each service, but we want to make sure that it’s clear what you’ll be paying for.

So here are straightforward definitions of each of the services:

Application fee

The application fee is for, you guessed it, the initial application. This involves completing and submitting a Form 16 (the “Debt Counselling Agreement”).

The Form 16 details the following:

- Terms and conditions of the debt review process

- Fees

- Rights and responsibilities

- And more

Administration fee

This fee covers some of the admin behind the process—things like submitting docs, keeping records, and communicating with the various parties. You get the idea.

The listed admin includes:

- Consultation

- The application process (Form 17.1), before signing the Form 16

- Data capturing and updating the Debt Help System

- Rejection process per Form 17.2(a) (if applicable)

Determination fees

Fees related to the initial financial assessment (analysing income, expenses, reviewing credit reports, etc.)

Restructuring fee

This fee covers the work that the debt counsellor does to secure a better debt repayment plan. Like negotiating with creditors.

Reckless lending fee

(*only applies upon request by the consumer)

This is an interesting one. When creditors dole out money without assessing whether the borrower can afford the credit, they breach the National Credit Act (NCA). If there is enough evidence to support reckless lending claims, the debt could be written off (or reduced).

The reckless lending fee covers additional work the debt counsellor does to investigate whether this might be the case. They’ll draw up a presentation or report to present to the NCR to try and get the debt written off or reduced.

Aftercare fee

The aftercare fee covers ongoing work, and unlike most of the other fees, this one is recurring. It covers things like ongoing processing, Debt Help System administration, and financial review.

NCT submission fee

The National Consumer Tribunal is a judicial body that helps mediate disputes between creditors and consumers. This fee is for the extra work involved in submitting an application on behalf of the consumer.

Attorney fee

This one goes to the suit. The attorney. The debt counselling process relies on attorneys and can’t work without the court. This fee covers getting court application documents drafted and even court attendance.

That covers the fees and what each fee is for but doesn’t illustrate what debt counselling might cost in practice. Sure, you know how much the fees are, but what do the fees come to in practice?

Let’s look at an example to put the cost in perspective.

How much does debt counselling (debt review) cost

The fees add up but aren’t excessive. Here’s an example of the total once-off fees for someone with R350,000 in debt. It is worth mentioning that the fees will be significantly lower for someone with a lot less debt.

Example of debt counselling fees payable

Applicant’s total debt: R350,000.00

Application: R57.50

Administration: R345.00

Payment Distribution Agency fee: R60.00

Restructuring fee: R6,708.33

Attorney fee: R6,708.33

Total fees = R13,879.16

*Includes VAT

**Does not include NCT submission, aftercare, or reckless lending fees.

It’s just an example, and everyone’s fees will differ. But at least now you know what debt counselling (debt review) costs look like in a ‘real-world’ scenario.

Oh, and btw. The fees are part of the debt repayment plan. This catches some people off-guard. We’ll explain in the next section.

When and how are debt counselling fees repaid?

The bulk of the fees is payable upfront, which means that the first payments made under debt review go towards the fees. Everything has to be clearly stated and declared so that the consumer understands how it works.

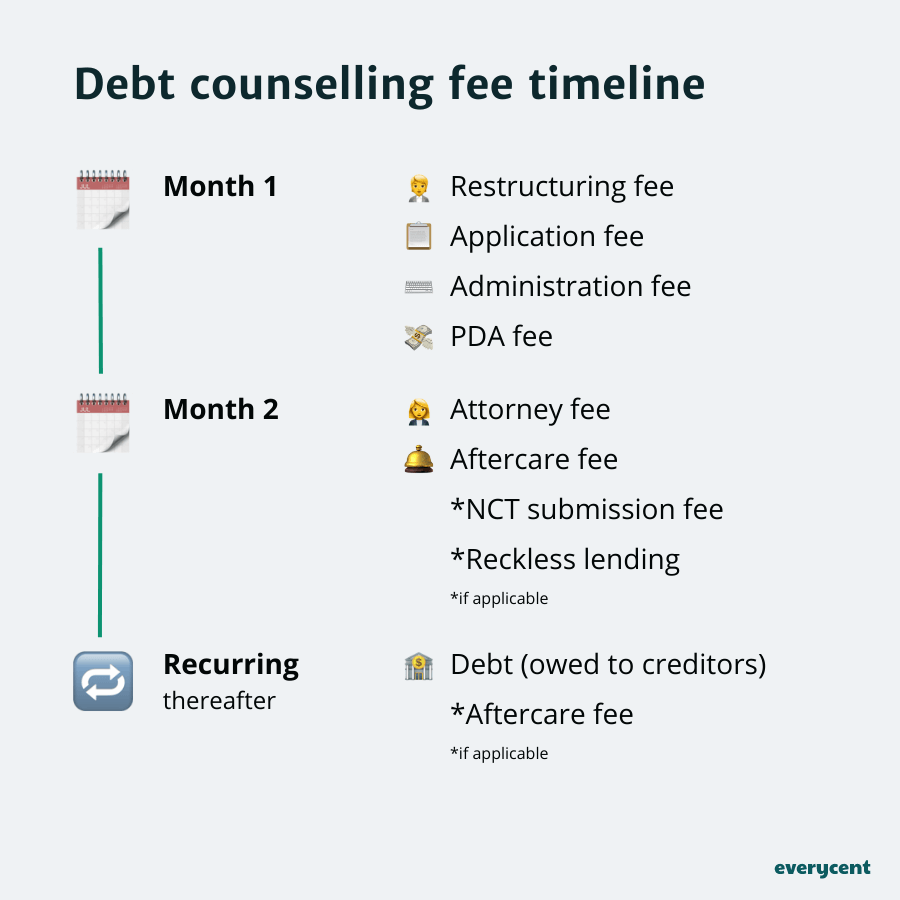

Here is a breakdown of the debt counselling fee payment timeline:

Month 1 — restructuring fee, application fee, administration fee and PDA fee. These fees are paid via debit order.

Month 2 — attorney fee and aftercare fee. In cases where the NCT submission fee and reckless lending fee apply, these fees will also be due.

Recurring thereafter — debt (creditor fees) and aftercare fees (where applicable)

This next part is important, so take note.

In the first two months, the repayment goes towards fees. Not to creditors. This is part of the agreement; it’s natural.

For anyone who didn’t pay attention (luckily, you’re following along nicely), this will feel a little sketchy, and so these consumers mistakenly believe that the debt counsellor is taking their money (they should’ve read this post first.)

Registered debt counsellors and Payment Distribution Agencies play by the rules. They don’t want to tick off the NCR. Anyone who sticks with them will be fine.

Who sets the debt counselling (debt review) fees

The costs of debt counselling in South Africa are determined by the National Credit Regulator (NCR). They regulate the entire credit industry in SA (including your favourite bank or lender), so it is fitting that the NCR decides the maximum fees.

The goal: keep the fees fair and transparent while covering the costs involved in the debt counselling process.

It’s a smart system, and it seems to be working. Thousands of people sign up for debt counselling each month, and the service is as popular as ever.

Final thoughts

Everything has its cost, and debt counselling is no different.

Are the fees worth it?

That probably depends on what the benefits of debt counselling mean for your financial situation.

Want to learn more? Keep reading on Everycent.