A lot of people believe that debt review is a bad thing.

Some even confuse it with being blacklisted.

But, that’s not the case at all.

Debt review is a positive, and it can positively impact someone’s credit score. Especially after debt review.

Here’s how it works.

What will my credit score be after debt review?

After debt review, applicants’ credit scores vary. It’s influenced by a couple of things like their credit score before debt review, and how responsibly they manage their debt while under debt review. By sticking to the process and paying monthly repayments, applicants are likely to see an improvement in their credit score after debt review.

Most people start seeing positive changes several months after debt review. Not right away.

But again, it varies from person to person and ultimately comes down to how you manage your debt.

Does debt review affect credit scores?

Yes, debt review listings have a temporary effect on credit scores. While under debt review, there’s a debt review status or flag that shows up on the person’s credit report. It’s a temporary sign that the person is repaying their debt under debt review. It tells creditors that they aren’t allowed to issue new credit during this time. But it’s temporary, and it’s a positive step. Unlike judgements or default listings that hurt someone’s credit score.

You see, debt review is a formal process under the National Credit Act in South Africa. That means creditors have to follow the rules too. While under debt review, it tells creditors to restrict access to new credit so the person can repay their outstanding debts.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

It’s one of the pros and cons of debt review.

(And that’s why some people get confused and start talking about blacklisting. But it’s not the same. Not at all.)

Missing payments, paying late, and legal action, those really hurt people’s credit scores.

All things that debt review can help fix.

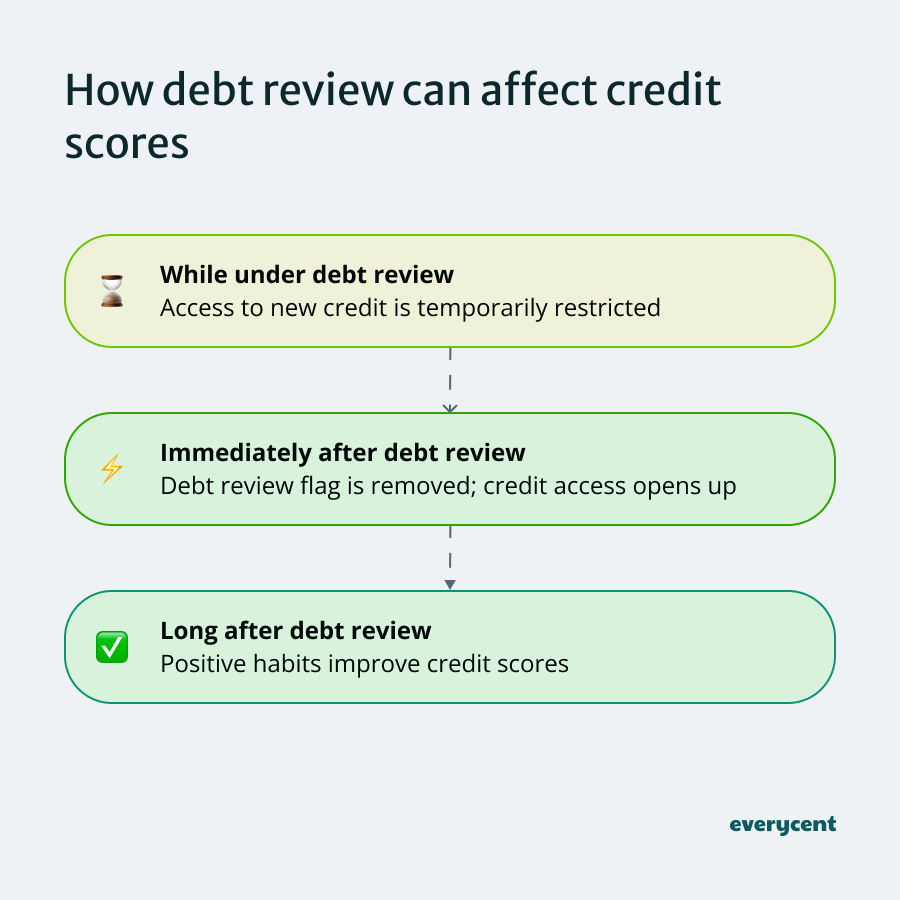

How debt review can affect credit scores

Debt review affects credit scores in different ways depending on the stage of the process. While under review, the temporary debt review status listing restricts access to new credit. After debt review clearance, when the debt review flag is removed, applicants can build their credit score and apply for credit again. In the long-run, positive financial behaviour after debt review can really help improve someone’s credit score and credit worthiness.

- While under debt review: Access to new credit is temporarily restricted.

- Immediately after debt review: Debt review flag is removed; credit access opens up.

- Long after debt review: Positive habits improve credit scores.

While under debt review

While in debt review, credit reports show a “debt review” listing. Which restricts access to new credit. This indicator tells lenders that the applicant is repaying their existing debt under debt review.

While under debt review, it’s important to stick with the repayment plan and make payments in full and on time.

After all, the repayments are lowered to suit the applicants’ budget.

Immediately after debt review

After completing debt review and receiving a debt review clearance certificate, the debt review status gets removed and so do its credit restrictions. Remember, it may take up to 21 business days for credit bureaus to update their records.

At this stage, credit providers look at the person’s credit score before approving new loans. If the person started debt review with a really bad credit score, they’ll need time to rebuild it.

Remember, negative listings like defaults, late payments and judgement can stay on credit reports from two to ten years.

If the person started with an average score and adhered to the debt review process, they’ll likely get access to new credit much sooner. And it’ll really set them up to get a good credit score later on.

Struggling to pay your debt bills?

Long after debt review

Over time, if you maintain good credit practices—like paying bills on time and keeping credit utilisation low—your credit score will improve.

Debt review can help someone rebalance their outstanding debt, income, and expenses. Which could set them up to build an excellent credit score. It all comes down to how they use credit after the debt review process.

Frequently asked questions

Can banks discriminate after debt review?

No, legally, banks may not discriminate after debt review. Once the debt review flag is removed from the credit report, lenders assess applications based on their current credit score, income, and payment history.

Can you get a loan while under debt review?

No, you cannot get a loan while under debt review. The debt review status restricts lenders from approving new loans. It’s illegal under the National Credit Act.

Debt review exists to help consumers get out of debt—not add new ones.

How long after debt review can I apply for credit?

Technically, you can apply for credit 7 days after getting your clearance certificate (which removes the debt review status). But, most professionals suggest waiting 3 months or more because there may be delays between creditors, debt counsellors, and credit bureaus.

After creditors issue paid-up letters, the debt counsellor must submit the debt review clearance certificate. Then, credit bureaus still have 21 days to update the user’s credit profile.

How long after debt review can I buy a house or car?

After the debt counsellor issues the clearance certificate, credit bureaus must remove the debt review status within 21 days. Once you’re unflagged, then you can apply for a home loan to buy a house, or financing to buy a car. Though, some people may still need to improve their credit score before lenders will approve the loan applications.

How to check if you are under debt review?

To check if you are under debt review, just look at your credit report. Try a credit bureau like TransUnion or Experian, or use a credit reporting tool like MyCreditCheck or ClearScore. The report will show a debt review listing if you’re currently under review.

📖 Related content:

In summary

In the short term, debt review’s effect on someone’s credit score is mostly temporary. It restricts access to new credit while under debt review.

In the long run, it’ll depend on what the person does after debt review…

It’s credit behaviour that has a real impact on credit scores. If debt review helps someone get there, then it’ll have a positive affect on their credit score.

Want to learn more? Keep reading on Everycent.