Have you ever dealt with a tyre puncture or a blow out?

I bet it cost more to repair than you would’ve liked to pay…

Tyres, and tyre repairs are pricey. That’s why insurers created ‘tyre insurance’ or ‘tyre and rim cover’.

We’ll explain everything. Plus, tell you where to find tyre insurance companies in South Africa.

Here we go.

Tyre insurance

Insurers offer tyre insurance as a standalone product or as part of their comprehensive insurance packages.

It’s insurance for tyres and rims, but there’s a little more to it.

What is tyre insurance?

Tyre insurance is a type of insurance that covers the cost of tyre repairs or replacements when there is accidental damage. Tyre insurance protects drivers from costs associated with tyre damage caused by road hazards like potholes and debris. Typically covering punctures, sidewall damage, wheel balancing and wheel alignment, and blowouts.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

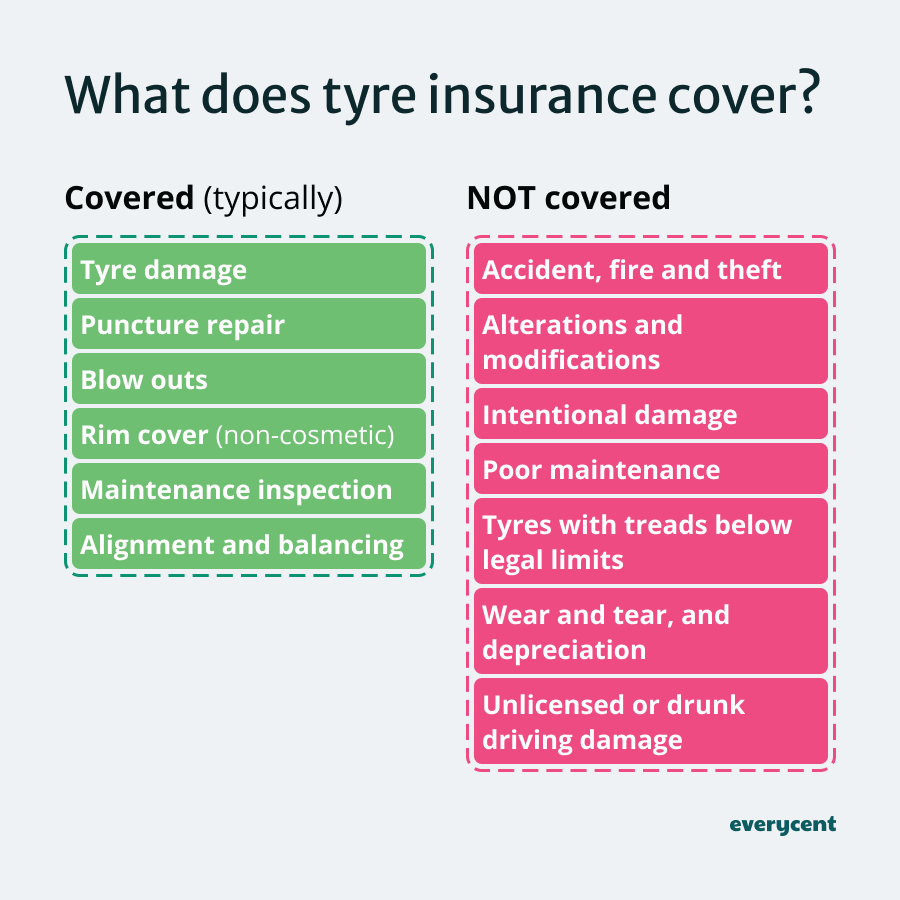

What does tyre insurance cover?

Tyre insurance or tyre protection cover, covers the cost of repairing or replacing a car’s tires when there is damage caused by potholes, debris (like bricks and stones) , or road hazards. Tyre insurance policies may vary slightly, but most will cover a combination of tyre damage, puncture repair, blow outs, alignment and balancing, and buckled or cracked rims.

Tyre insurance typically covers:

- Tyre damage

- Puncture repair

- Blow outs

- Rim cover (non-cosmetic)

- Wheel alignment and balancing

- Regular maintenance inspection

Tyre insurance may NOT cover:

- Accident, fire and theft

- Alterations and modifications

- Wear and tear, depreciation, mildew and fading

- Intentional damage

- Poor maintenance

- Payouts for tyres with treads below legal limits*

- Damage due to unlicensed or drunk driving

*Legal tyre tread limits are stated in the National Road Traffic Act, No. 93 of 1996.

Let’s go over an example…

On her way to work, Sam hits a sharp object on the road and damages two of her tyres.

The cost to replace one of her car’s tyres is R800.

Without tyre insurance, she would have to pay out of pocket. It will cost her R1,600 for two new tyres.

With tyre insurance, Sam pays R99 per month for tyre insurance. In her case, her insurance pays up to R2,000 for tyre repair or replacement. This means the tyre insurance will cover the full cost of the replacement for both tyres.

(Good for Sam)

Let’s check out the cost of tyre insurance next.

Struggling to pay your debt bills?

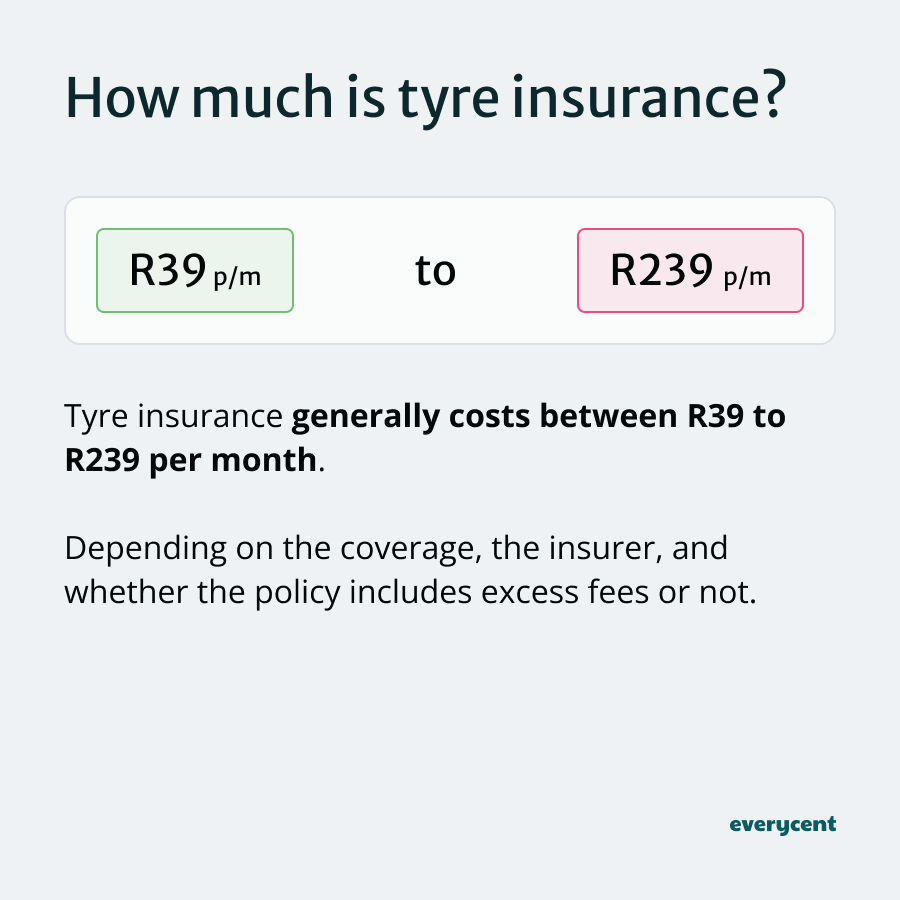

How much is tyre insurance?

Tyre insurance generally costs between R39 and R239 per month. Depending on the coverage, the insurer, and whether the policy includes excess fees or not.

Some insurers, like King Price, offer lower prices with excess fees per claim. Whereas others, like Tyremart by Bidvest offer higher monthly premiums without the additional cost of excess.

Luckily, it is easier to find out how much tyre insurance costs than it is to figure out how much car insurance is because most tyre insurance providers provide packages with fixed prices.

Just shop around to find a price and package that works for you.

Next, let’s look at the claims process.

How to claim tyre insurance

To claim tyre insurance, customers must contact the insurer to report or submit a claim (usually within 30 days) and get authorisation to go ahead with the repair or replacement. Then, the car should go to an authorised repair centre.

Here are the steps.

Steps to claim tyre insurance:

- Check the damage

- Contact the insurer within 30 days

- Get authorisation

- Get the tyre fixed

1. Check the damage – Make sure the tyre damage is covered by the insurance policy.

2. Contact the insurer within 30 days – Notify the insurance provider through their website or by calling their helpline. Most tyre insurance policies have a 30-day limit. Check yours to be safe.

3. Get authorisation – The insurance provider may arrange an inspection or ask questions before approving the claim. Answer questions and submit any documents the company requests.

4. Get the tyre fixed – Once the claim is approved, follow the insurer’s process to repair or replace the tyre at an authorised provider or get reimbursed for the costs.

That’s fairly simple, right? Now, let’s say you want to get tyre insurance in SA…where should you begin?

That’s next.

📖 Related content: How to claim insurance and get approved

Tyre insurance in South Africa

There are several tyre insurance providers in South Africa. Some offer tyre insurance as a standalone product, while others offer it as part of a vehicle insurance package.

Here’s a list of tyre insurance providers in South Africa.

Tyre insurance providers in South Africa:

- King Price

- Tyre Mart (underwritten by Bidvest)

- Motorvaps (underwritten by Old Mutual)

- Budget Insurance

- First for Women

- Standard Bank

- Auto & General

- Dialdirect

- Dunlop (“free”)

- Hollard (part of insurance)

- Outsurance (part of insurance)

- MiWay (part of insurance)

Take your time. Talk to a couple of companies to get a feel for their offer. It’s the best way to find a package that works for you.

In summary

Tyre insurance is a lot like normal car insurance. It’s just for tyre damage.

South Africans can buy tyre insurance for a relatively low monthly fee to cover the cost of tyre repairs and replacement. As long as the claim isn’t outside of the policy limitations.

Now, should you get tyre insurance?

Do the maths. How often would you claim? And how does the replacement cost compare to the total of your monthly premium payments over that time?

If it seems worth it. Go for it. If not, don’t.

Maybe you just want peace of mind? In that case…same thing…go for it. It’s up to you.

Keep reading on Everycent to learn more about money and finances in South Africa.