Claiming from insurance can be quick and painless…

But it can also be slow and stressful.

(Trust me, I wrote off a car less than two months ago. I’m writing from experience.)

Whether it’s a car accident claim (like mine) or a simple claim like cell phone damage…this post will guide you through it.

Let’s get started.

Claiming insurance

Each day, the claims process gets easier. Nowadays, most insurance providers have an app. But there’s more to it. Lots of documents, police reports (in some cases), and policies.

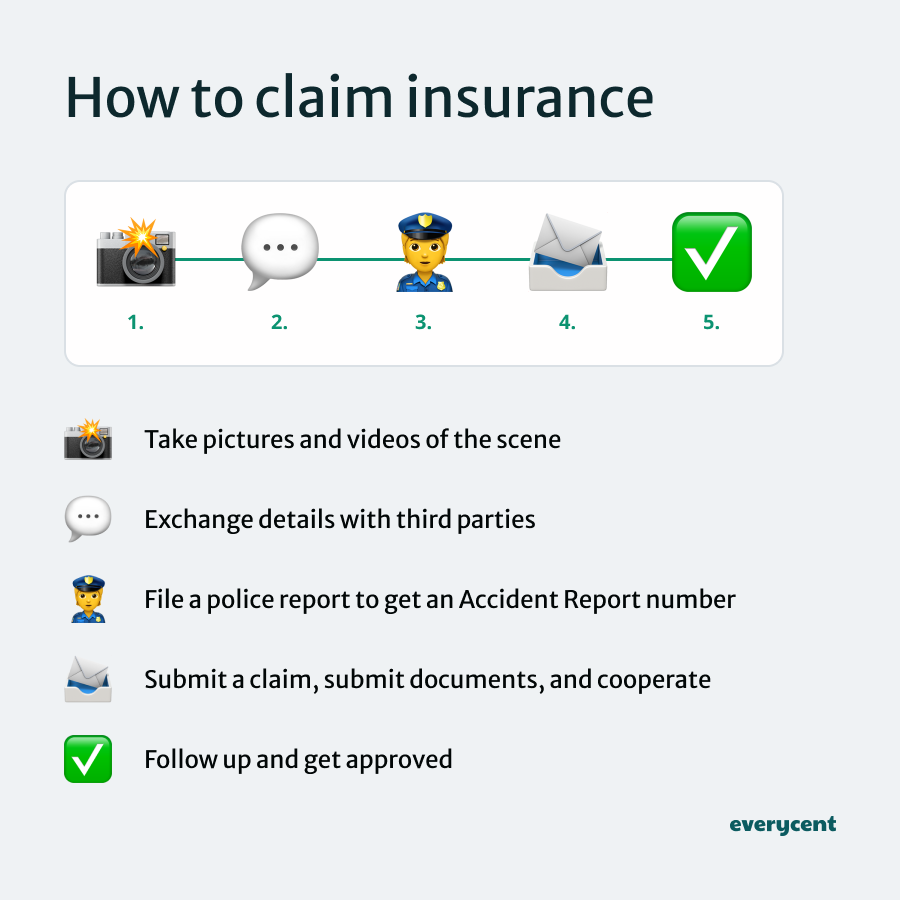

90% of the time, it looks something like this…

How to claim insurance

To claim insurance, report the incident to the insurer and follow the claims process. Today, most insurance providers let users submit claims via an app. Others may rely on telephonic or email claims.

The requirements vary based on the type of incident. But generally, claiming insurance involves submitting a claim, sharing details and documents, awaiting approval, and lastly, pay out or denial.

Don’t worry. We’ll go over the process in detail next.

Starting with insurance claims after an accident. After that, we’ll check out how to claim for other non-car-related claims. Things like home, medical, personal belongings, or pet insurance.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Claiming car insurance after an accident

Car accidents suck. Big time. Plus, it’s really stressful. Try following these steps. It can help make managing the insurance claim a little easier.

Steps to claim car insurance after an accident:

- Call the right towing company (if necessary)

- Take pictures and videos of the scene

- Exchange details with third parties

- Record the time and location

- File a police report to get an Accident Report number

- Collect other important documents (like the vehicle registration)

- Submit a claim

- Cooperate with assessments

- Get approval before making repairs

- Follow up on your claim

1. Call the right towing company (if necessary): This is important. Some towing companies charge insane towing rates. And some insurers have policies that don’t pay for towing unless you use a company that they list.

(I was charged R20,000+ for a short tow and two days’ storage. Then, my insurer only covered the first R2,000. Don’t make the same mistake. Seriously.)

2. Take pictures and videos of the scene: Use your phone to take photos and videos of the scene. Capture the damage to all of the cars, registration numbers, the surroundings, and any visible injuries.

3. Exchange details with third parties: If people are involved, get their details.

This should include:

- Full name

- ID number

- Contact number

- Email address

- Physical address

- Vehicle details (make, model, color, condition, and estimated speed at the time of the accident)

4. Record the time and location: Note the exact time, date, and location of the accident. If there are witnesses, ask for their contact details.

If you forgot to note the date and time, check your photos. For location, you may be able to check your timeline on Google Maps.

5. File a police report to get an Accident Report number: Report the accident to the police within 24 hours. Take note of the AR (accident report) number. You’ll need it. It’s useful to take a photo of the report for easy reference.

6. Collect other important documents: Collect any other relevant paperwork, like the vehicle’s registration documents and the details of any repairs or inspections you’ve done recently.

7. Submit a claim: Use your insurance app or contact your insurer and follow the claims process. This typically involves completing a claim form and uploading photos and documents.

8. Cooperate with assessments: Help the insurer with any requests that come up. Sometimes, insurers send an assessor to evaluate the claim. Answer their questions and work with them throughout the assessment. (Assessors can ask A LOT of questions. Be prepared.)

9. Get approval before making repairs: Wait for your insurer’s approval before starting repairs. They may direct you to approved repair shops or take care of the process themselves.

10. Follow up on your claim: Regularly check the status of your claim with your insurer to ensure everything is moving forward.

I know…what a process! Luckily, some claims are simpler than others. Just follow steps 1 to 7 to kick things off. After that, the insurance company will guide you.

📖 Related content:

Now…let’s look at other insurance claims.

Struggling to pay your debt bills?

Claiming insurance in general

General insurance claims are things like home or personal belongings insurance. The basic process is similar. But again, there will be different requirements depending on the type of claim.

Steps to claim general types of insurance:

- Report what happened (quickly)

- Share evidence

- Complete the claim form

- Cooperate with the assessment

- Receive payment or repairs

1. Report what happened (quickly): Contact your insurer as soon as the event (like damage, theft, or medical issues) happens. Most insurers let you report claims through an app, email, or phone. Do this ASAP. Most policies have time limits.

2. Collect important documents: Gather everything you need, like receipts, photos of the damage, repair estimates, or medical bills. The more details you provide, the faster your claim can be processed.

Tip: For stolen items, provide proof you own the item (like receipts or bank statements).

3. Complete the claim form carefully: Whether you’re using an app, email, or old-fashioned pen and paper, fill out the form with all the details about the incident. Double-check everything. Then send it.

4. Work with the assessor if needed: For property damage and medical claims, your insurer might send an assessor to review things on their behalf. Do your part and provide any extra information they might need.

5. Wait for claim approval: After submitting all the documents, the insurer reviews everything and approves or denies the claim. Ask questions before spending on replacements, repairs, and so on. There may be specific policies. Ask the insurer what to expect when the claim pays out and what’s allowed in the meantime.

Tip: For home insurance, check if the insurer has to choose a contractor or whether you can choose your own.

📖 Related content:

Frequently asked questions

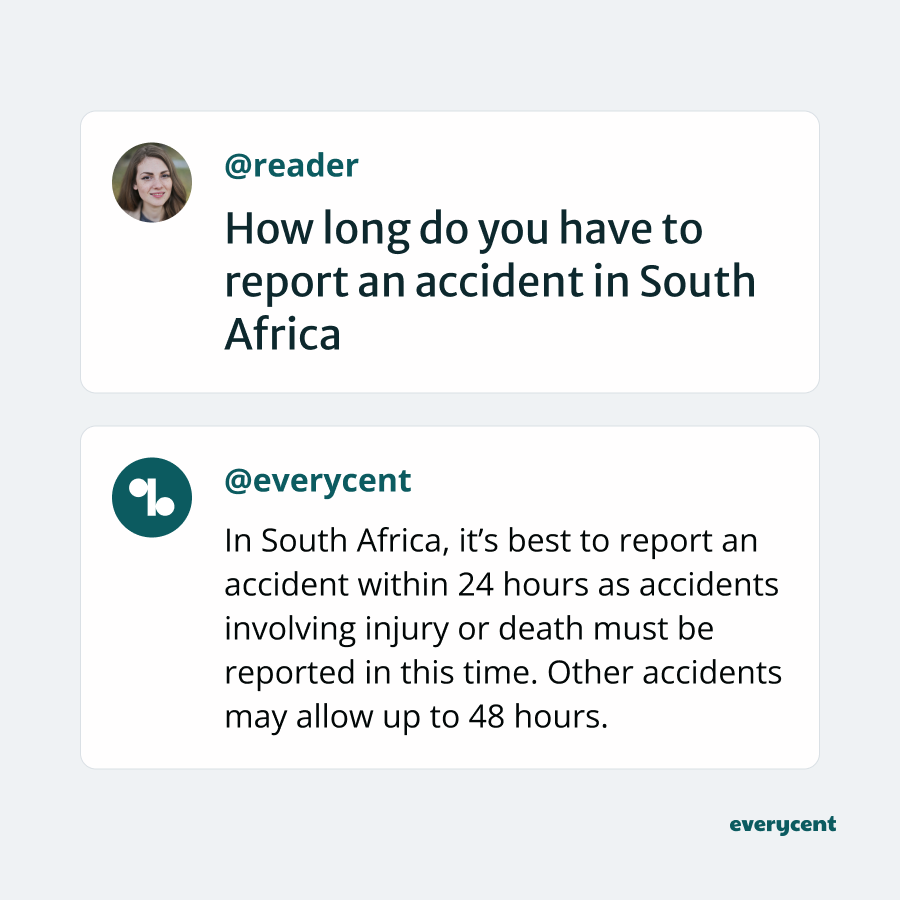

How long do you have to report an accident in South Africa?

In South Africa, it’s best to report an accident within 24 hours. Accidents involving injury or death must be reported within 24 hours. Whereas other accidents may allow a 48-hour period or the next working day. If the police arrive at the scene, report the incident and get the report information. Otherwise, you’ll need to report the accident at the right station. Different areas fall under distinct South African Police Service (SAPS) station jurisdiction.

Tip: Check a map app and give the station a call beforehand to confirm whether it’s the right one.

How long after a car accident can you claim for damage?

The timeframe within which an insurer allows a claim depends on the insurance policy and the insurer. Check your insurance policy for an exact timeframe. The insurance policy should specify how long after an accident, claims will be accepted. Some may only allow 7 days. While others allow 30 – 60 days.

Regardless, it’s best to submit a claim as soon as possible.

How long does it take for an insurance claim to be approved?

The time it takes for an insurance claim to be approved in South Africa varies. Simple claims can be approved within a couple of days. While complicated claims can take weeks or months.

Simple claims don’t require as much investigation and cooperation. Which speeds up the process. Complicated claims with higher damages or multiple parties need more time for assessments and communication between everyone involved.

How long does insurance take to pay out?

Insurance payouts generally take between 7 and 30 days after the claim is approved and all the required documents are submitted. Things like additional investigations or missing documents can delay pay-outs. The exact timing depends on the insurer, the policyholder’s cooperation, and the type of claim.

In summary

And that’s how claiming on insurance works.

As you can see, there’s a lot to take into account. It’s not a one-size-fits-all process.

Do your part and act as quickly as possible. The rest will be up to your insurer. Some are faster than others. But be prepared to wait. (That way, you won’t be disappointed.)

Keep reading on Everycent to learn more about money and finances in South Africa.