In insurance, there’s this thing called excess…

At first, it may seem like a rip-off. Or an extra expense. But there’s some sound logic behind insurance excess fees.

Plus, it can work in your favour. Yeah. That’s not a typo—it can actually be beneficial.

Here’s what you need to know about insurance excess fees (and what to do to make sure you win.)

Insurance excess

What is excess in insurance?

Insurance excess is the amount of money the insurance customer (the policyholder) must pay out of pocket when they make a claim. For example, if a person with an R2,000 excess files a claim for R10,000, the insurer will cover R8,000 and the insurance customer (the policyholder) will pay R2,000.

For insurers: Excess helps reduce unnecessary small claims and keeps policyholders honest. Essentially, it’s a way for them to help manage their risk.

For policyholders (insurance customers): Excess offers a way to lower the cost of their monthly insurance premiums. Insurance with higher excess typically costs less per month.

Remember this… Policyholder refers to the person who takes out insurance. People who pay to insure their stuff or themselves, the insurance customer is the policyholder.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

Types of excess

Insurance policies can include various types of excess, each serving a specific purpose:

- Voluntary excess

- Compulsory or standard excess

- Additional or special additional excess

- Percentage excess

- Zero-rand excess

Voluntary excess: This is an extra amount insurance customers choose to pay on top of the compulsory or standard excess. Choosing a higher voluntary excess lowers the monthly cost of the insurance, but costs more out of pocket when there’s a claim.

Compulsory or standard excess: This is a fixed amount the insurance customer must pay when making an insurance claim. This amount is set by the insurer.

Additional or special additional excess: This is an extra amount insurers apply under certain conditions. Like, for young or new drivers, or if the situation is riskier. This amount is added on top of the compulsory excess.

Percentage excess: Instead of a fixed amount, this excess is a percentage of the total claim. For example, if the excess is 10% and there’s a R10,000 claim, the excess equals R1,000 (10% of 10,000).

Zero-rand excess: With this option, insurance customers pay a higher monthly premium, but don’t have to pay any excess when they claim. It means there’s no out-of-pocket costs when something happens.

What is excess in car insurance?

Excess in car insurance is the same as excess in general insurance. It’s the out-of-pocket amount the insurance customer must pay when they file a claim for vehicle-related damages or losses. Car insurance excesses can include compulsory, voluntary, and additional excesses. It all depends on the driver’s age, experience, and the car’s risk profile.

How is excess calculated in insurance?

Insurers calculate excess based on several factors. There isn’t a fixed equation for calculating excess because different insurance providers use different calculations.

The primary factors that may influence excess costs are:

- Type of insurance

- Level of risk

- Personal factors: such as age, driving experience, car type, where you live, and how you use your car

For voluntary excess, the insurance customer can choose the amount, which affects the cost of the premium. Higher voluntary excess = a lower your premium, and vice versa.

With me so far?

Now, let’s look at how excess works in the real world.

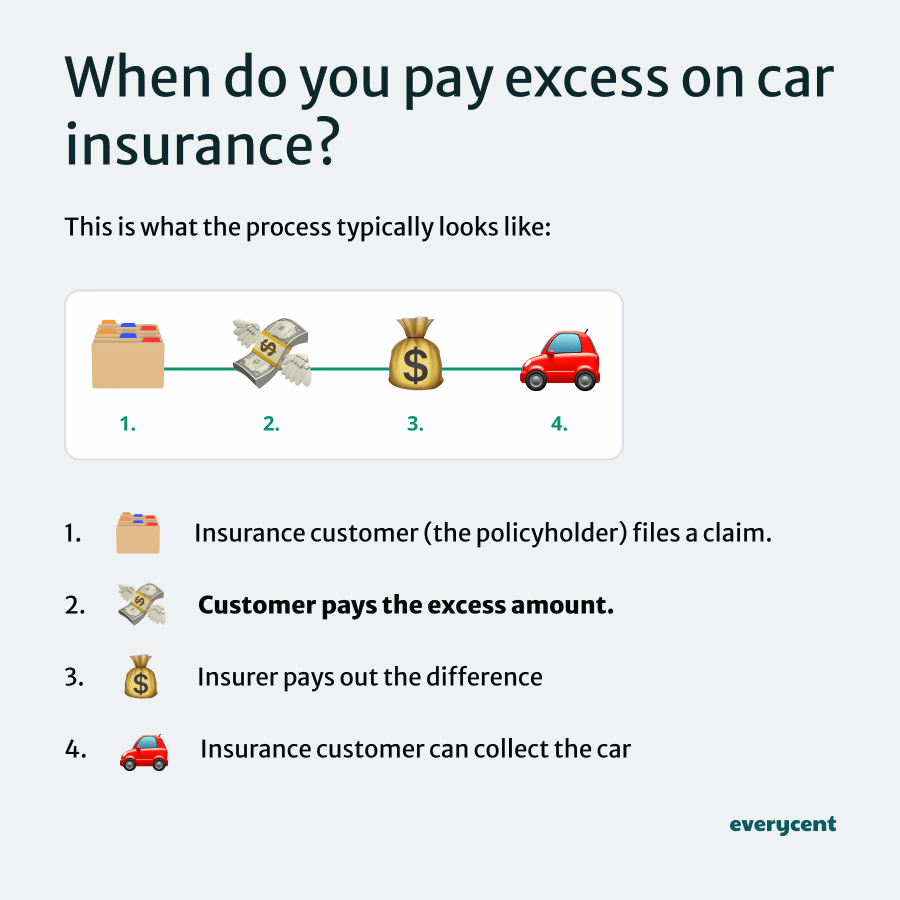

When do you pay excess on car insurance?

Whenever the insurance customer (the policyholder) files a claim, they must pay the excess amount. Insurers typically require the excess payment before the insurer pays out or before the insurance customer can collect the car. Regardless of whether the accident or damage is the insurance customer’s fault. If someone else is at fault, and their insurer accepts liability then it may be possible to get the excess back from them.

Usually, the excess is paid either directly to the repair service or it is deducted from the claim.

📖 Related content:

- Everything you need to know about comprehensive car insurance

- What is third-party insurance?

- How much is car insurance in South Africa

So far, excess may sound like an extra expense. But, it can also work in the customer’s favour.

Remember we mentioned that excess can influence the cost of the monthly premium? That can be a perk.

Let’s go over the advantages and disadvantages of excess fees.

Pros and cons of higher excess vs higher premiums

It’s all about finding a balance that meets your needs and affordability. Whether to choose higher excess or higher premiums is a personal decision. It’ll vary from person to person.

Here are the pros and cons of each:

| Higher excess, lower premium | Lower excess, higher premium | |

| ✅Pros | Lower premiums. | Lower out-of-pocket costs when claiming. |

| Could be cheaper for customers who rarely claim. | Easier to pay without emergency savings. | |

| ❌Cons | Higher out-of-pocket costs when claiming. | Higher premiums. |

| Harder to pay without emergency savings. | Could be more expensive for customers who rarely claim. |

It’s kind of 50/50. Things either go one way or the other. Here are a few practical steps that can help you choose.

Struggling to pay your debt bills?

How to choose the right excess amount for you

To choose the right excess amount, balance the impact of premium costs and excess costs with how often you claim. And take into consideration how much savings you have on hand.

Here are some tips:

- Assess how much money you have to cover unexpected excess: Do you have a solid emergency fund? If you do, then you can afford higher excess if it’ll work in your favour.

- Review your claim history to see how often you claim: How often do you make insurance claims? People who claim often, benefit from lower excess while those who rarely claim benefit from higher excess.

- Compare quotes with different excess amounts: Use online comparison tools to see how different excess amounts affect the premiums. Try to compare different insurers, too.

- Do the maths to evaluate your risk: Compare the premium savings with the excess cost to try and calculate whether it’ll be smarter to opt for higher vs lower excess fees.

In summary

While insurance excess fees sound like an extra expense, it actually gives insurance customers more control.

The ability to use excess fees to offset premium costs is extremely valuable. Some people (like me) don’t claim that often. With higher excess, I get to drop my monthly insurance costs—and I appreciate that.

But the opposite can also be true. Follow the tips to decide what amount works for you, and check out what different insurers have to offer.

Want to learn more? Keep reading on Everycent.