You may have heard of a brilliant, government-backed, legal way to reduce debt and become debt-free.

99% of the time. People are talking about debt review.

Now, you might be thinking, “Brilliant, government-backed, and legal—you have my interest. But how does it work?”

Great question. Here’s the answer.

How does debt review work?

Debt review is a process that helps people who have too much debt. The way it works is—a debt counsellor places over-indebted South Africans under debt review through a legal process. Then, while under debt review, legal benefits make it easier for them to repay what they owe. Things like a lower monthly debt repayment amount, legal protection, and a consolidated payment help reduce the debt over time. When the debt is settled, a certificate gets issued to end the process.

That’s the fundamental idea.

Here’s a little background and a step-by-step breakdown to make it clearer.

What is debt review?

Debt review is a legal process backed by South Africa’s National Credit Regulator (NCR). It provides a secure way for consumers to manage and repay debt and avoid damaging legal processes like repossession and insolvency. The debt review process restructures and consolidates debts to make everything affordable and provides additional legal benefits that help protect the consumer.

📖 Related content:

Interesting, right?

That’s just the definition. Here’s how it works in practice.

Struggling to pay your debt bills? Check to see if you qualify to lower your debt instalment and free up money for other expenses.

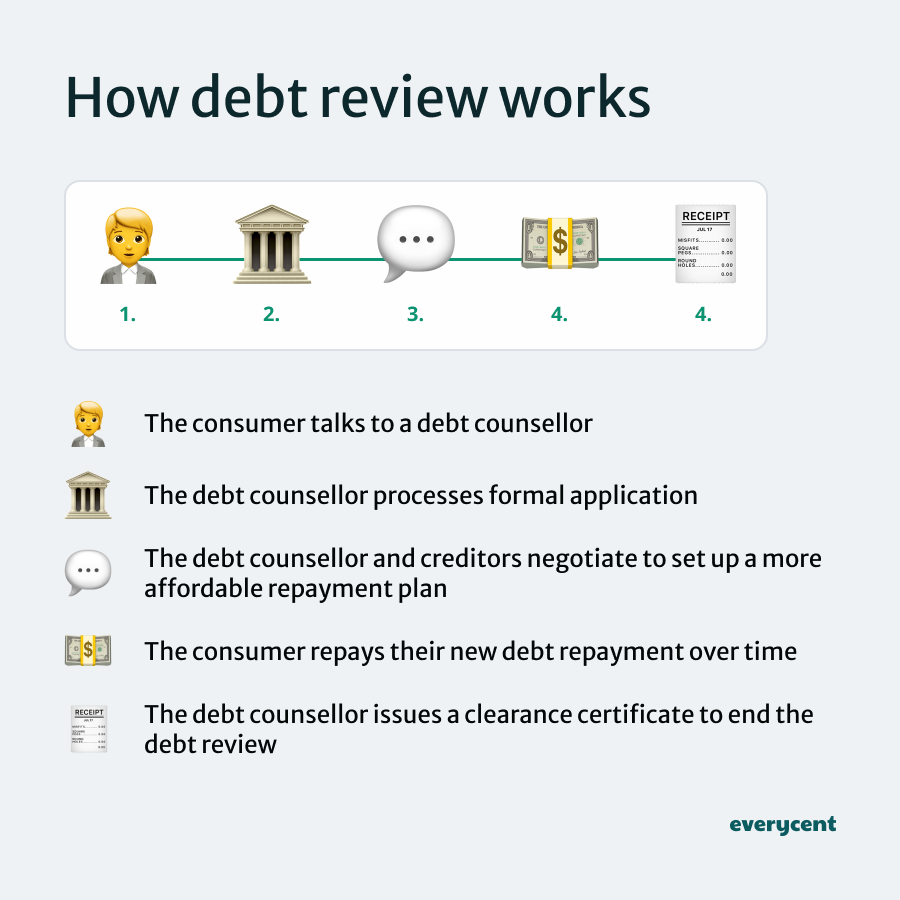

Debt review process (step by step)

The goal of the debt review process is to protect consumers, and to give creditors a way to get paid without going to court. Since the process involves both consumers (the individual who borrows money) and creditors (the entity that lends money), there are several steps.

Here’s a step-by-step overview of the debt review process:

- The consumer talks to a debt counsellor.

- The debt counsellor processes a formal application and debt review listing.

- The debt counsellor and creditors negotiate to determine a more affordable repayment plan.

- A court order and consent orders confirm the repayment plan.

- The consumer makes payments according to the repayment plan.

- The debt counsellor issues a clearance certificate to end the debt review.

- The consumer talks to a debt counsellor: The first step is to apply online and see if you qualify. After getting in touch, a registered debt counsellor evaluates your finances. Some simply ask consumers about their income, expenses, and outstanding debt. While others review statements. This step helps determine whether you are indeed over-indebted and eligible for debt review.

- The debt counsellor processes formal application and debt review listing: Next, the debt counsellor makes it official by processing the necessary paperwork. At this stage, they’ll list the applicant on the National Credit Bureau’s NCR Debt Help database. (This listing restricts access to new credit. Which protects the consumer from incurring more debt.)

- The debt counsellor and creditors negotiate to determine a more affordable repayment plan: Now, it’s time for negotiation. Creditors get to assess proposed plans with more favourable terms for the consumer. Terms like lower monthly repayments or reduced interest rates. They must agree to the terms and have the right to disagree. This is where the debt counsellor negotiates on behalf of the consumer to make sure they can afford the monthly payments.

- A court order and consent orders confirm the repayment plan : After negotiations, creditors and the court must confirm the restructured proposal. Each creditor must sign a consent order which gets filed with a court and must be approved by a judge. This step makes the reduced repayment plan legally binding. From here on, the consumer has legal protection.

- The consumer makes payments according to the repayment plan: With the repayment plan in place, the consumer starts making monthly payments through a Payment Distribution Agency (PDA). This is how debt review effectively consolidates the debt. The PDA distributes the ‘consolidated’ payment to the creditors. This step typically lasts 36 to 60 months for most South Africans. But it can be much shorter depending on the total amount of debt.

📖 Related content: How long does debt review last (and stay on your name)?

- The debt counsellor issues a clearance certificate to end the debt review: At the end, when the debt is settled, creditors must provide paid-up letters. Then, the debt counsellor issues a clearance certificate and notifies the credit bureaus. Finally, the debt review status gets removed (there’s no permanent record).

*Takes a deep breath* — “Ahhhh, debt-freedom.”

Let’s look at a practical example.

Struggling to pay your debt bills?

Example of how debt review works

Sam is struggling to keep up with her debt. She earns R15,000 and has to spend R12,000 on debt repayments each month.

Sam wants to apply for debt review for two primary reasons:

- She needs to reduce the cost to her debt to balance her income, expenses, and debts.

- She has a car loan and wants to protect her car from being repossessed

📖 Related content:

Here’s a look at her circumstances before-, and during the debt review process.

Sam’s situation before debt review:

- Monthly income: R15,000

- Total monthly debt repayments (before debt review): R12,000

- Key debt: A car loan that’s at risk of repossession.

Sam’s situation during debt review:

- Reduced monthly debt repayments: R7,500

- Monthly savings: R4,500 (now, she has R7,500 to cover her expenses.)

- Key benefit: Her car is legally protected against car repossession.

Now, Sam can comfortably cover her living cost and reduce her debt over time. She gets to keep her car. And makes her finances less stressful.

In Summary

Debt review is a remarkable tool available to South Africans who are struggling with their debt.

Just remember. It’s a legal process. That’s a good thing. It means it’s secure and really effective. It also means that you can’t just change your mind and apply and cancel as you wish.

In short, the process is regulated by the NCR, and debt counsellors do most of the work. All consumers have to do is stick with, make payments, and communicate with their debt counsellor if something comes up.

It’s a great option for anyone struggling to afford their debt repayments or who is at risk of losing their car or going to court because they can’t make payments.

Want to learn more? Keep reading on Everycent.